The Best Time to Sell: The Week of April 16-22

Article by: Hannah Jones | realtor.com

Home sellers on the fence waiting for that perfect moment to sell should start preparations, because the best time to list a home in 2023 is approaching quickly.

The week of April 16-22 is expected to have the ideal balance of housing market conditions that favor home sellers, more so than any other week in the year.

This selection comes from looking at seasonal trends from 2018-2019 and 2021-2022 data. Due to the onset of the pandemic, 2020 was an uncharacteristic year and has therefore been excluded from the analysis. We expect the 2023 housing market to behave similarly to 2021, 2022 and pre-pandemic years in terms of seasonality. Each week was scored based on favorability toward sellers — this included competition from other sellers (active listings and new listings), listing prices, market pace (days on market), likelihood of price reductions, and homebuyer demand (views per property on Realtor.com). Percentile levels for each week were calculated along each metric , and were then averaged together across metrics to determine a Best Time to List score for each week. Rankings for each week were based on these Best Time to List scores.

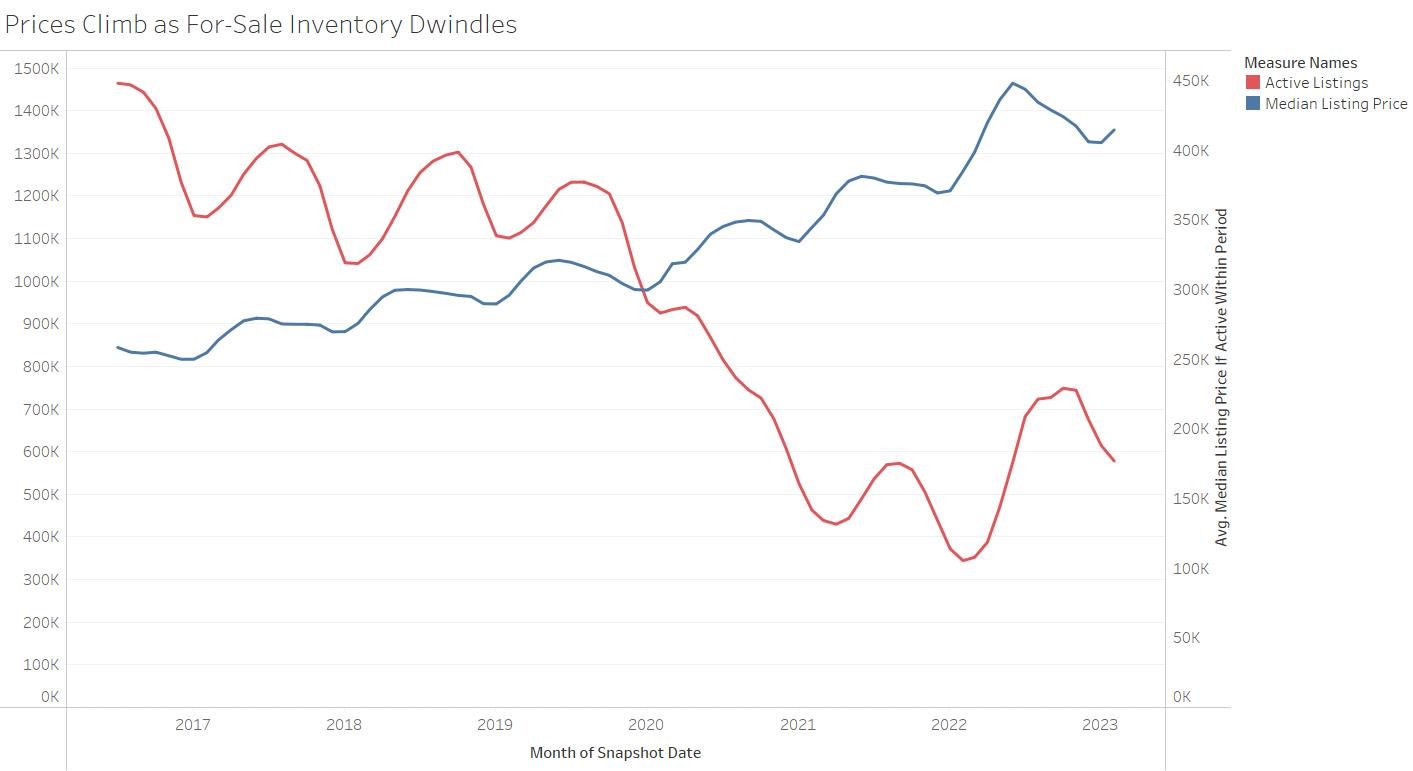

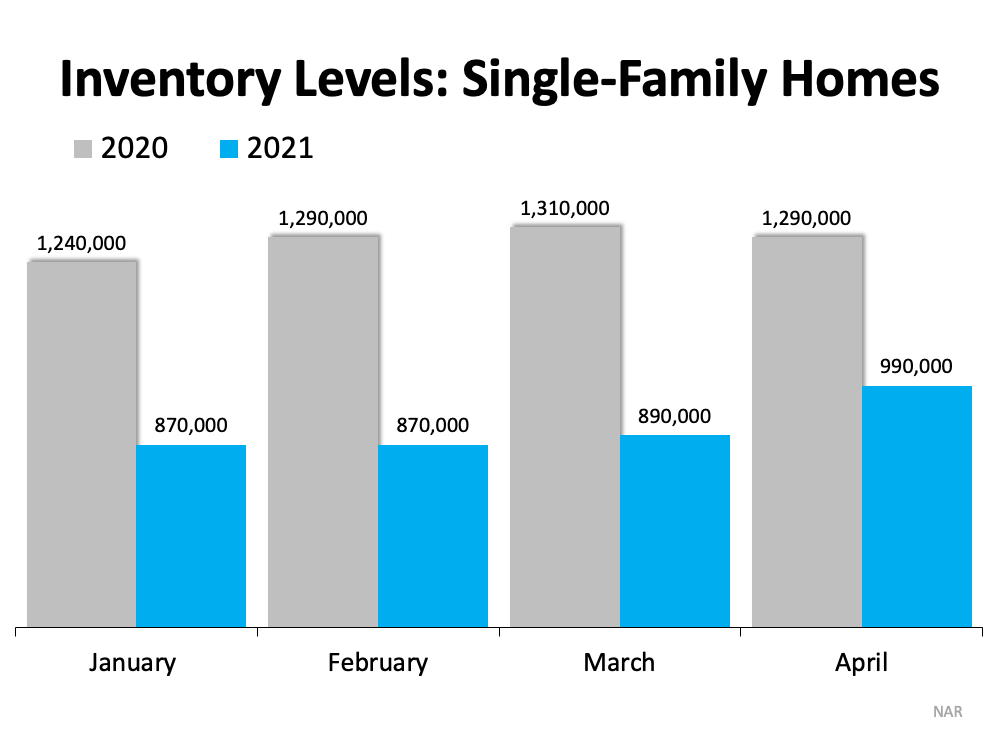

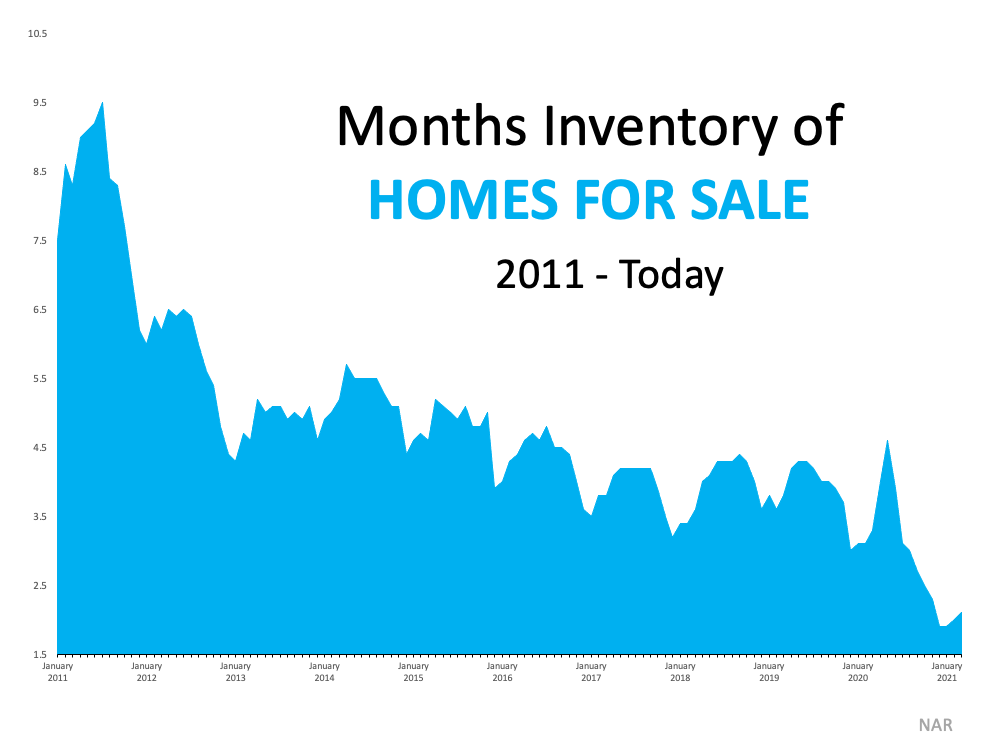

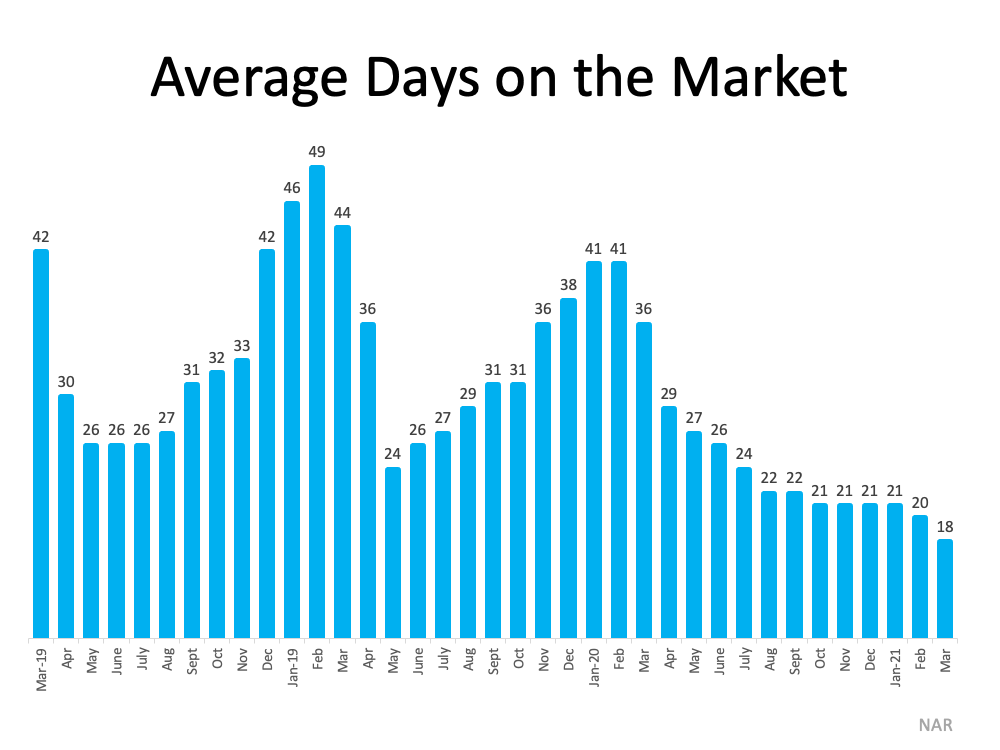

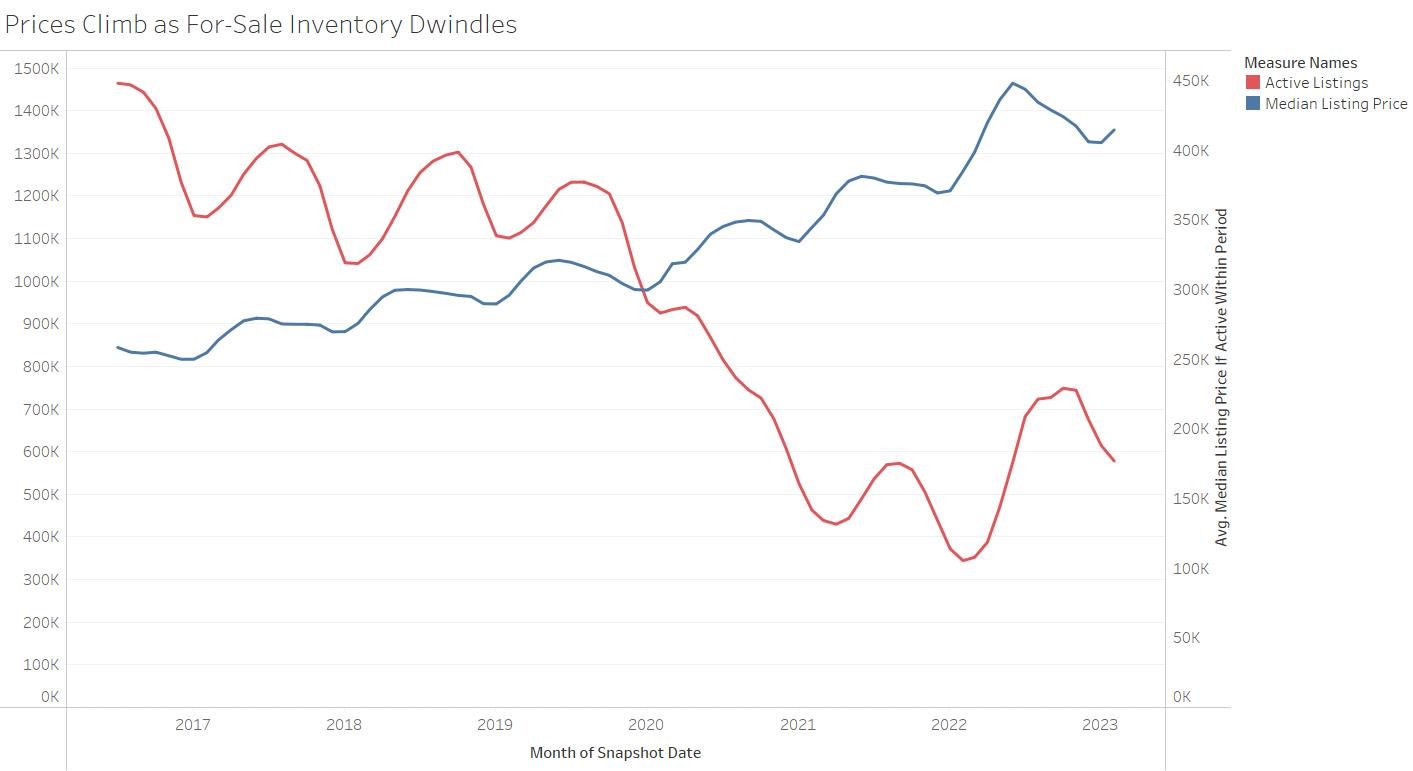

2022 was yet another remarkable year in housing, with prices reaching record high levels before the market cooled due to wide-spread unaffordability. Mortgage rates started climbing at the beginning of 2022, increasing the cost of financing a home purchase significantly as home price growth continued to accelerate compared to 2021. Home prices peaked at a median listing price of $449,000 nationally in June 2022, and price growth relative to the previous year continued through the end of the year. Red-hot buyer demand cooled around the home price peak as evidenced by fewer pending listings compared to the previous year, as well as homes spending an increased time on market. Though housing demand cooled in 2022 relative to the previous year, homes were still spending significantly less time on market than pre-pandemic, and inventory remained well below pre-pandemic norms. However, sellers responded to this market slowdown by pulling back significantly on new listings. Builders also responded by slowing the rate of single-family home construction starting in February.

However, as 2022 concluded, mortgage rates fell slightly, enabling some buyers to re-engage with the housing market. Home sellers were less active in January 2023 compared to the previous year, but with home prices just 8.1% higher year-over-year–after a year of double-digit growth, and affordability slightly improved, the spring market could be advantageous for both buyers and sellers.

Benefits of Listing April 16-22, 2023

At a national level, this week represents a balanced selection of market conditions that favor sellers. While it does not have the highest price or the lowest time on market, this week offers higher than average prices and lower than average time on markets while also offering a higher than average number of buyers–measured as viewers per listing. While buyers vastly outnumbered sellers in recent years, we expect to see more balance between buyers and sellers in 2023. In more balanced housing market conditions, we expect the benefits of strategically listing during the most seasonally advantageous week to be greater.

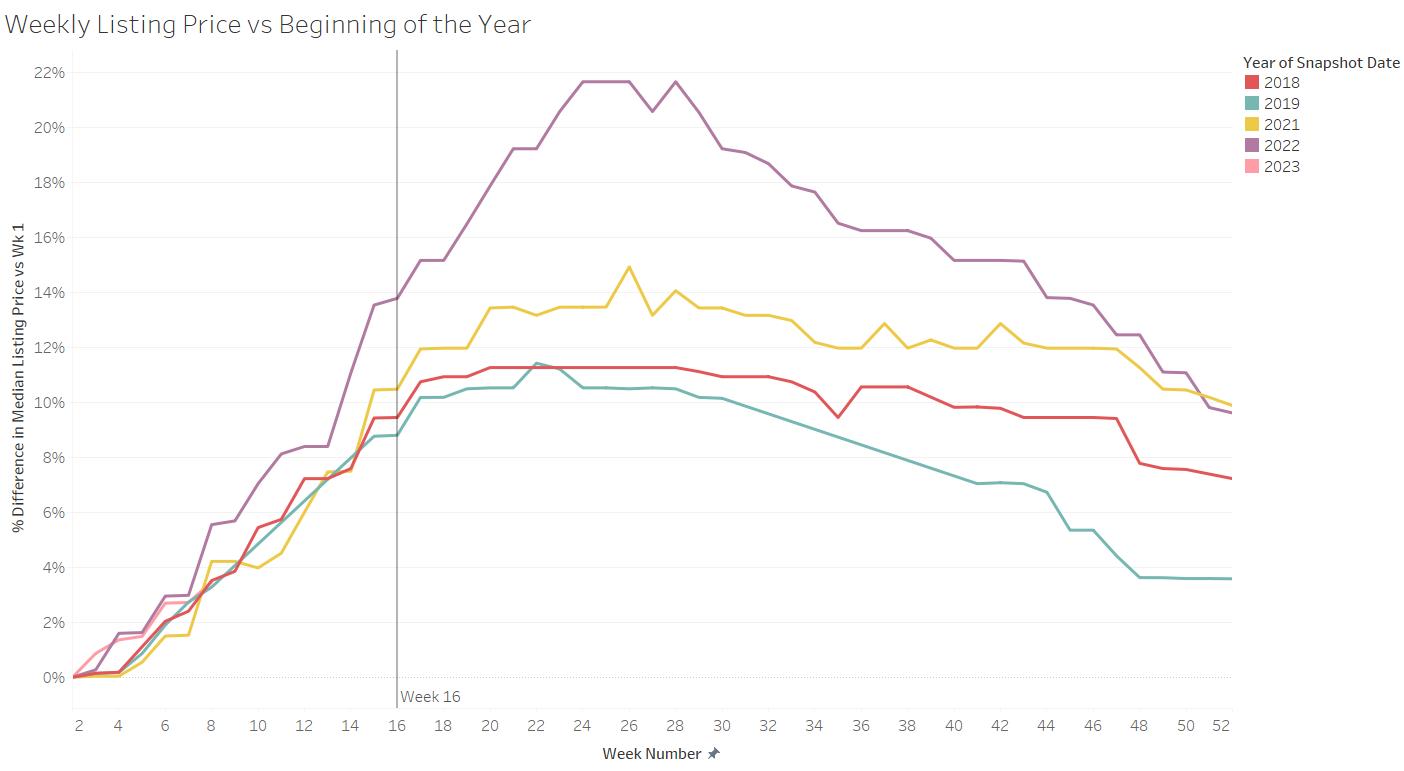

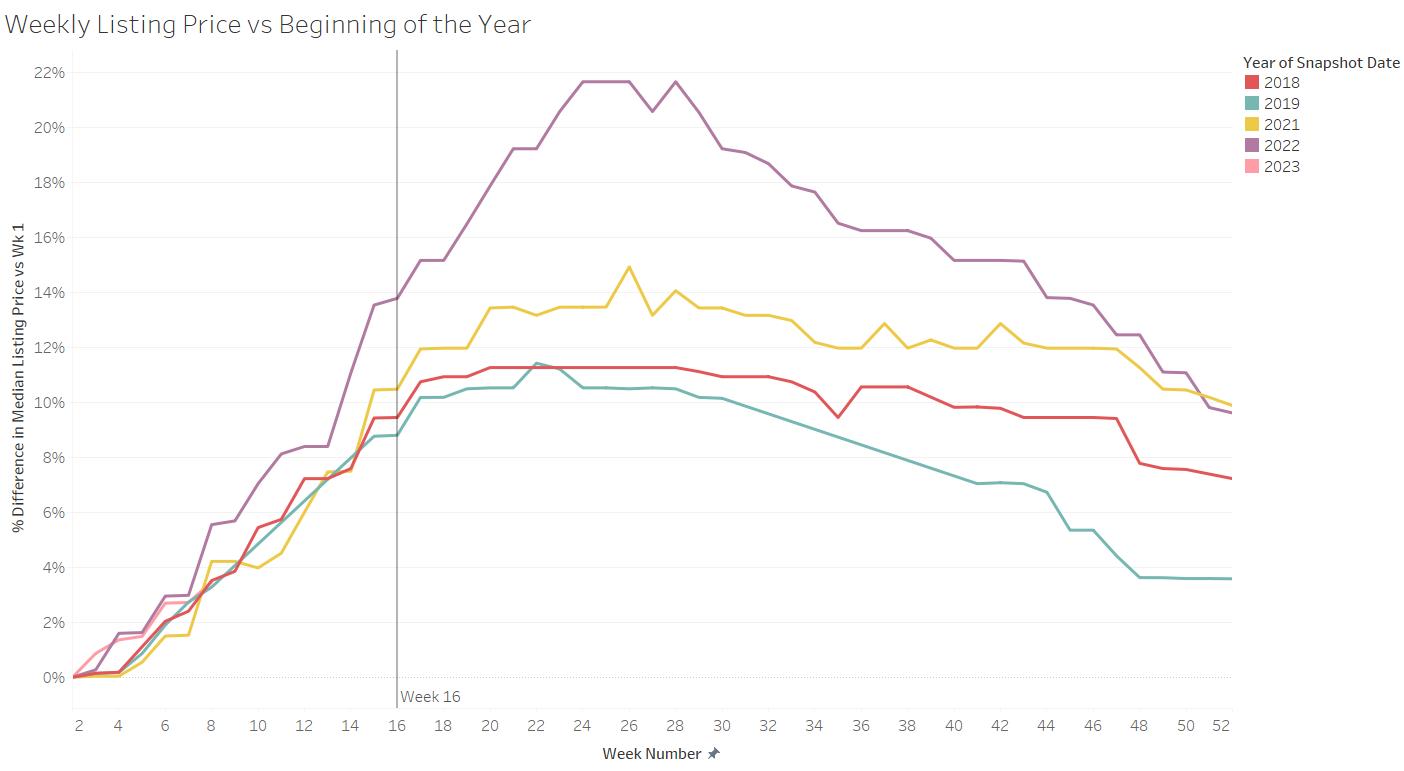

Above-average prices – Homes during this week have historically reached prices 2.1% higher than the average week throughout the year, and are typically 12.1% higher than the start of the year. If 2023 follows the typical seasonal trend, the national median listing price could reach $8,400 above the average week, and $48,000 more than the start of the year.

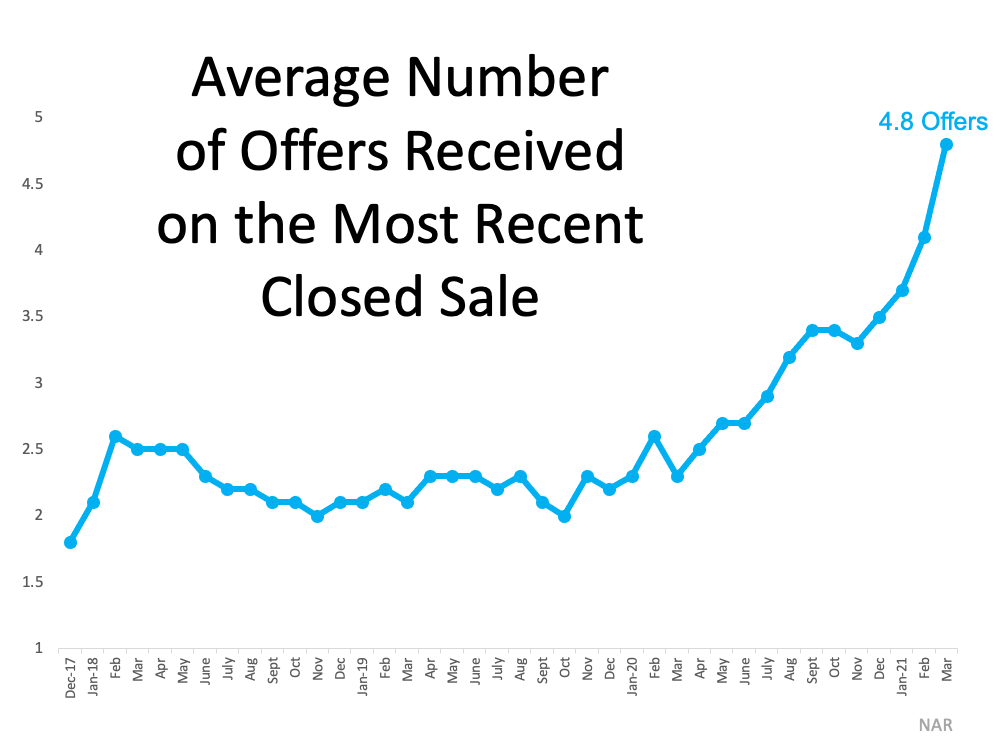

Above-average buyer demand – The number of buyers looking at a listing can determine how many offers a home gets and how quickly it sells. The more buyers looking at a home, the better for the seller, and in most years buyers start earlier than sellers. Historically, this week garnered 16.4% more views per listing than the typical week, but in 2022 this week got 32.5% more views per listing than the average week throughout the year due to the latter part of the year’s drop off in buyer demand and increase in homes for sale.

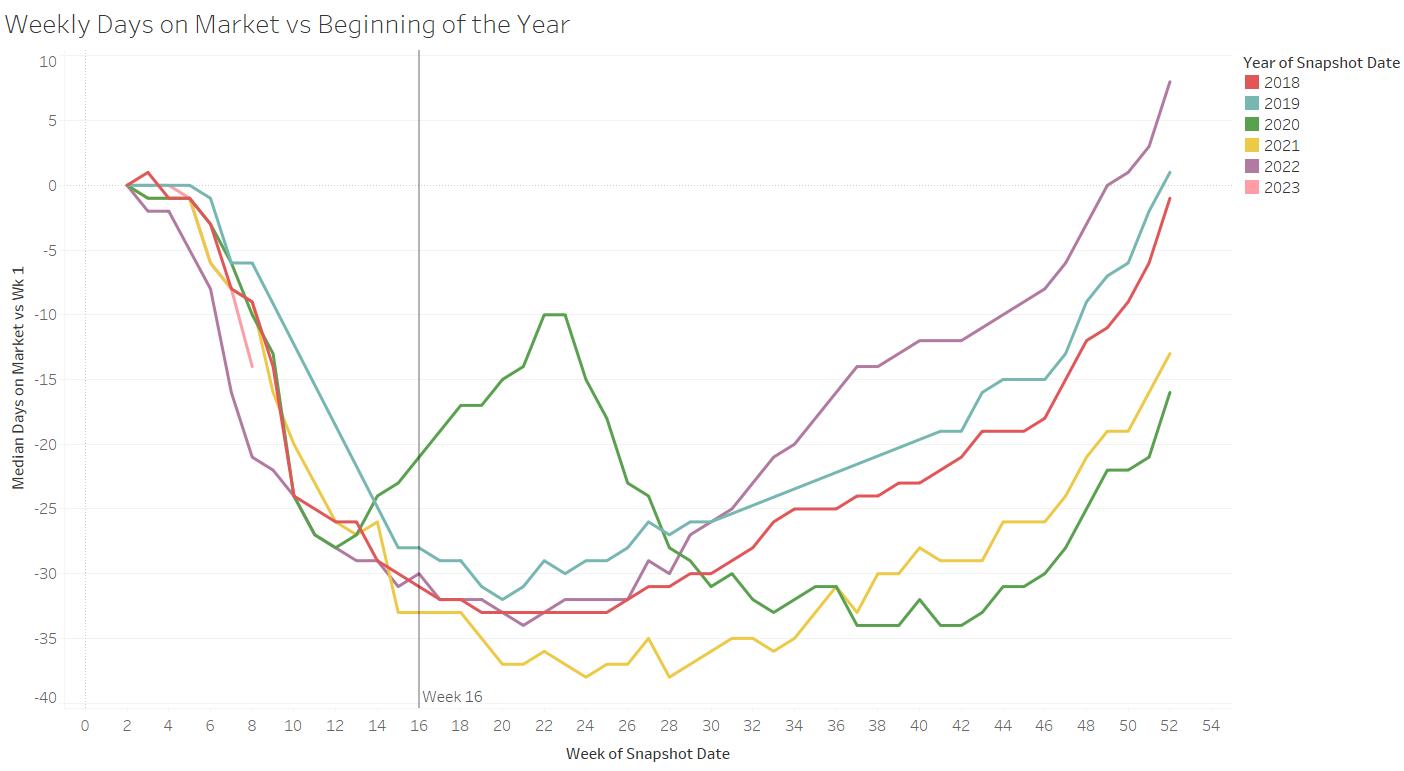

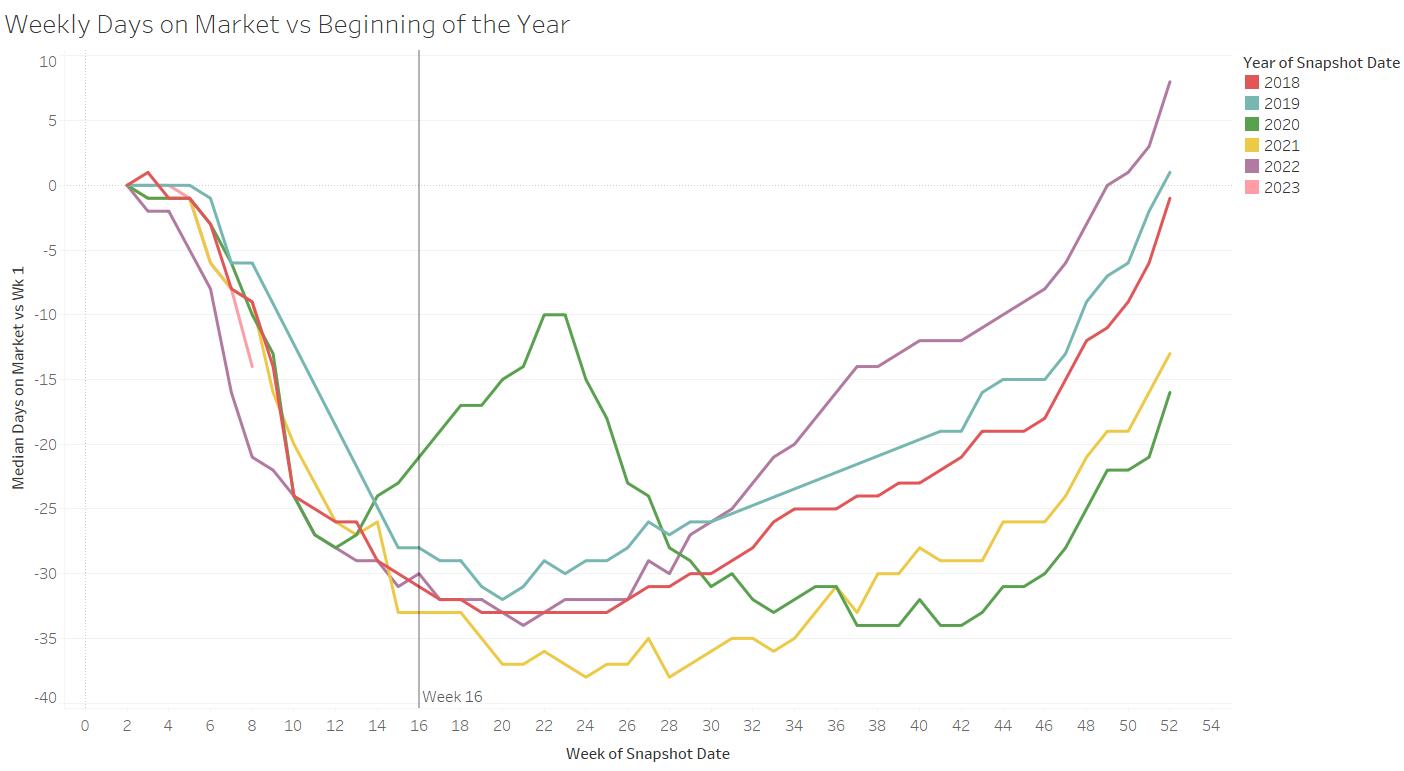

Fast market pace – Thanks to above-average demand, homes sell more quickly during this week. Historically, homes actively for sale during this week sold 18.0% faster than the average week. In the fast-moving 2022 market, this week saw homes typically on the market for 32 days, 13 days faster than the year’s average, and 37 days faster than was typical in 2019. The 2023 market is not expected to move as quickly as in 2022, but the best week is still expected to see a more rapid market pace than the year’s typical pace.

Lower competition from other sellers – A typical inventory trend would mean 9.3% fewer sellers on the market during this week compared to the average week throughout the year. With few exceptions, the number of sellers tends to increase from the beginning of the year until roughly November. Last year saw more significant inventory gains after the first four months as buyer demand cooled, but sellers responded by pulling back on listings once again by the end of the year. Active inventory was 65.5% higher at the start of 2023 versus 2022, but still 43.2% lower than pre-pandemic levels. This gap means there continue to be opportunities for sellers who enter the market this spring.

Market Dynamics Shift – Pent-Up Buyer Demand

Last year, sellers enjoyed sustained demand until mortgage rates caught up to buyers, pushing many out of the market altogether. As a result, inventory climbed and price growth eventually slowed (though continued to be higher than in 2021). For-sale inventory is still well below pre-pandemic levels, so sellers can expect demand to return with force as affordability improves.

-

- Mortgage rates are expected to remain elevated. Mortgage rates climbed from 3.2% at the beginning of 2022, to more than 7% in November before settling back to 6.42% by the end of the year and have stayed above 6% so far in 2023. We expect mortgage rates to remain elevated through 2023 as the Fed continues its tightening cycle to bring inflation down to 2%. Though the Fed has slowed the rate of rate increases, they continue to emphasize their intent to continue raising rates until the inflation target is in sight. This means that buyers will continue to see high borrowing costs, which may take away from their home budget.

- Supply does not match up to demand. 2021 saw the highest rates of home construction in the last decade-plus. However, 2022 slowed this trend as builders saw buyer demand dwindle, worsening the home supply gap. Buyer demand has fallen due to increasing unaffordability. While this may limit asking prices, it can benefit sellers who are cashing in on their record-high home equity. Sellers who are also buyers may be able to be more flexible in closing both a sale and a purchase this year.

- Prices tend to peak later, as does competition. Likewise, sellers should consider that peak prices later in the season also come with greater competition from other sellers for a similar-sized pool of buyers. Historically, by the end of June, while prices reached near-peak levels (+15.0%) compared to the start of the year, new sellers also surged, increasing to nearly 1.5 times higher than at the start of the year (+43.7%). More sellers mean more options for buyers and therefore more competition among sellers. Sellers can mitigate that risk by being an early entry into the market, raising their already high odds of a successful close and likely negotiating favorable terms.

- Strong Demand for Well-maintained, Fairly-Priced Homes – While overall buyer demand may not be what it was in the past couple of years, many sellers are still seeing competition for homes that are well-priced and move-in ready in prime locations. Buyers feeling the pressure of affordability will likely be choosier and less willing to shell out the big bucks for a less-than-ideal home.

What does this mean for sellers?

While we’ve identified April 16-22 as the best week to list for sellers, the housing market remains undersupplied, so a seller listing a well-priced, move-in ready home is likely to find success. Because spring is generally the high season for real estate activity and buyers are more plentiful earlier rather than later in the year, listing earlier in the spring raises a seller’s odds of a successful sale. Sellers will want to remember that it’s a process. In a recent survey we explored the steps sellers took to prepare their home for sale and how long it took them to get ready.

What does this mean for home buyers?

For buyers who have been facing still-high home prices, and elevated mortgage rates, there is a key takeaway: the usual seasonal dynamics of the housing market, builder sentiment, and seller sentiment suggest that it’s going to get better. Inventory improved in 2022, and continues to grow year-over-year, though lags pre-pandemic levels. However, so far in 2023, seller, builder and buyer sentiment have all improved, signaling that all parties involved are feeling a bit more optimistic about the housing market as we enter the spring.

Historically, the number of views per listing has cooled in the late summer/early fall and tends to improve for buyers from that point forward. Additionally, by mid-August, the number of sellers with actively-listed homes increased 32% over the beginning of the year, which means more options for buyers. Thus, buyers who can persist in their home searches are likely to catch a bit of a break in the sense that they can expect some more options to choose from in the weeks ahead.