Housing Could Be A Leader In The Post-Pandemic Economy

|

||

|

||

|

Displaying blog entries 131-140 of 170

|

||

|

||

|

"We estimate that there are currently 29 states that have a housing deficit, and when we consider only these states, the housing shortage grows from 2.5 million units to 3.3 million units"

Texas currently is experiencing a 4.81% deficit in housing supply

- from the Freddie Mac Report - The Housing Supply Shortage: State of the States

Contact one of our expert agents today if you are looking to buy or sell and want to know your options during the Coronavirus. Our team is always here to help and educate!

972-215-7747 | cannonteamhomes.com

The novel coronavirus was unable to dampen the interest of homebuyers in the past week.

Even as people follow stay-at-home guidelines, the number of people filing home purchase applications rose 12 percent on a seasonally adjusted basis, according to the Mortgage Bankers Association.

That's the strongest level in almost a month.

"The ten largest states had increases in purchase activity, which is potentially a sign of the start of an upturn in the pandemic-delayed spring homebuying season, as coronavirus lockdown restrictions slowly ease in various markets,” said Joel Kan, MBA’s associate vice president of economic and industry forecasting. “California and Washington continued to show increases in purchase activity, with New York seeing a significant gain after declines in five of the last six weeks.”

Helping to boost purchase interest was a decline in mortgage rates to 3.43 percent for a 30-year mortgage, a record low in MBA's survey.

"Refinance activity declined 7 percent, as rates for refinances likely remained higher than those for purchase loans, " said Kan. "Lenders are still working through pipelines at capacity, and observed changes in credit availability for refinance loans have also in turn impacted rates.”

Overall demand for mortgage applications fell 3.3 percent from the prior week.

The survey covers over 75 percent of all U.S. retail residential mortgage applications and has been conducted weekly since 1990.

In a recent survey by realtor.com, people thinking about selling their homes indicated they’re generally willing to allow their agent and some potential buyers inside if done under the right conditions. They’re less comfortable, however, hosting an open house. This is understandable, given the health concerns associated with social contact these days. The question is, if you need to sell your house now, what virtual practices should you use to make sure you, your family, and potential buyers stay safe in the process?

In today’s rapidly changing market, it’s more important than ever to make sure you have a digital game plan and an effective online marketing strategy when selling your house. One of the ways your agent can help with this is to make sure your listing photos and virtual tours stand out from the crowd, truly giving buyers a detailed and thorough view of your home.

So, if you’re ready to move forward, virtual practices may help you win big when you’re ready to sell. While abiding by state and local regulations is a top priority, a real estate agent can help make your sale happen. Agents know exactly what today’s buyers need, and how to put the necessary digital steps in place. For example, according to the same survey, when asked to select what technology would be most helpful when deciding on a new home, here’s what today’s homebuyers said, in order of preference:

After leveraging technology, if you have serious buyers who still want to see your house in person, keep in mind that according to the National Association of Realtors (NAR), there are ways to proceed safely. Here are a few of the guidelines, understanding that the top priority should always be to obey state and local restrictions first:

Getting comfortable with your agent – a true trusted advisor – taking these steps under the new safety standards might be your best plan. This is especially important if you’re in a position where you need to sell your house sooner rather than later.

Nate Johnson, CMO at realtor.com ® notes:

"As real estate agents and consumers seek out ways to safely complete these transactions, we believe that technology will become an even more imperative part of how we search for, buy and sell homes moving forward."

It sounds like some of these new practices might be here to stay.

In a new era of life, things are shifting quickly, and virtual strategies for sellers may be a great option. Opening your doors up to digital approaches may be game-changing when it comes to selling your house. Let’s connect so you have a trusted real estate professional to help you safely and effectively navigate through all that’s new when it comes to making your next move.

There are two crises in this country right now: a health crisis that has forced everyone into their homes and a financial crisis caused by our inability to move around as we normally would. Over 20 million people in the U.S. became instantly unemployed when it was determined that the only way to defeat this horrific virus was to shut down businesses across the nation. One second a person was gainfully employed, a switch was turned, and then the room went dark on their livelihood.

The financial pain so many families are facing right now is deep.

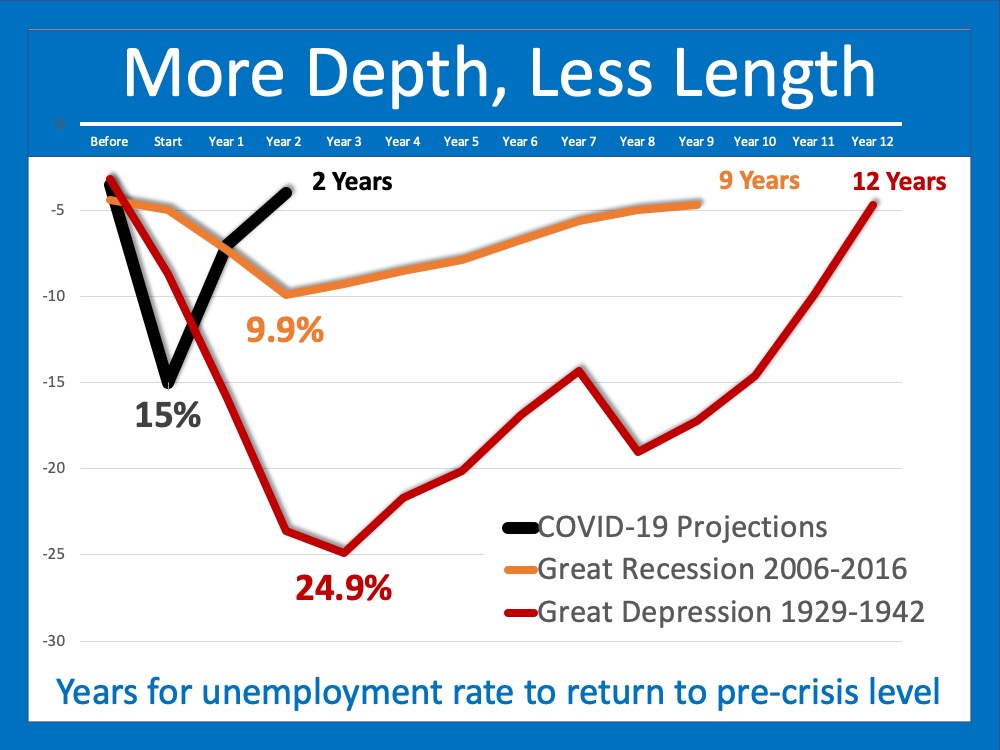

Major institutions are forecasting unemployment rates last seen during the Great Depression. Here are a few projections:

As horrific as those numbers are, there is some good news. The pain will be deep, but it won’t last as long as it did after previous crises. Taking the direst projection from Goldman Sachs, we can see that 15% unemployment quickly drops to 6-8% as we head into next year, continues to drop, and then returns to about 4% in 2023.

When we compare that to the length of time it took to get back to work during both the Great Recession (9 years long) and the Great Depression (12 years long), we can see how the current timetable is much more favorable.

It’s devastating to think about how the financial heartache families are going through right now is adding to the uncertainty surrounding their health as well. Hopefully, we will soon have the virus contained and then we will, slowly and safely, return to work.

![How Technology is Helping Buyers Navigate the Home Search Process [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2020/04/16133213/20200417-MEM-Eng-1046x1308.png)

Every day that passes, people have a need to buy and sell homes. That doesn’t stop during the current pandemic. If you’ve had a major life change recently, whether with your job or your family situation, you may be in a position where you need to sell your home – and fast. While you probably feel like timing with the current pandemic isn’t on your side, making a move is still possible. Rest assured, with technology at your side and fewer sellers on the market in most areas, you can list your house and make it happen safely and effectively, especially when following the current COVID-19 guidelines set forth by the National Association of Realtors (NAR) and the Centers for Disease Control and Prevention (CDC).

You may have a new baby, a new employment situation, a parent who moved in with you, you just built a home that’s finally ready to move into, or some other major part of your life that has changed in recent weeks. Buyers have those needs too, so rest assured that someone is likely looking for a home just like yours.

According to the NAR Flash Survey: Economic Pulse taken April 5 – 6, real estate agents indicate, not surprisingly, that there’s a noticeable decline in current homebuyer interest. That said, 10% of agents said in the same survey that they saw no change or even an increase in buyer activity. So, while buyer interest is low compared to normal spring markets, there are still buyers in the market. Don’t forget, you only need one buyer – the right one for your home.

Here’s the other thing – people are spending a lot of time on the Internet right now, given the stay-at-home orders implemented across the country. Buyers are actively looking at homes for sale online. Some of them are reaching out to real estate professionals for virtual tours and getting ready to make offers too. Homes are being sold in many markets.

The same survey indicates that 56% of NAR members said sellers are removing their homes from the market right now. This can definitely work in your favor. If other sellers are removing their listings, your home has a better chance of rising to the top of a buyer’s search list and being seen. Keep in mind, listings will pick up again soon, as 57% of the respondents note that sellers are only planning to delay the process by a couple of months. If you need to sell right now, don’t wait for the competition to get back into the market again.

This year, delayed listings from the typically busy spring season will push into the summer months, so more competition will be coming to the market as the pandemic passes. Getting ahead of that wave now might be your biggest opportunity.

Real estate agents are working hard every single day under untraditional circumstances, utilizing technology to help both buyers and sellers who need to continue with their plans. We’re using virtual tours to show homes currently on the market, staying connected with the buyers and sellers through video chats, and leveraging resources to complete transactions electronically. We’re making sure the families we support remain safe and can keep their real estate needs on track, especially as life is changing so rapidly.

Homes are still being bought and sold in the midst of this pandemic. If you need to sell your house and would like to know the current status in our local market, let’s work together to create a safe and effective plan that works for you and your family.

With over 90% of Americans now under a shelter-in-place order, many experts are warning that the American economy is heading toward a recession, if it’s not in one already. What does that mean to the residential real estate market?

According to the National Bureau of Economic Research:

“A recession is a significant decline in economic activity spread across the economy, lasting more than a few months, normally visible in real GDP, real income, employment, industrial production, and wholesale-retail sales.”

COVID-19 hit the pause button on the American economy in the middle of March. Goldman Sachs, JP Morgan, and Morgan Stanley are all calling for a deep dive in the economy in the second quarter of this year. Though we may not yet be in a recession by the technical definition of the word today, most believe history will show we were in one from April to June.

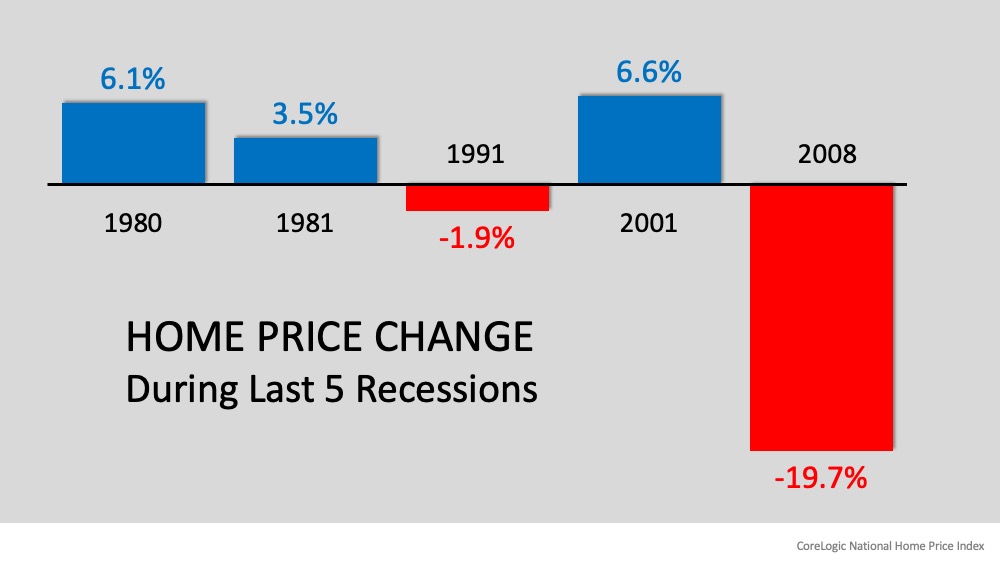

Many fear a recession will mean a repeat of the housing crash that occurred during the Great Recession of 2006-2008. The past, however, shows us that most recessions do not adversely impact home values. Doug Brien, CEO of Mynd Property Management, explains:

“With the exception of two recessions, the Great Recession from 2007-2009, & the Gulf War recession from 1990-1991, no other recessions have impacted the U.S. housing market, according to Freddie Mac Home Price Index data collected from 1975 to 2018.”

CoreLogic, in a second study of the last five recessions, found the same. Here’s a graph of their findings:

This is what three economic leaders are saying about the housing connection to this recession:

Robert Dietz, Chief Economist with NAHB

“The housing sector enters this recession underbuilt rather than overbuilt…That means as the economy rebounds - which it will at some stage - housing is set to help lead the way out.”

Ali Wolf, Chief Economist with Meyers Research

“Last time housing led the recession…This time it’s poised to bring us out. This is the Great Recession for leisure, hospitality, trade and transportation in that this recession will feel as bad as the Great Recession did to housing.”

John Burns, founder of John Burns Consulting, also revealed that his firm’s research concluded that recessions caused by a pandemic usually do not significantly impact home values:

“Historical analysis showed us that pandemics are usually V-shaped (sharp recessions that recover quickly enough to provide little damage to home prices).”

If we’re not in a recession yet, we’re about to be in one. This time, however, housing will be the sector that leads the economic recovery.

/arc-anglerfish-arc2-prod-dmn.s3.amazonaws.com/public/G5AMJKVFLJB5BORUONTMA6AA64.jpg)

Housing markets that will be most negatively affected by the COVID-19 infections and resulting economic recession are mostly in the Northeast and Florida, according to a new report by analysts at Attom Data Solutions.

Researchers looked at almost 500 home markets around the country and rated them based on foreclosures, homeowner equity, wages and other factors.

“It’s too early to tell how much effect the coronavirus fallout will have on different housing markets around the country. But the impact is likely to be significant from region to region and county to county,” Attom Data’s Todd Teta said in the just-released report. “What we’ve done is spotlight areas that appear to be more or less at risk based on several important factors.

“From that analysis, it looks like the Northeast is more at risk than other areas,” he said. “As we head into the spring homebuying season, the next few months will reveal how severe the impact will be.”

Attom Data estimates the major housing markets most at risk from the virus include four in New Jersey and the New York area, three in Connecticut and 10 from Florida. Only one was in California, and none were located in other West Coast states.

“Texas has 10 of the 50 least vulnerable counties from among the 483 included in the report, followed by Wisconsin with seven and Colorado with five,” Attom Data analysts said. “The 10 counties in Texas include three in the Dallas-Fort Worth metro area (Dallas, Collin and Tarrant counties).

Harris County in the Houston area and Travis County in the Austin area were also ranked low for coronavirus-related housing shakeouts.

The pandemic and shelter-in-place orders are already affecting North Texas’ housing markets because there are fewer home shoppers in the market at a time of year when home sales typically boom.

And the Dallas-Fort Worth area was one of the few major metros in the country that saw a decline in the median list prices of homes listed for sale in March — they were down 3% from a year ago, according to Realtor.com

Dr. James Gaines, chief economist with the Real Estate Center at Texas A&M University, said he’s seen forecasts that predict Texas’ home markets will fare better coming out of the pandemic. But he’s wary of making any predictions.

“Obviously, the New York market will be collapsed and the tourist areas,” Gaines said. “Beyond that, we simply flat don’t know.

“The hit of the virus here in Texas so far has been considered light compared to other areas of the country.”

Gaines said it will be several months before sales and pricing numbers show where the Texas home markets land.

“I’ve seen some preliminary March numbers that indicate that we have had a slowdown but not a collapse,” he said. “But going forward, it’s going to look really bad year-over-year.

“March, April, May, June and July are usually our hot housing months.”

/arc-anglerfish-arc2-prod-dmn.s3.amazonaws.com/public/3U2OSOXNKBCVRCNMQVH7B66VCE.jpg)

![The Housing Market Is Positioned to Help the Economy Recover [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2020/04/02095400/20200403-MEM-EN-1046x1308.jpg)

With interest rates hitting all-time lows over the past few weeks, many homeowners are opting to refinance. To decide if refinancing your home is the best option for you and your family, start by asking yourself these questions:

There are many reasons to refinance, but here are three of the most common ones:

1. Lower Your Interest Rate and Payment: This is the most popular reason. Is your current interest rate higher than what’s available today? If so, it might be worth seeing if you can take advantage of the current lower rates.

2. Shorten the Term of Your Loan: If you have a 30-year loan, it may be advantageous to change it to a 15 or 20-year loan to pay off your mortgage sooner rather than later.

3. Cash-Out Refinance: You might have enough equity to cash out and invest in something else, like your children’s education, a business venture, an investment property, or simply to increase your cash reserve.

Once you know why you might want to refinance, ask yourself the next question:

There are fees and closing costs involved in refinancing, and The Lenders Network explains:

“As an example, let’s say your mortgage has a balance of $200,000. If you were to refinance that loan into a new loan, total closing costs would run between 2%-4% of the loan amount. You can expect to pay between $4,000 to $8,000 to refinance this loan.”

They also explain that there are options for no-cost refinance loans, but be on the lookout:

“A no-cost refinance loan is when the lender pays the closing costs for the borrower. However, you should be aware that the lender makes up this money from other aspects of the mortgage. Usually charging a slightly higher interest rate so they can make the money back.”

Keep in mind that, given the current market conditions and how favorable they are for refinancing, it can take a little longer to execute the process today. This is because many other homeowners are going this route as well. As Todd Teta, Chief Officer at ATTOM Data Solutions notes about recent mortgage activity:

“Refinancing largely drove the trend, with more than twice as many homeowners trading in higher-interest mortgages for cheaper ones than in the same period of 2018.”

Clearly, refinancing has been on the rise lately. If you’re comfortable with the up-front cost and a potential waiting period due to the high volume of requests, then ask yourself one more question:

To answer this one, do the math. Will it help you save money? How much longer do you need to own your home to break even? Will your current home meet your needs down the road? If you plan to stay for a few years, then maybe refinancing is your best move.

If, however, your current home doesn’t fulfill your needs for the next few years, you might want to consider using your equity for a down payment on a new home instead. You’ll still get a lower interest rate than the one you have on your current house, and with the equity you’ve already built, you can finally purchase the home you’ve been waiting for.

Today, more than ever, it’s important to start working with a trusted real estate advisor. Whether you connect by phone or video chat, a real estate professional can help you understand how to safely navigate the housing market so that you can prioritize the health of your family without having to bring your plans to a standstill. Whether you’re looking to refinance, buy, or sell, a trusted advisor knows the best protocol as well as the optimal resources and lenders to help you through the process in this fast-paced world that’s changing every day.

Displaying blog entries 131-140 of 170