House Prices.. Stabilizing...?

Not Likely Yet..........

Displaying blog entries 131-140 of 157

Not Likely Yet..........

I am often asked about the foreclosure market here in North Texas. A great tool in understanding how much change we have seen over the last 18-months in regards to foreclosures is CoreLogic's National Foreclosure Report. According to CoreLogic's May report, foreclosures are on 31 months of consecutive year-over-year decline. In simply terms, May 2014 represents a 37% decline compared to May 2013 - and 9.4% year-over-year decline. While it is true that TX is represented in the top 5 states of foreclosure volume in the last 12 months, we are also among the lowest by percentage of inventory. TX's foreclosure inventory represents .07% versus a national average of 1.7%.

Does this mean the "foreclosure" market is in permanent decline?.. I would be very hesitant to say such... many factors affect real estate, both in the short term & long term. And while in TX (a non-judicial foreclosure state) our inventory has moved quickly, there remains a "backlog" of inventory in many parts of the country. Likewise, in many areas, we can still see Mortgage Delinquency Rates (a "precursor" to foreclosures) remain higher than historical averages.

All that said, at least in the North TX market, a buyer offering that they "just want to look at foreclosures" may have (as we say in TX) some very slim pickins'.

- Christie Cannon

“Why is it….

By now we have all experienced it… House Today, Gone Tomorrow! But why so fast?... Sometimes the answer is obvious – the home is priced well, staged, well marketed, in a desirable area, low inventory, priced below FHA limits,… etc & thus moves quickly. BUT what about that home that is 112 days on the market, you finally go look at it… make your offer & BOOM – multiple offers, or worse… the seller just accepted another offer! That (my friends) is a whole other level of frustration… how odd that no-one bought it for all that time, until (seemingly) “we” get interested. So why is it?

It is important to understand that often the very same market factors that “drove” you to that particular home are driving other buyers. It isn’t hard to surmise that buyers are looking for the best home at the best price – but to see how that may play out in a home that seems more “market stale” than others, picture this same 112 “days on market” home for the last 100 days as having strong competition in surrounding homes. One with an award winning media room, one on a greenbelt, one almost new, one with massive updates, perhaps one a little less functionally obsolete, or maybe a few just priced less – all of these fall under contract, one after the other - until POOF, the 112 “days on market” house’s time has come. This isn’t to take away from the 112 “days on market” house, but simply to reflect that as competition falls off the market, simply due to scarcity of the inventory, the desirability of the 112 day home increases (this is especially true if new listings to the market continue to have price increases) - driving you & the other buyers towards the same home.

Even knowing this…. it still doesn’t make it feel any less like a conspiracy.

Stay "searching" my friends,

- Christie Cannon - 469-951-9588 - Christie@christiecannon.com

The MLS just released the preliminary Frisco numbers for March 2014 & WOW!

A couple of things that stand out to me…

Have questions on how this market may affect you or your family's real estate goals? Have questions about how your city, area, or neighborhood is doing?

Please feel free to call or email with questions!

- Christie Cannon - 469-951-9588 - Christie@christiecannon.com

The season is almost upon us.... property tax protest season! So what do you do when that envelope arrives & your value went sky high? You do have the opportunity & option to contest/protest your tax value. Despite what some may lead you to believe, it is not a terribly difficult process.

While counties do have variations, tax protests start about May 1st. While most counties offer easy steps & explanations to the process, the how & why a value was derived still leaves many of us wondering.

Once again Texas A&M's Real Estate Center has come to the rescue in this month's Tierra Grande, offering a wonderful article on the detai ls of the Property Tax Protest & Appeal!

You can find the article on their website - http://recenter.tamu.edu/pdf/2062.pdf

Need help or have questions about the comps for your home (from Jan 1st time)? - please feel free to give me a call...

- Christie Cannon

The Frisco Economic Development Council -http://www.friscoedc.com/ - offered a wonderful presentation to the Heritage Green HOA earlier this month.

For anyone getting to know Frisco - or just looking for an update on the information that you have, it is a great place to start!

You can find their presentation here - Heritage Green HOA - Frisco EDC - it is an excellent source of some of the newest developments, demographics, & growth!

Thanks - Christie Cannon - 469-951-9588

People often ask me about Frisco's size, growth, population, demographics & more!

Here is apeek at Frisco's latest numbers:

Quick Facts:

- Current Population Estimate: 138,360 (as of March 1, 2014)

| • Current Area: | 67.7 square miles (includes everything currently annexed) | ||

| • Area at Build out: | 70.23± square miles; 44,950 acres (includes ETJ) | ||

| • Build out Percentage: |

59.1% Built or Platted (as of January 1, 2014) |

||

| • Median age: | 34 years | ||

| • Housing Units: | 49,620 | (as of March 1, 2014) | |

| • Households: | 47,420 | (as of March 1, 2014) | |

| • Median Household Income: | $111,690 | ||

| Median Family Income: | $120,940 | ||

| Per Capita Income: | $42,750 | ||

| • Frisco ISD Students: |

46,260 |

(as of January 6, 2014) |

|

| • Educational Attainment: (adults 25 years and older) |

96.5% |

high school graduates or GED |

|

- Detailed information from the City of Frisco can be found here: Frisco at a Glance

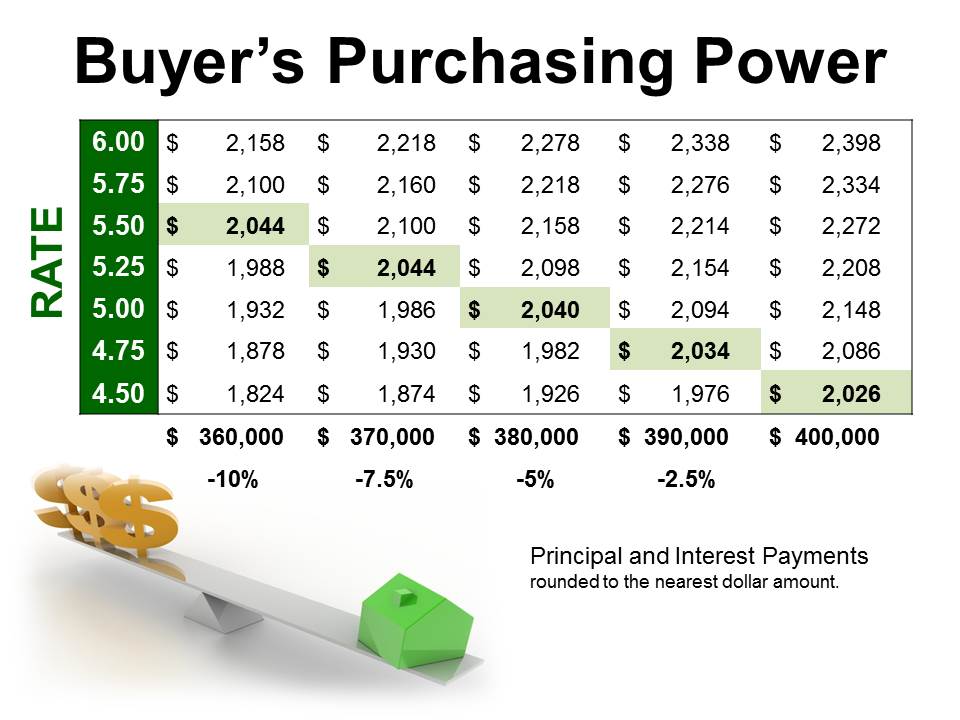

I know, I sound like a broken record.... but if you are borrowing money, interest rate is king!

The below graph does an excellent job of illustrating the effective relationship between interest rate & purchasing power based on monthly payment.

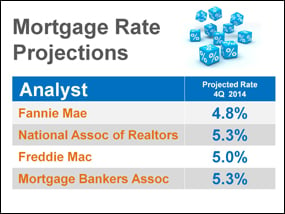

Everyone knows it is coming.... but no one really agrees on exactly when or where they may end up...

Recent surveys on major retail real estate websites already cite rising interest rate fears as buyer number one concern (with low inventory closely behind). Below is compiled some of the major real estate institutions predictions for 4th quarter 2014.

An interesting point on these predictions is that the typically rosy prediction from the National Association of Realtors (NAR) is significantly higher than Fannie & Freddie, and more inline with the traditionally conservative Mortgage Bankers Association. Towards the tale end of last year, NAR actually predicted rates to be closer to 5.4%/5.5%.

While rates have remained at historically low prices - and yes we now scoff at our past excitement at refi-ing below 6.5%, - when it comes to a buyer's purchasing power, the relative effect of the interest rate is profound

Nationally acclaimed John Burns Real Estate Consulting ranked the top 50 Master-Planned Communities in the US. McKinney's own (and ever growing) Westridge ranked among the elite of this list. While TX accounted for a whopping 1/3 of the communities listed, Westridge was the only greater Dallas suburb to make the cut! A renewed interest in large master-planned communities in our area has resulted from stronger buyer confidence, low pre-owned inventory, renewed investor confidence, & a new-home contruction boom. With communities such as Celina's Light Farms & Frisco's own Phillips Creek Ranch.... perhaps 2014 will see more North TX communities making the grade.

Displaying blog entries 131-140 of 157