Do I Really Need a 20% Down Payment to Buy a Home?

Do I Really Need a 20% Down Payment to Buy a Home?

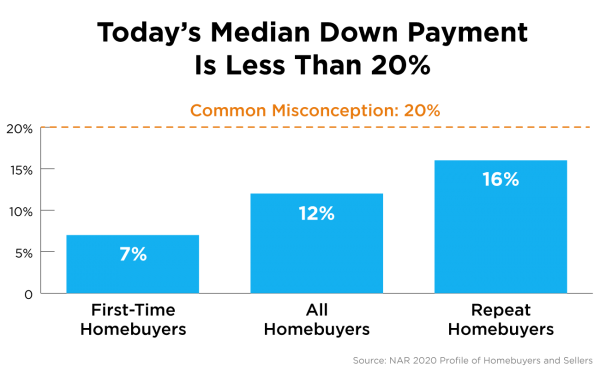

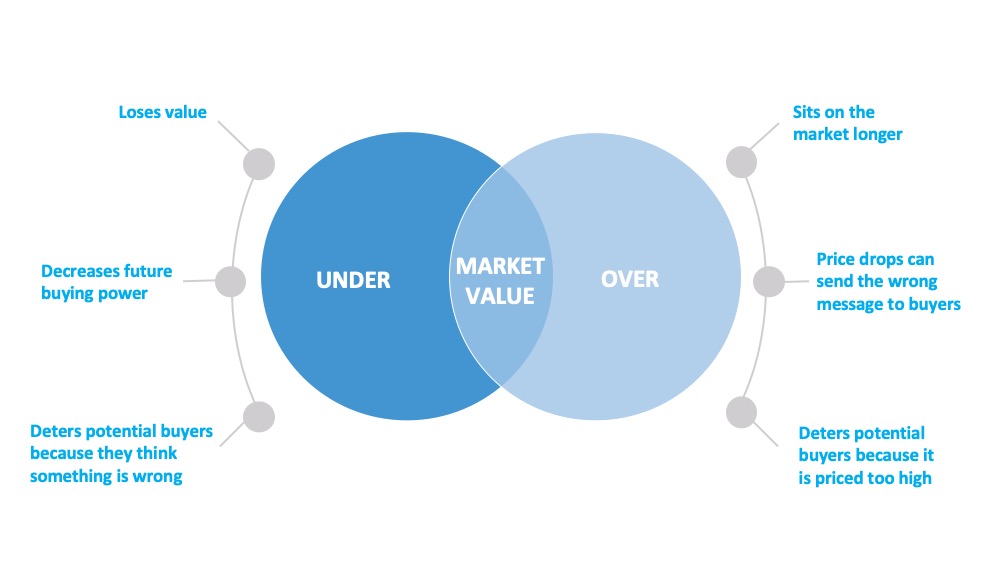

Is the idea of saving for a down payment holding you back from buying a home right now? You may be eager to take advantage of today’s low mortgage rates, but the thought of needing a large down payment might make you want to pump the brakes. Today, there’s still a common myth that you have to come up with 20% of the total sale price for your down payment. This means people who could buy a home may be putting their plans on hold because they don’t have that much saved yet. The reality is, whether you’re looking for your first home or you’ve purchased one before, you most likely don’t need to put 20% down. Here’s why.

According to Freddie Mac:

“The most damaging down payment myth—since it stops the homebuying process before it can start—is the belief that 20% is necessary.”

If saving that much money sounds daunting, potential homebuyers might give up on the dream of homeownership before they even begin – but they don’t have to.

Data in the 2020 Profile of Home Buyers and Sellers from the National Association of Realtors (NAR) indicates that the median down payment actually hasn’t been over 20% since 2005, and even then, that was for repeat buyers, not first-time homebuyers. As the image below shows, today’s median down payment is clearly less than 20%.

What does this mean for potential homebuyers?

As we can see, the median down payment was lowest for first-time buyers with the 2020 percentage coming in at 7%. If you’re a first-time buyer and putting down 7% still seems high, understand that there are programs that allow qualified buyers to purchase a home with a down payment as low as 3.5%. There are even options like VA loans and USDA loans with no down payment requirements for qualified applicants.

It’s important for potential homebuyers (whether they’re repeat or first-time buyers) to know they likely don’t need to put down 20% of the purchase price, but they do need to do their homework to understand the options available. Be sure to work with trusted professionals from the start to learn what you may qualify for in the homebuying process.

Bottom Line

Don’t let down payment myths keep you from hitting your homeownership goals. If you’re hoping to buy a home this year, let’s connect to review your options.

![Winning as a Buyer in a Sellers’ Market [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2020/12/08151044/20201211-MEM-1046x2448.png)

![Top Reasons to Love Homeownership [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2020/02/13122038/20200214-MEM-ENG-1046x1308.jpg)