New Build Inventories are Seeing a New Peak

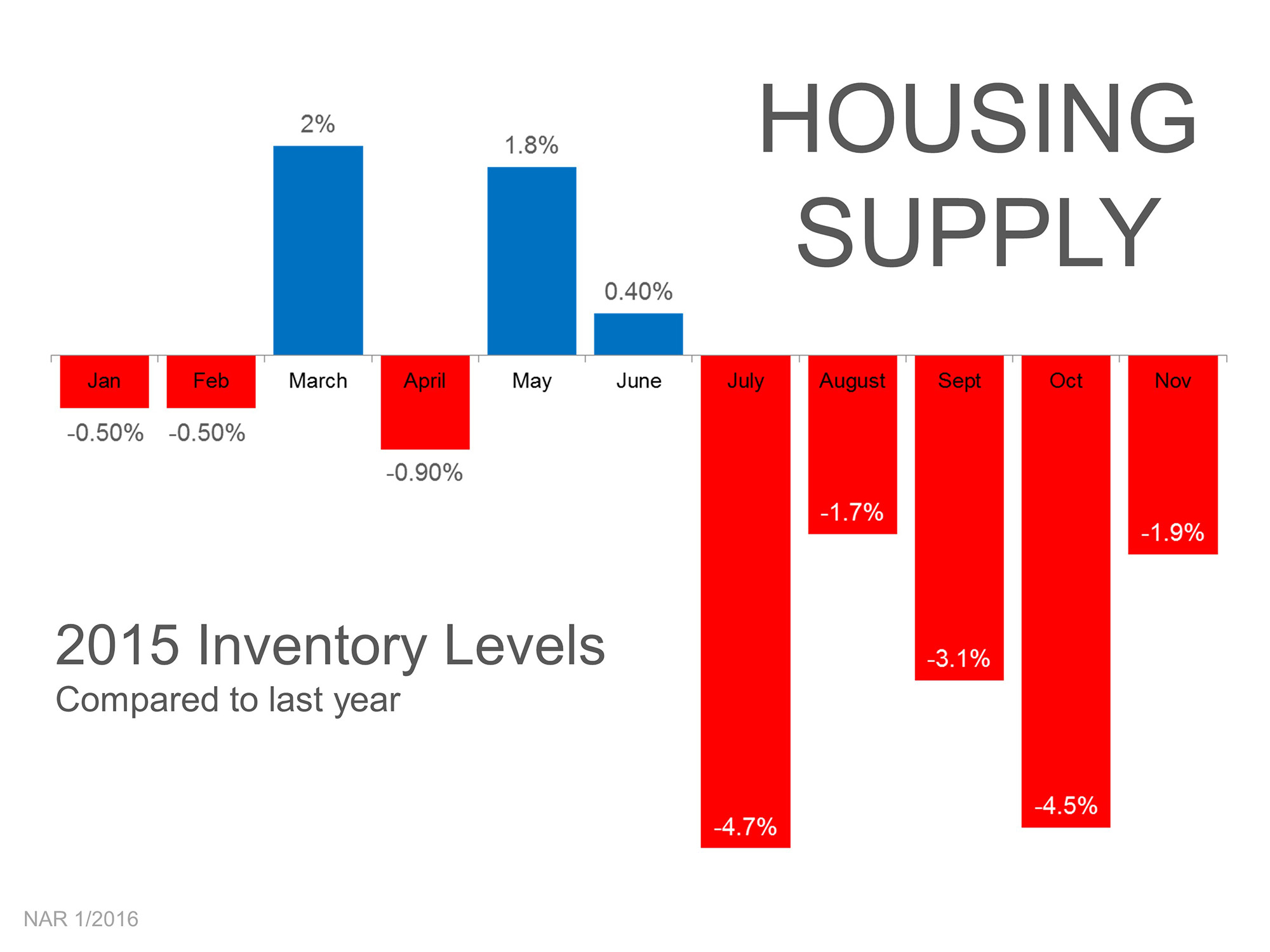

Many experts have been calling upon home builders to ramp up construction to help with the lack of existing inventory for sale. For the past two months, new home sales have surged, with July’s total coming in at the highest since October 2007.

The latest estimates from the US Census Bureau and Department of Housing and Urban Development show that sales in July were31.3% higher than this time last year, and 12.4% higher than last month, at a seasonally adjusted annual rate of 654,000.

Zillow’s Chief Economist, Svenja Gudell, echoed the reaction of some as she commented:

“July(‘s) new home sales data was a surprise, but a welcome one. For years, the market has been practically begging builders to both ramp up their efforts overall and to put more focus on serving the less expensive end of the market. Today's data confirms both are happening in earnest.”

The National Association of Home Builder’s (NAHB) Chairman, Ed Brady, didn’t seem as surprised:

“This rise in new home sales is consistent with our builders’ reports that market conditions have been improving. As existing home inventory remains flat, we should see more consumers turning to new construction.”

NAHB’s Chief Economist, Robert Dietz, believes this is just the start for new home sales if market conditions continue:

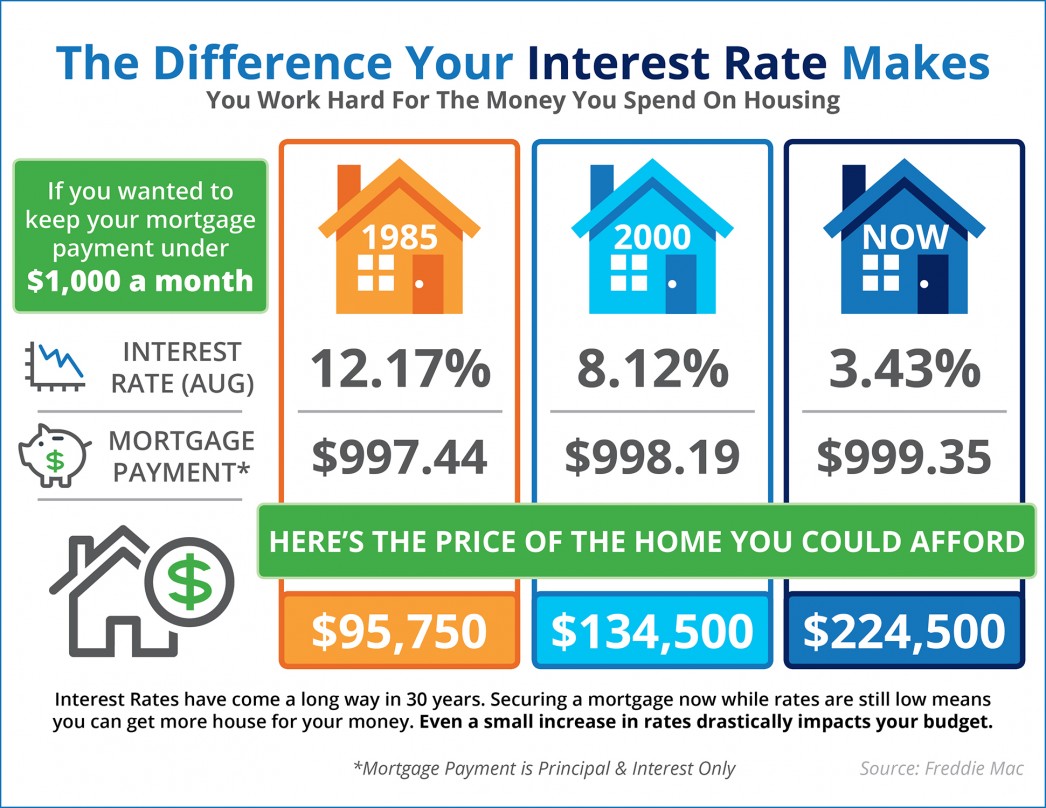

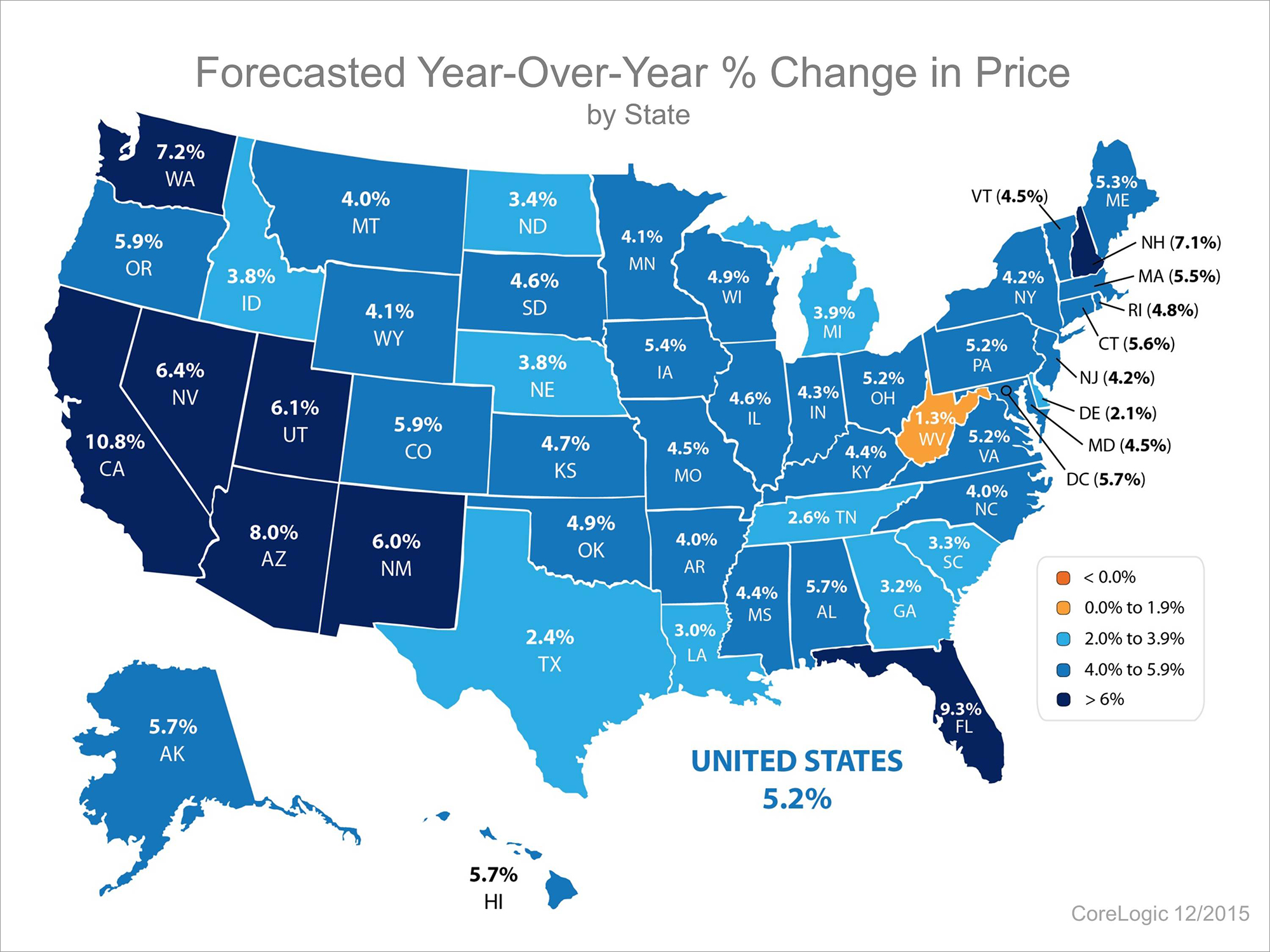

“July’s positive report shows there is a need for new single-family homes, buoyed by increased household formation, job gains and attractive mortgage rates. This uptick in demand should translate into increased housing production throughout 2016 and into next year.”

The existing home sales numbers for July will be released today and will shed more light on the overall health of the housing market.

Bottom Line

New home sales hit their highest mark in over 9 years. Buyers are out in force to find a home that fits their needs. Many are turning to new construction, as the inventory of existing homes has not been able to keep up with demand.