Four Ways You Can Use Your Home Equity

Four Ways You Can Use Your Home Equity

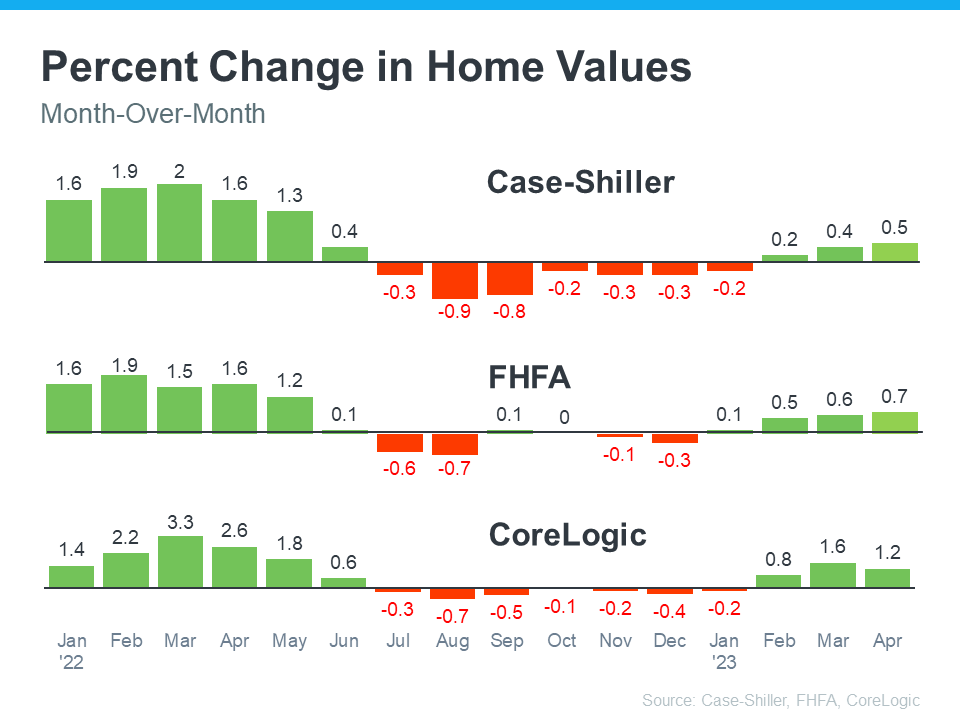

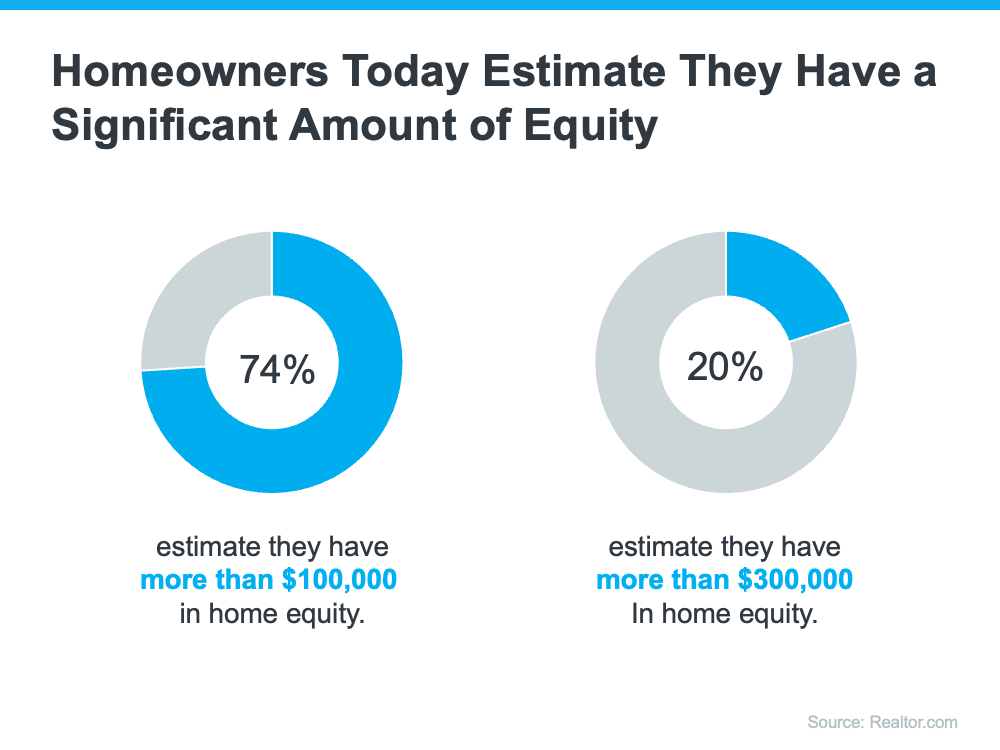

If you’re a homeowner, odds are your equity has grown significantly over the last few years. Equity builds over time as home values grow and as you pay down your home loan. And, since home prices skyrocketed during the ‘unicorn’ years, you’ve likely gained more than you think.

According to the latest Equity Insights Report from CoreLogic, the average homeowner has more than $274,000 in equity right now. That much equity can help you achieve certain goals. In a recent article, Bankrate elaborates:

“While the pandemic created serious challenges, the silver lining for anyone who owned a home was the sizable equity gain. Understanding how home equity works, and how to leverage it, is important for any homeowner.”

Here are a few examples of how you can put your home equity to work for you.

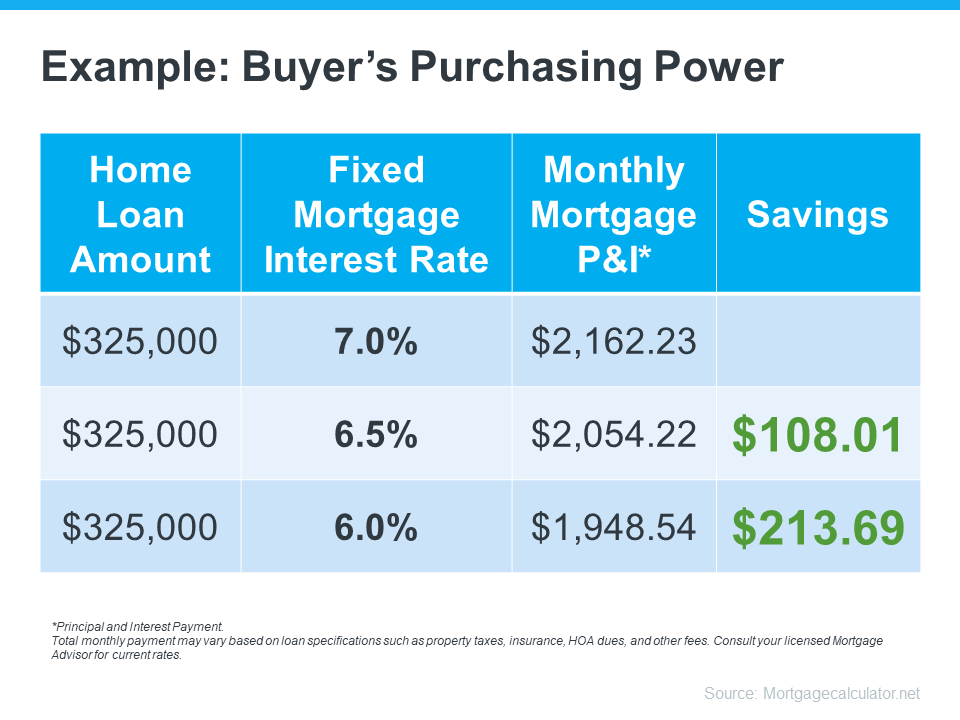

1. Buy a Home That Fits Your Needs

If your current space no longer meets your needs, it might be time to think about moving to a bigger home. And if you've got too much space, downsizing to a smaller home could be just right. Either way, you can put your equity toward a down payment on a home that fits your changing lifestyle. A real estate agent can help you figure out how much equity you've got and how to use it when buying your next home.

2. Reinvest in Your Current Home

Renovations are a great option if you want to change your living space, but you aren’t yet ready to make a move. Home improvement projects give you the freedom to tailor your home to match your needs and personal style. But it's important to consider the long-term benefits certain upgrades can bring to your home’s value. Lean on a real estate professional for the best advice on which improvement projects to prioritize in order to get the greatest return on your investment when you sell later on.

3. Pursue Personal Ambitions

Home equity can also serve as a catalyst for realizing your life-long dreams. That could mean investing in a new business venture, retirement, or funding an education. While you shouldn’t use your equity for unnecessary spending, using it responsibly for something meaningful and impactful can really make a difference in your life.

4. Understand Your Options to Avoid Foreclosure