Consumers Agree: It’s a Good Time To Sell

Consumers Agree: It’s a Good Time To Sell

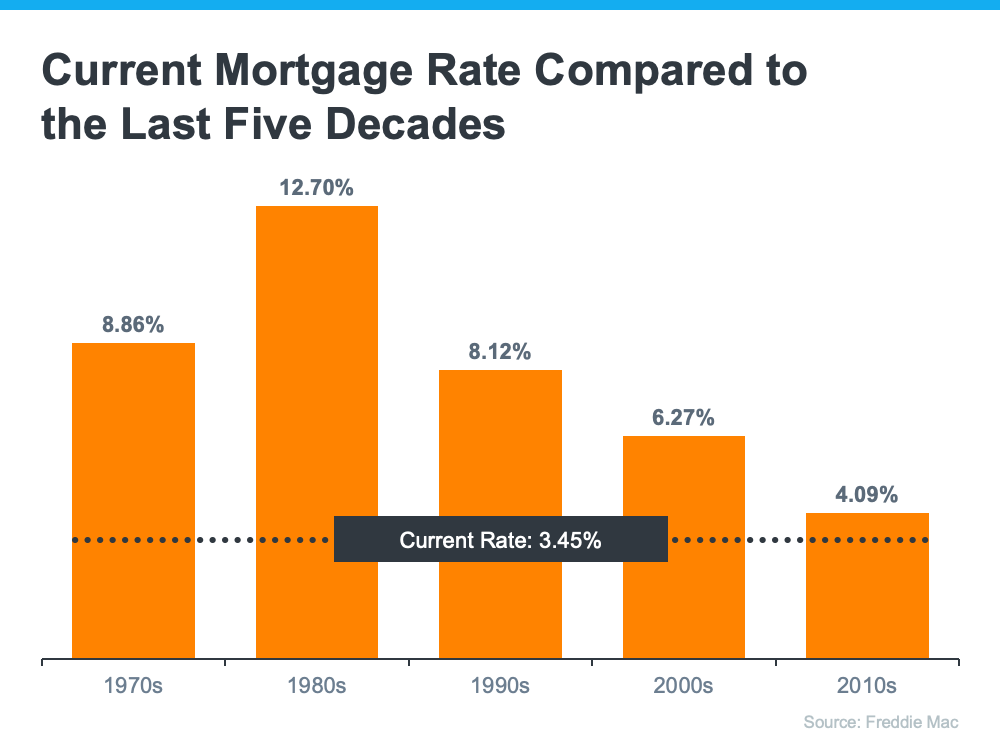

In today’s sellers’ market, many homeowners are weighing their options and trying to decide if they should sell their house. If you’re in that group, you may be balancing things like the ongoing health crisis, rising mortgage rates, and your own changing needs to determine your best time to make a move.

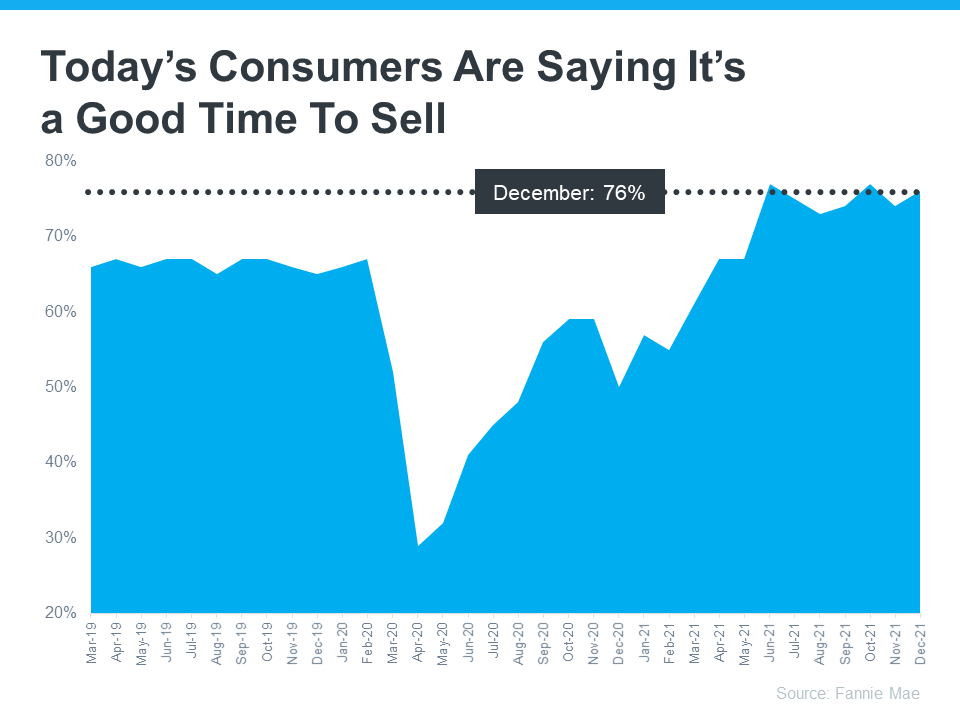

However, recent data shows that time may already be here. According to the latest Home Purchase Sentiment Index (HPSI) by Fannie Mae, 76% of consumers believe now is a good time to sell.

Looking back over the past few years, its clear consumers are incredibly optimistic today. The graph below shows the percent of survey respondents who say it’s a good time to sell a house, and their positive outlook is on the rise. The big dip near the middle of the chart indicates how consumer sentiment about selling dropped at the beginning of the pandemic as uncertainty about the health crisis and its impact grew. The good news is, the trend today shows a continued, drastic improvement, and people are feeling more and more confident with time about selling a home.

In fact, survey respondents think it’s an even better time to sell a house today than they did in the lead-up to the health crisis. The latest survey results indicate we’re at one of the strongest peaks in seller sentiment since March of 2019, hitting highs when 77% of people thought it was a good time to sell only twice before in June and October of 2021.

Why Are Consumers So Optimistic About Today’s Housing Market?

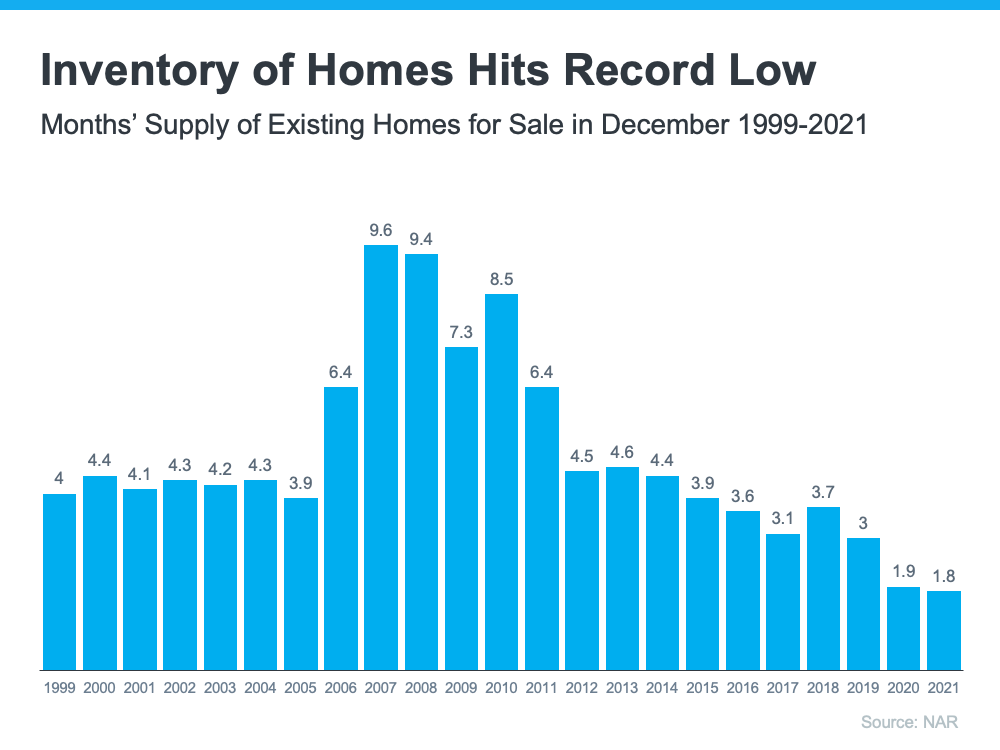

From record-high equity gains to record-low housing supply and significant buyer demand, homeowners have more motivation than ever to sell. There are more buyers in today’s market than there are homes for sale, and that’s driving home prices up, making it a great time to sell your house.

According to the National Association of Realtors (NAR), the current supply of homes for sale today is at a 1.8-month supply, which is an all-time low. When the supply of homes for sale is low, sellers will likely see more offers, which is exactly what’s happening right now. As NAR notes:

“The average home for sale is receiving 3.8 offers today, up from 3.3 offers just one year ago.”

Bottom Line

With the inventory of houses for sale so low today pushing home prices in an upward direction, it’s no wonder consumers think it’s a good time to sell. If you’re ready to take advantage of today’s favorable sellers’ market, let’s connect today.