The Best Time of Year to Purchase?

When is the Best Time to Buy a Home?

Finance news website, The Nerd Wallet, recently published an article extolling the virtues of purchasing your home in January! So how, how does January really stack up as the best month to buy a home in Dallas?

Based on the latest REALTOR.com reporting, the Dallas, TX market while down 2 spots, remains number 4 in the nation’s Hottest Real Estate Markets.

|

Rank |

20 Hottest Markets |

Rank |

Rank Change |

|

1 |

1 |

0 |

|

|

2 |

4 |

2 |

|

|

3 |

3 |

0 |

|

|

4 |

2 |

-2 |

|

|

5 |

5 |

0 |

|

|

6 |

9 |

3 |

|

|

7 |

11 |

4 |

|

|

8 |

6 |

-2 |

|

|

9 |

7 |

-2 |

|

|

10 |

13 |

3 |

|

|

11 |

15 |

4 |

|

|

12 |

8 |

-4 |

|

|

13 |

14 |

1 |

|

|

14 |

18 |

4 |

|

|

15 |

10 |

-5 |

|

|

16 |

20 |

4 |

|

|

17 |

17 |

0 |

|

|

18 |

23 |

5 |

|

|

19 |

12 |

-7 |

|

|

20 |

16 |

-4 |

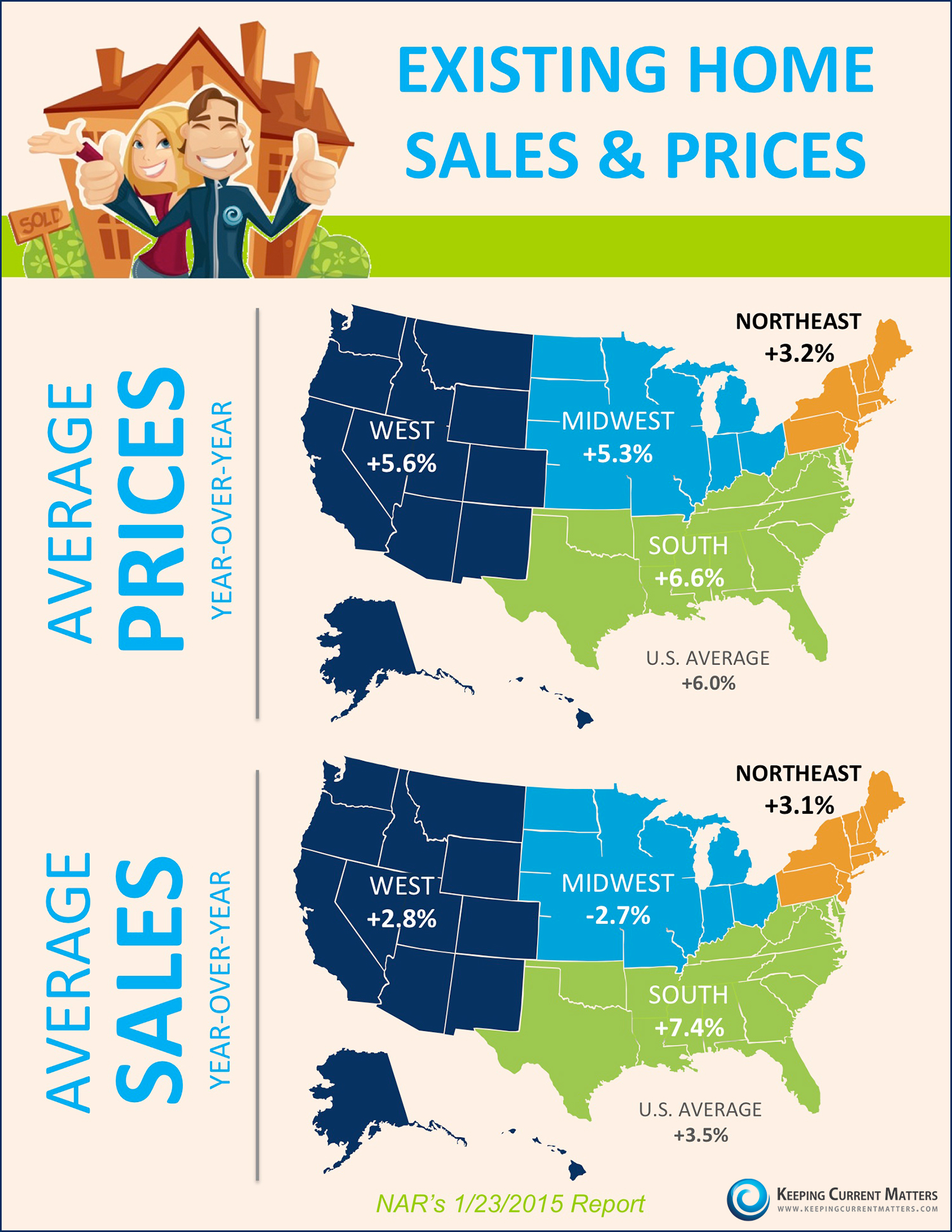

Based on REALTOR.com’s 2014 & 2015 combined data, buyer’s typically pay a premium in summer & enjoy a dip in prices in the winter. Their data estimates up to a 2% historical premium. In a recent article in the Dallas Business Journal, Ted Wilson of Residential Strategies, offered that the data suggests that while the “Best Time” may not be restricted to one month, a great deal of data does suggest the early spring is a great time to be looking. So what are some of the reasons that support buyers star their hunting season sooner rather than later?

- Competition may be lower – According to NerdWallet, over the last 2-years, while the inventory may be down 21%, buyer traffic is down over 40%

- Prices are expected to rise, especially in new homes

- Mortgage rates are expected to rise – as interest rates rise, buying power decreases

For more information on Dallas Business Journal’s take on this subject, please click HERE.

CHRISTIE CANNON REALTOR

The Christie Cannon Team

Keller Williams Frisco

469-951-9588: Mobile

Voted as one of the BEST Realtors in D Magazine for 2010-2016

Voted as a Five Star Professional 2012-2016 Texas Monthly Magazine

Name among America's Best Real Estate Agents by Real Trends Magazine

Certified Luxury Home Marketing Specialist

#1 Keller Williams Agent 2011-2016

Top 100 Agents in the Nation / KW

4783 Preston Rd #300, Frisco, TX 75034