Why It’s Still a Seller’s Market Today

Why It’s Still a Seller’s Market Today

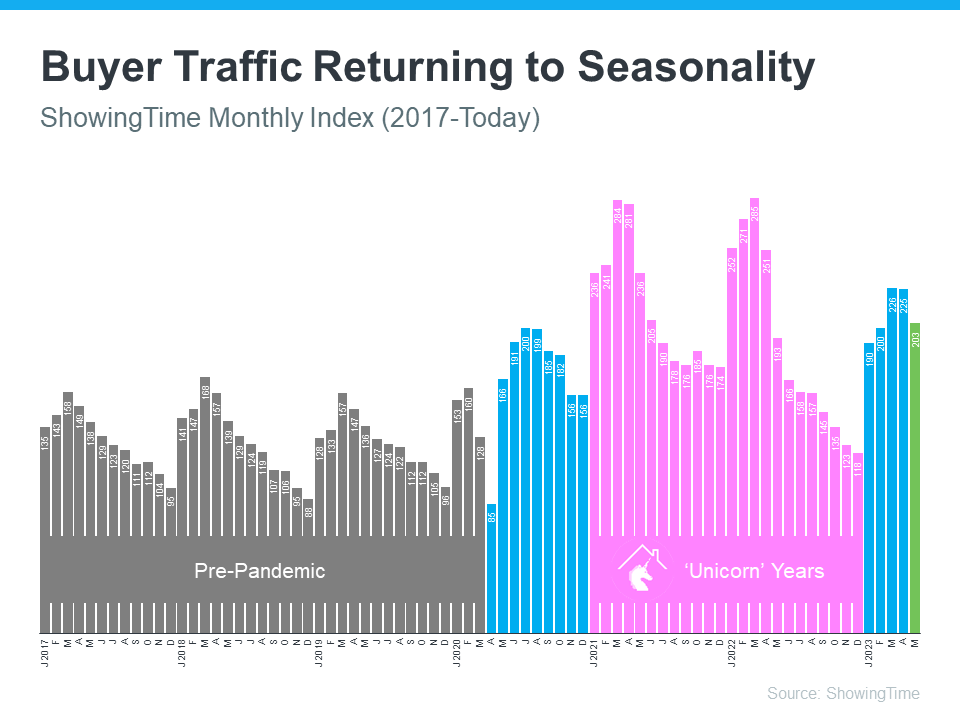

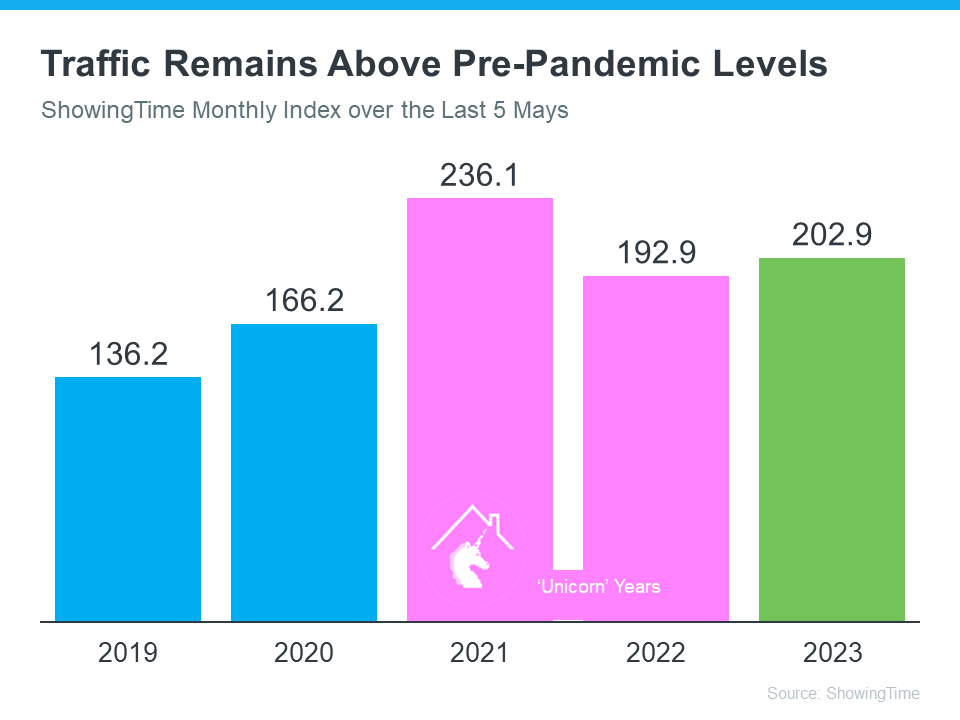

Even though activity in the housing market has slowed from the frenzy that was the ‘unicorn’ years, it’s still a seller’s market because the supply of homes for sale is so low. But what does that really mean for you? And why are conditions today so good if you want to sell your house?

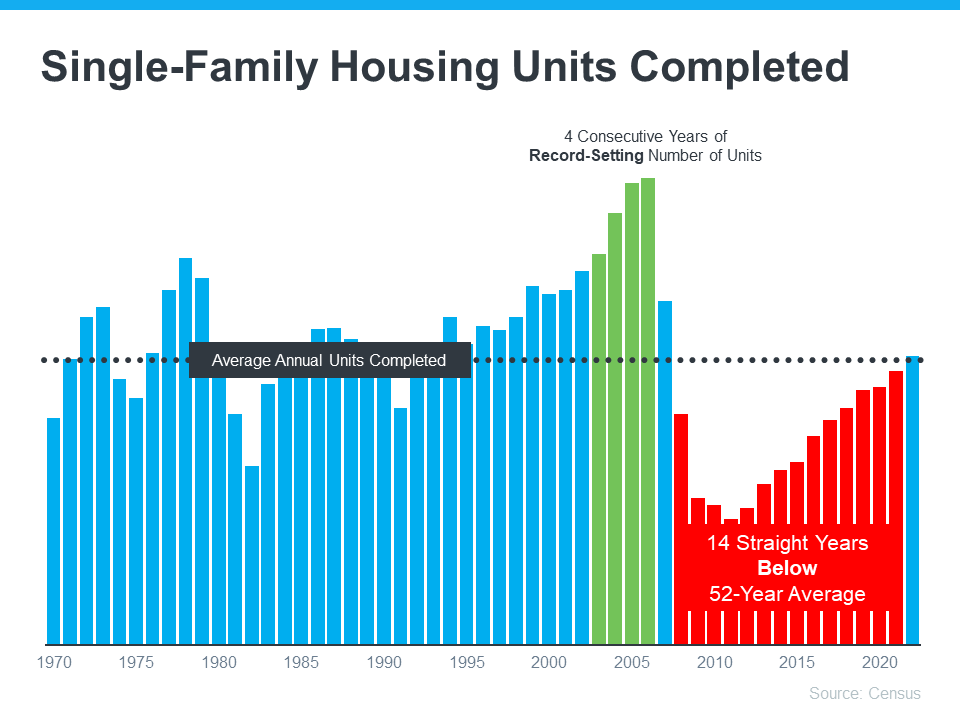

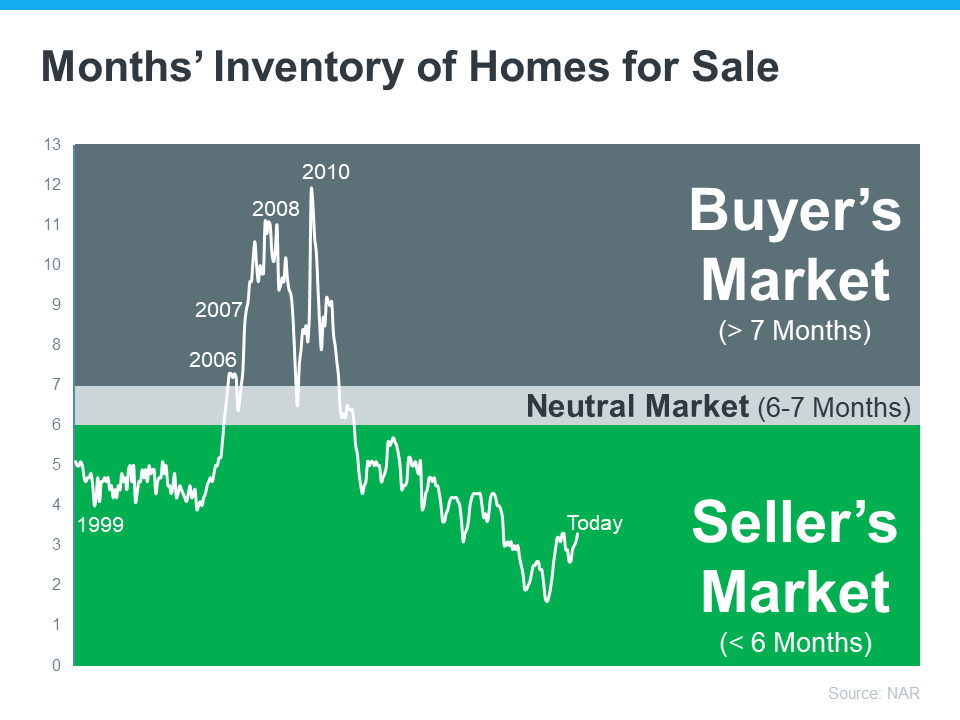

The latest Existing Home Sales Report from the National Association of Realtors (NAR) shows housing supply is still astonishingly low. Housing inventory is measured by the number of available homes on the market. It’s also measured by months’ supply, meaning the number of months it would take to sell all those available homes based on current demand. In a balanced market, there’s usually about a six-month supply. Today, we have only about 3 months’ supply of homes at the current sales pace (see graph below):

As the visual shows, given the current inventory of homes, it’s still a seller's market.

As the visual shows, given the current inventory of homes, it’s still a seller's market.

Today, we’re nowhere near what’s considered a balanced market. In fact, the current months’ supply is half of what’s typical of a normal market. That means there just aren’t enough homes to go around based on today’s buyer demand.

As Lawrence Yun, Chief Economist for NAR, says:

“There are simply not enough homes for sale. The market can easily absorb a doubling of inventory.”

How Does Being in a Seller’s Market Benefit You?

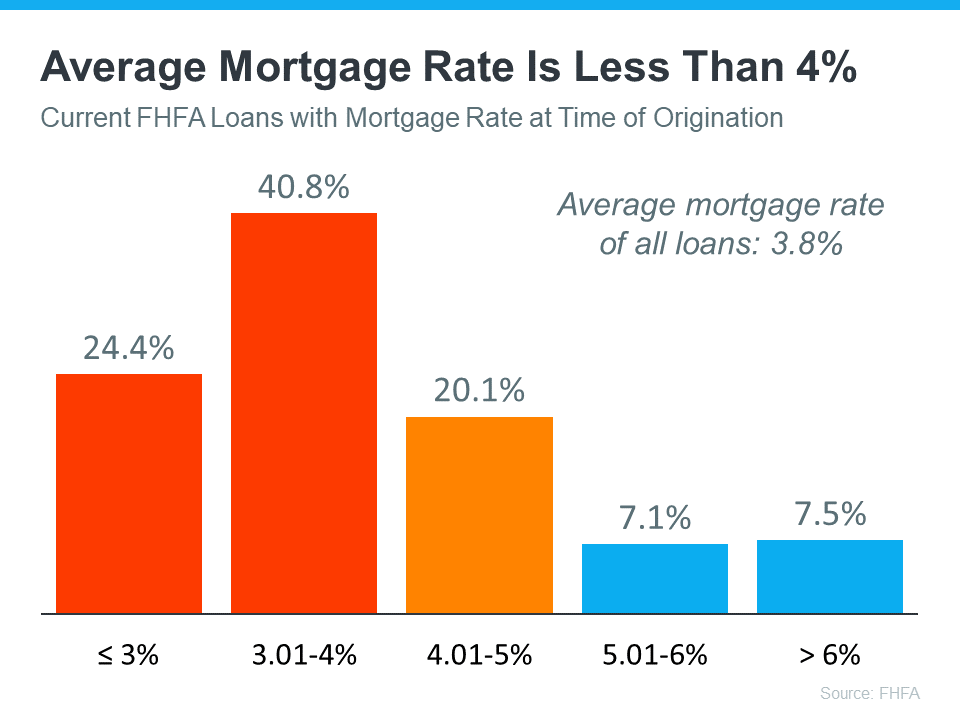

Sellers, these conditions give you a real edge. Right now, there are buyers who are ready, willing, and able to purchase a home. And, because there's a shortage of homes up for sale, the ones that do hit the market are like magnets for those buyers.

If you work with a local real estate agent to list your house right now, in good condition, and at the right price, it could get a lot of attention. You might even end up with multiple offers.

Bottom Line

Today’s seller’s market sets you up with a big advantage when you sell your house. Because supply is so low, your house will be in the spotlight for motivated buyers who are craving more options. Let’s connect so you understand what’s happening in our local area as you get ready to enter the market.