Homeownership is Cornerstone of American Dream

Homeownership is a Cornerstone of the American Dream

“The rumors of my death are greatly exaggerated.”

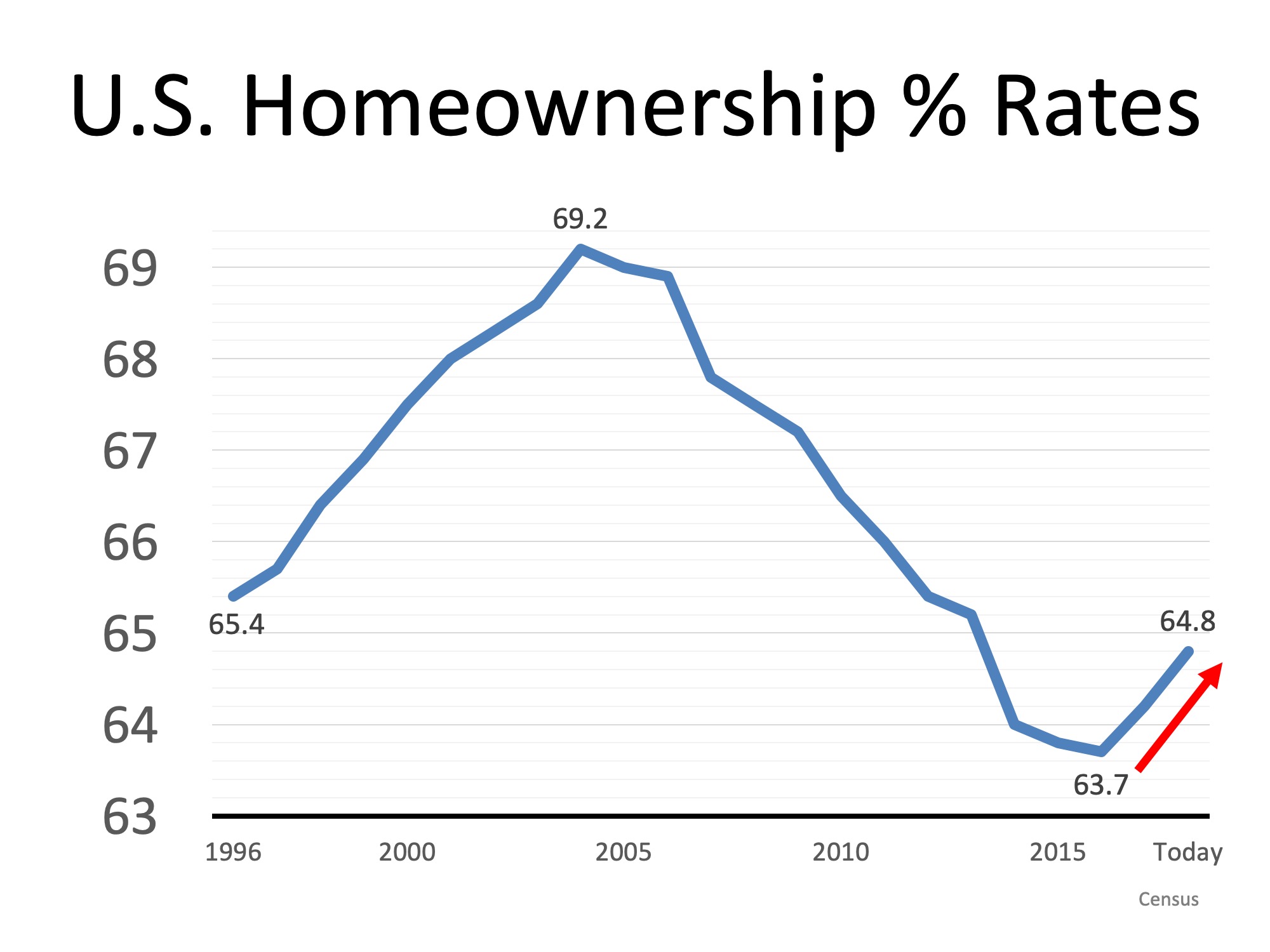

The famous quote attributed to Mark Twain can apply to homeownership in the United States today. During the housing bubble of the last decade, the homeownership rate soared to over sixty-nine percent. After the crash, that percentage continued to fall for the next ten years.

That led to speculation that homeownership was no longer seen as a major component of the American Dream. That belief became so widespread that the term “renters’ society” began to be used by some to define American consumers.

However, the latest report by the Census Bureau on homeownership shows that over the last two years, the percentage of homeowners has increased in each of the last eight quarters.

Going forward…

It appears the homeownership rate will continue to increase.

The 2019 Aspiring Home Buyers Profile recently released by the National Association of Realtors revealed that 84% of non-owners want to own a home in the future. That percentage increased from 73% earlier last year.

Bottom Line

In the United States, the concept of homeownership as part of the American Dream is very much alive and well.

To discuss if homeownership fits into our family & financial plan, contact one of our agents at 469-951-9588

.jpg)