Millionaire To Millennials: Don’t Get Stuck Renting A Home… Buy One!

Millionaire To Millennials: Don’t Get Stuck Renting A Home… Buy One!

In a CNBC article, self-made millionaire David Bach explained that: “The biggest mistake millennials are making is not buying their first home.” He goes on to say that, “If you want to build real financial security, real wealth for your lifetime, then you need to buy a home.”

Bach went on to explain:

“Homeowners are worth 40 times more than renters. Now, that first home doesn’t need to be a dream home, it can be a very small home. You might literally have to buy a small studio apartment, but that’s how you get started.”

Then he explains the secret to buying that home!

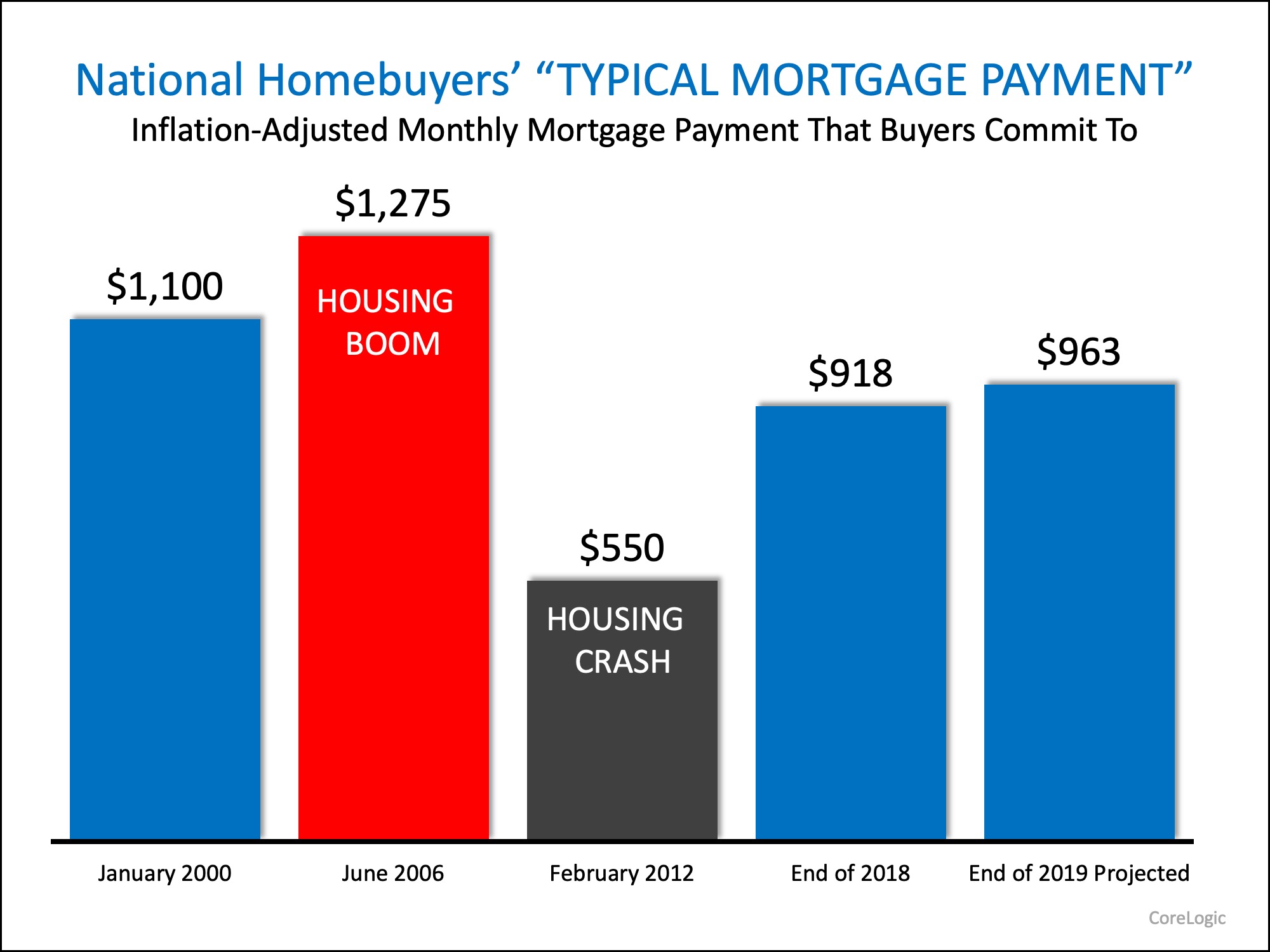

“Don’t do a 30-year mortgage. You want to take that 30-year mortgage and instead pay it off early, do a 15-year mortgage. What happens if you do a 15-year mortgage? Well, one, you pay the mortgage off 15-years sooner, that means you’ll be able to retire in your fifties. Number two, you’ll save a fortune (on potentially hundreds of thousands of dollars in interest payments).”

What will it cost to pay your mortgage in fifteen years? He explains further:

“For fifteen years, you got to brownbag your lunch. Think about that! Brownbag your lunch literally for fifteen years. You can retire ten years sooner than your friends. You’ll have real wealth, because you bought a home – you’re not a renter. And you’ll be financially secure for life.”

Bottom Line

Whenever a well-respected millionaire gives investment advice, people usually clamor to hear it. This millionaire gave simple advice – if you don’t yet live in your own home, go buy one.

Who is David Bach?

Bach is a self-made millionaire who has written nine consecutive New York Times bestsellers. His book, “The Automatic Millionaire,” spent 31 weeks on the New York Times bestseller list. He is one of the only business authors in history to have four books simultaneously on the New York Times, Wall Street Journal, BusinessWeek and USA Today bestseller lists.

He has been a contributor to NBC’s Today Show, appearing more than 100 times, as well as a regular on ABC, CBS, Fox, CNBC, CNN, Yahoo, The View, and PBS. He has also been profiled in many major publications, including the New York Times, BusinessWeek, USA Today, People, Reader’s Digest, Time, Financial Times, Washington Post, the Wall Street Journal, Working Woman, Glamour, Family Circle, Redbook, Huffington Post, Business Insider, Investors’ Business Daily, and Forbes.

Christie Cannon | REALTOR

The Christie Cannon Team

Keller Williams Realty Frisco

972-215-7747

www.ChristieCannon.com

www.CannonTeamHomes.com

Global powerhouses with household names and large workforces continue to flock to North Texas. Companies like Toyota, Pizza Hut, Keurig Dr Pepper, Frito Lay & JCPenney have all left their longtime headquarters and set up new ones right here.

Global powerhouses with household names and large workforces continue to flock to North Texas. Companies like Toyota, Pizza Hut, Keurig Dr Pepper, Frito Lay & JCPenney have all left their longtime headquarters and set up new ones right here.

![5 Reasons Homeowners Throw the Best Super Bowl Parties! [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2019/01/29060304/20190201-Super-Bowl-MEM-ENG-1046x808.jpg)