What Are Your Goals in the Housing Market This Year?

What Are Your Goals in the Housing Market This Year?

If buying or selling a home is part of your dreams for 2023, it’s essential for you to understand today’s housing market, define your goals, and work with industry experts to bring your homeownership vision for the new year into focus.

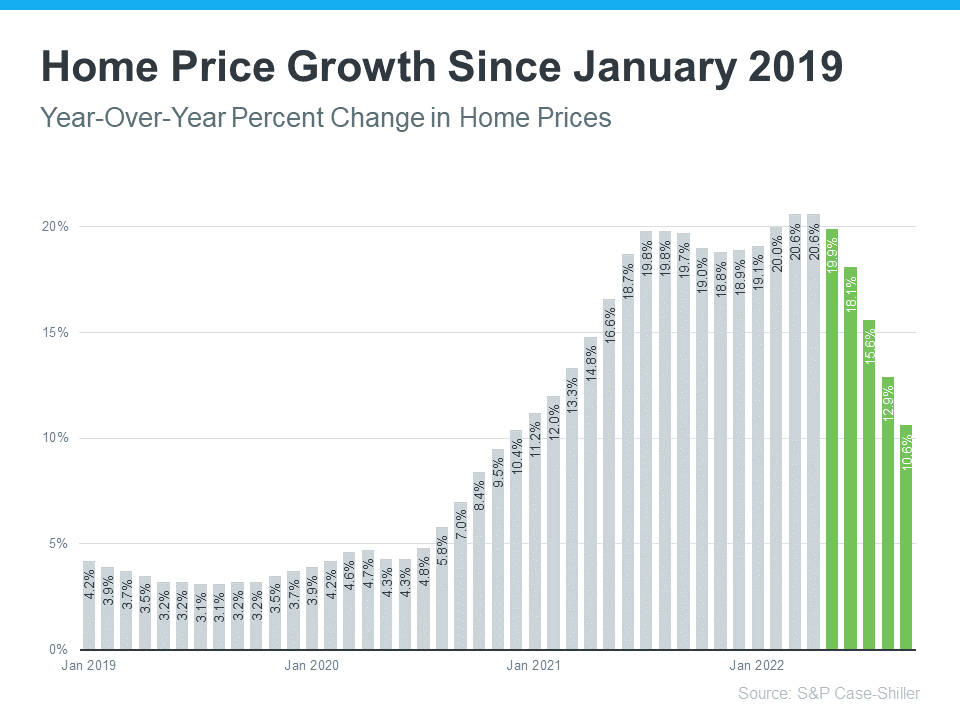

In the last year, high inflation had a big impact on the economy, the housing market, and likely on your wallet too. That’s why it’s critical to have a clear understanding of not just the market today, but also what you want out of it when you buy or sell a home. Danielle Hale, Chief Economist at realtor.com, explains:

“The key to making a good decision in this challenging housing market is to be laser focused on what you need now and in the years ahead, so that you can stay in your home long enough that buying is a sound financial decision.”

Here are a few questions you can start thinking through as you fine tune your goals for 2023.

1. What’s Motivating You?

You’re dreaming about making a move for a reason – what is it? No matter what’s happening in the market, there are still many compelling reasons to buy a home today. Your needs may have changed in a way your current house can’t address, or you could be ready to step into homeownership for the first time and have a space that’s truly your own. Use what’s motivating you as a guidepost in partnership with an expert advisor to help make sure your move will give you a lasting sense of accomplishment.

2. What Does Your Next Home Look Like?

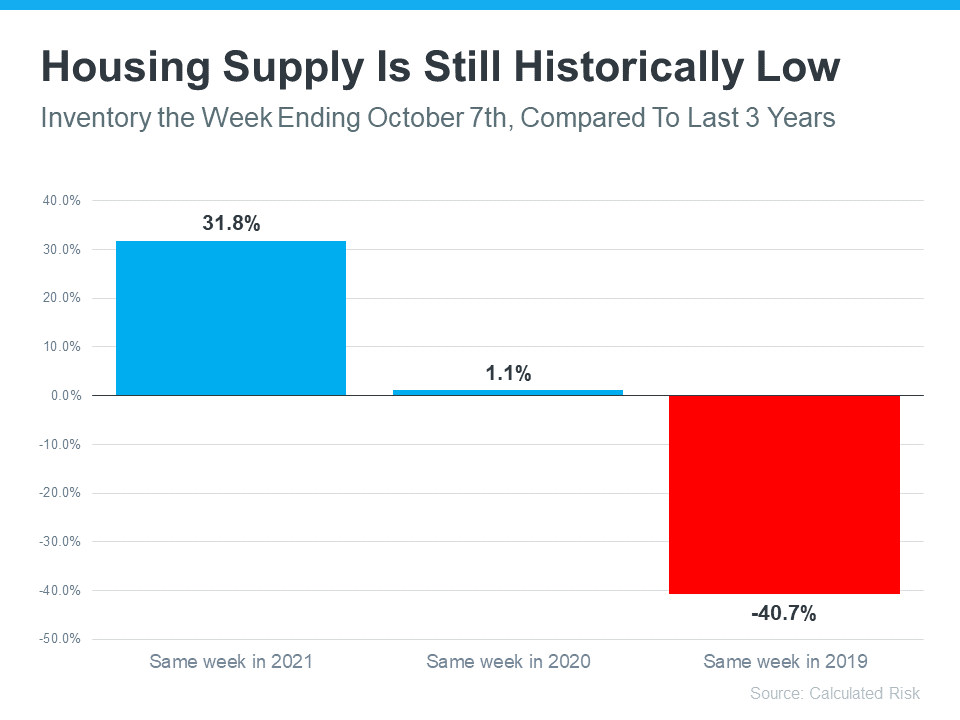

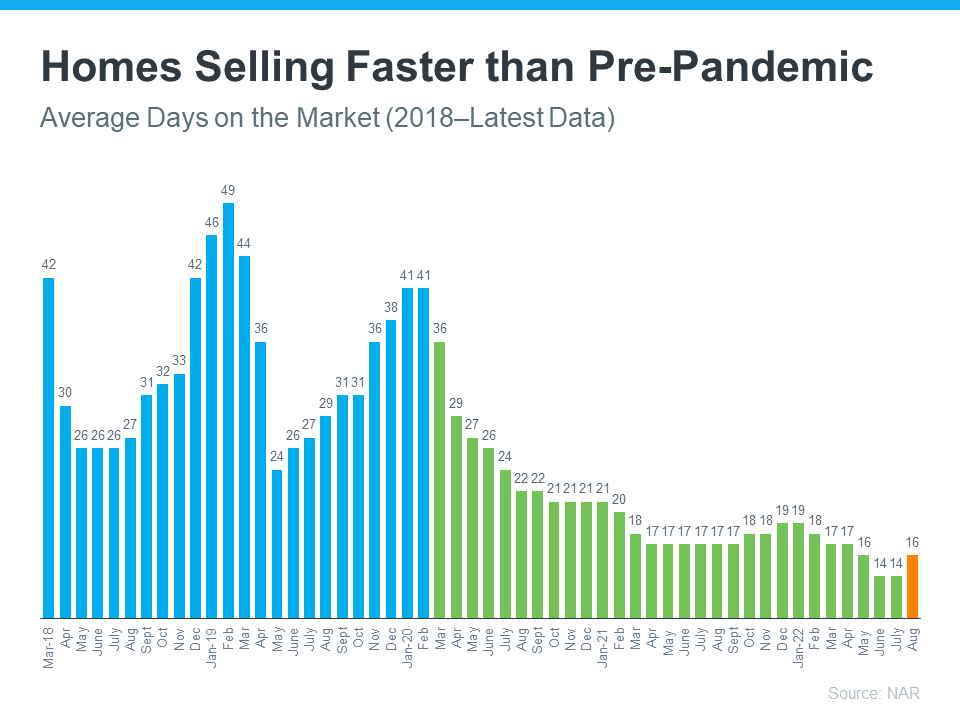

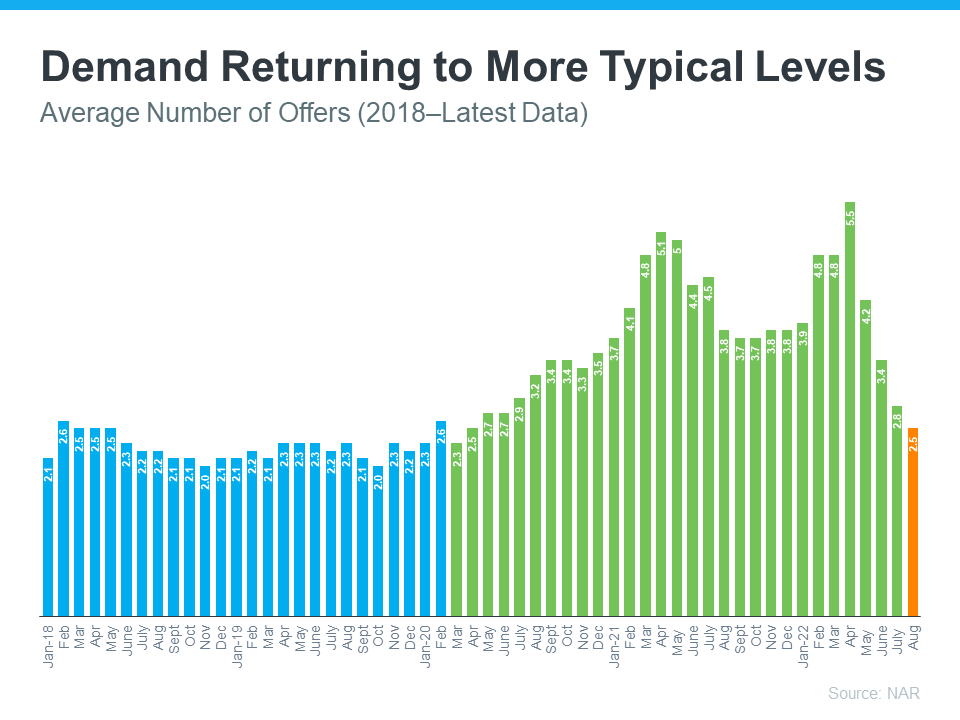

You know you want to move, but how would you describe your dream home? The available supply of homes for sale has grown, and that could mean more options to choose from when you buy. Just be sure to keep your budget in mind and work with a trusted real estate professional to balance your wants and needs. The better you understand what’s essential and where you can be flexible, the easier it can be to find the home that’s right for you.

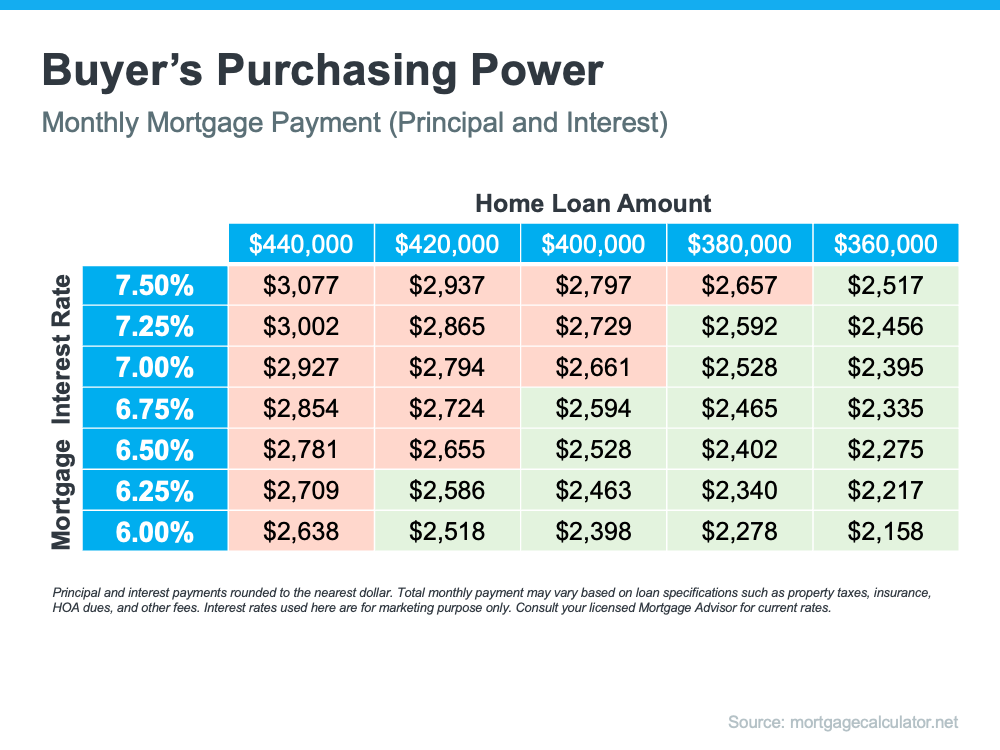

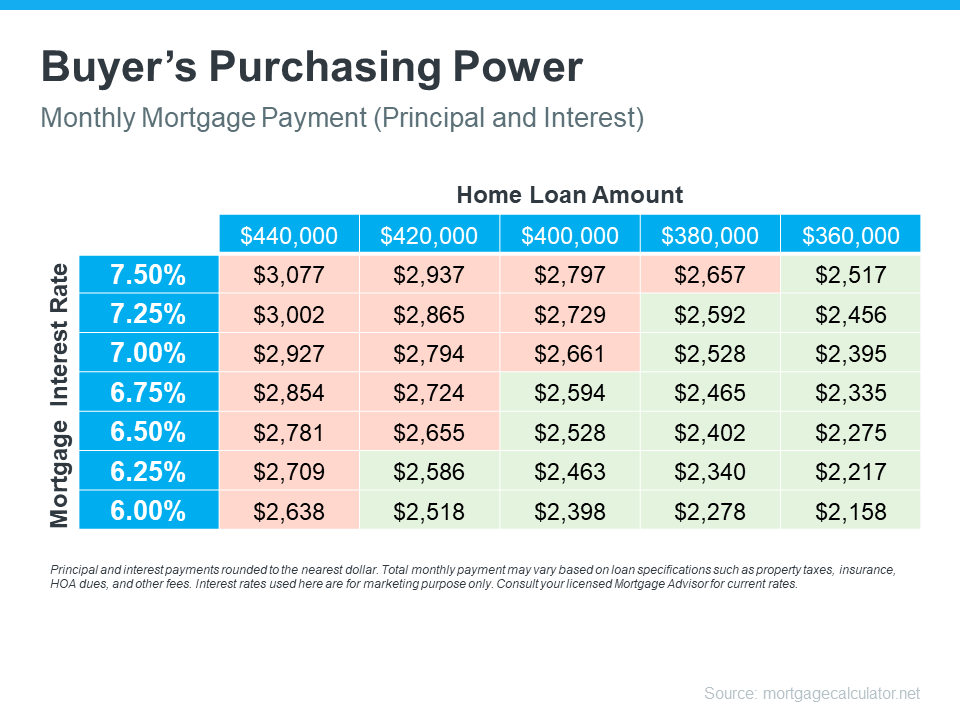

3. How Ready Are You To Buy?

Getting clear on your budget and savings is essential before you get too far into the process. Working with a local agent and a lender early is the best way to make sure you’re in a good position to buy. This could include planning how much to save for a down payment, getting pre-approved for a home loan, and assessing your current home equity if your move involves selling your existing house.

A Professional Will Guide You Through Every Step of the Process

Buying or selling a home is a big process that takes expertise to navigate. If that feels a bit overwhelming, you aren’t alone. According to a recent Harris Poll survey, one in five respondents see a lack of information or knowledge about the homebuying process as a barrier from owning a home. Don’t let uncertainty hold you back from your goals this year. A trusted expert can bridge that gap and give you the best advice and information about today’s market.

Bottom Line

Let’s connect to plan how your dreams for 2023 can become a reality.