DFW Makes TOP 10 Hidden Real Estate Gems

DFW Makes TOP 10 Hidden Real Estate Gems = That means these metro areas are likely to experience stronger price increases compared with other markets in 2022.

Article provided by: Swapna Venugopal Ramaswamy, USA TODAY | Yahoo.com

Go south, young people. Or at least invest in the Southern states.

Most of the top 10 affordable real estate markets that underperformed but have strong underlying fundamentals are in the South, according to a report by the National Association of Realtors (NAR). That means these metro areas are likely to experience stronger price increases compared with other markets in 2022.

NAR examined factors such as wage and job growth; percentage of people 25 to 44; and net domestic migration to create the list. Another metric was affordability of homes compared with the median income of the area.

Key Things To Avoid After Applying for a Mortgage

Once you’ve found your dream home and applied for a mortgage, there are some key things to keep in mind before you close. It’s exciting to start thinking about moving in and decorating your new place, but before you make any large purchases, move your money around, or make any major life changes, be sure to consult your lender – someone who’s qualified to explain how your financial decisions may impact your home loan.

Here’s a list of things you shouldn’t do after applying for a mortgage. They’re all important to know – or simply just good reminders – for the process.

1. Don’t Deposit Cash into Your Bank Accounts Before Speaking with Your Bank or Lender.

Lenders need to source your money, and cash isn’t easily traceable. Before you deposit any amount of cash into your accounts, discuss the proper way to document your transactions with your loan officer.

2. Don’t Make Any Large Purchases Like a New Car or Furniture for Your Home.

New debt comes with new monthly obligations. New obligations create new qualifications. People with new debt have higher debt-to-income ratios. Since higher ratios make for riskier loans, qualified borrowers may end up no longer qualifying for their mortgage.

3. Don’t Co-Sign Other Loans for Anyone.

When you co-sign, you’re obligated. With that obligation comes higher debt-to-income ratios as well. Even if you promise you won’t be the one making the payments, your lender will have to count the payments against you.

4. Don’t Change Bank Accounts.

Remember, lenders need to source and track your assets. That task is much easier when there’s consistency among your accounts. Before you transfer any money, speak with your loan officer.

5. Don’t Apply for New Credit.

It doesn’t matter whether it’s a new credit card or a new car. When you have your credit report run by organizations in multiple financial channels (mortgage, credit card, auto, etc.), your FICO® score will be impacted. Lower credit scores can determine your interest rate and possibly even your eligibility for approval.

6. Don’t Close Any Credit Accounts.

Many buyers believe having less available credit makes them less risky and more likely to be approved. This isn’t true. A major component of your score is your length and depth of credit history (as opposed to just your payment history) and your total usage of credit as a percentage of available credit. Closing accounts has a negative impact on both of those determinants of your score.

Bottom Line

Any blip in income, assets, or credit should be reviewed and executed in a way that ensures your home loan can still be approved. If your job or employment status has changed recently, share that with your lender as well. The best plan is to fully disclose and discuss your intentions with your loan officer before you do anything financial in nature.

Two Reasons Why Waiting To Buy a Home Will Cost You

Two Reasons Why Waiting To Buy a Home Will Cost You

If you’re a homeowner who’s decided your current house no longer fits your needs, or a renter with a strong desire to become a homeowner, you may be hoping that waiting until next year could mean better market conditions to purchase a home.

To determine whether you should buy now or wait another year, you can ask yourself two simple questions:

- Where will home prices be a year from now?

- Where will mortgage rates be a year from now?

Let’s shed some light on the answers to both of these questions.

Where Will Home Prices Be a Year from Now?

Three major housing industry entities are projecting ongoing home price appreciation in 2022. Here are their forecasts:

- Fannie Mae: 7.4%

- Freddie Mac: 7%

- Mortgage Bankers Association: 5.1%

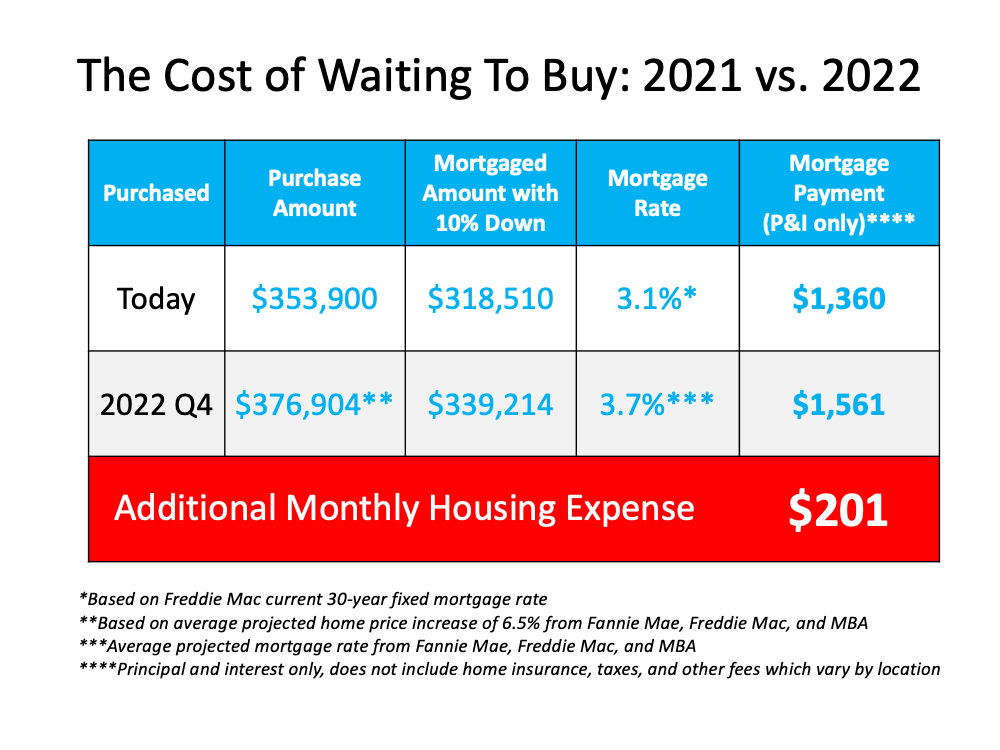

According to the National Association of Realtors (NAR), the median price of a home today is $353,900. Using an average of the three price projections above (6.5%), a home that sold for $353,900 today would be valued at $376,904 at the end of next year. As a prospective buyer, you would therefore pay an additional $23,004 by waiting.

Where Will Mortgage Rates Be a Year from Now?

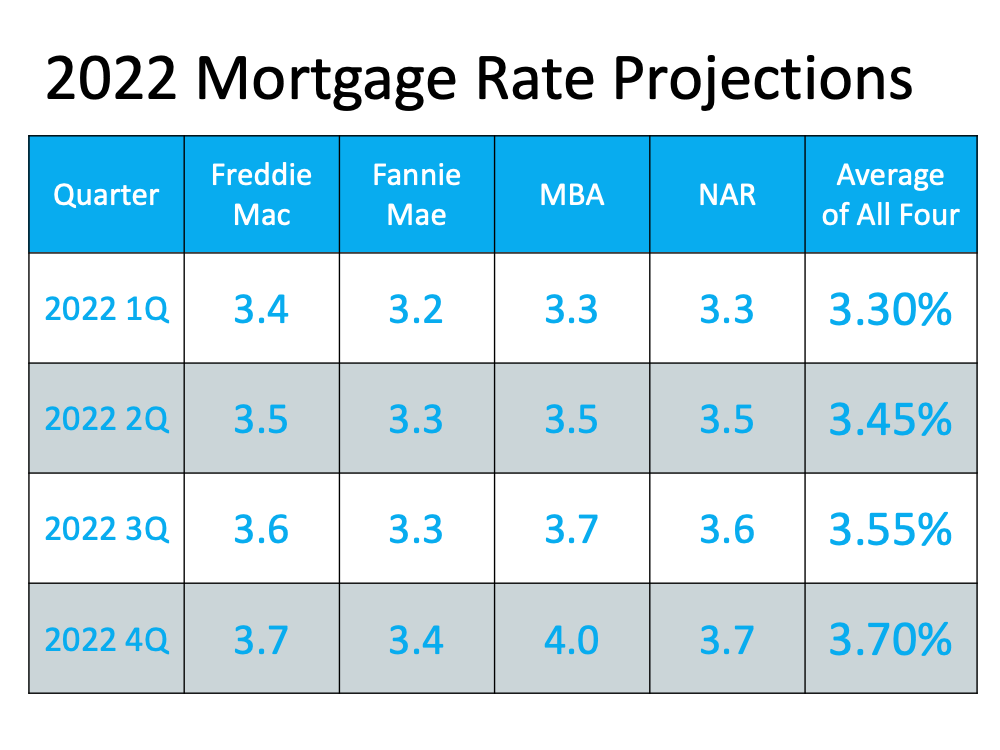

Today, Freddie Mac announced their 30-year fixed mortgage rate was at 3.1%. However, most experts believe mortgage rates will rise as the economy recovers. Here are the forecasts for the fourth quarter of 2022 by the three major entities mentioned above:

- Fannie Mae: 3.4%

- Freddie Mac: 3.7%

- Mortgage Bankers Association: 4%

That averages out to 3.7% if you include all three forecasts. Any increase in mortgage rates will increase your costs.

What Does It Mean for You if Home Values and Mortgage Rates Increase?

If both variables increase, you’ll pay a lot more in mortgage payments each month. Let’s assume you purchase a $353,900 home today with a 30-year fixed-rate loan at 3.1% (the current rate from Freddie Mac) after making a 10% down payment. According to mortgagecalculator.net, your monthly mortgage payment would be approximately $1,360 (this does not include insurance, taxes, and other fees because those vary by location).

That same home one year from now could cost $376,904, and the mortgage rate could be 3.7% (based on the industry forecasts mentioned above). Your monthly mortgage payment after putting down 10%, would be approximately $1,561. The difference in your monthly mortgage payment would be $201. That’s $2,412 more per year and $72,360 over the life of the loan.

The difference in your monthly mortgage payment would be $201. That’s $2,412 more per year and $72,360 over the life of the loan.

Add to that the approximately $23,004 a house with a similar value would build in home equity this year due to home price appreciation, and the total net worth increase you could gain by buying this year is over $95,364 (the $72,360 mortgage savings plus the $23,004 potential gain in equity if you buy now).

Bottom Line

When asking if you should buy a home, you may think of the non-financial benefits of homeownership. When asking when to buy, the financial benefits make it clear that doing so now is much more advantageous than waiting until next year.

Win When You Sell (And When You Move)

Win When You Sell (And When You Move)

.jpg)

If you’re trying to decide when to sell your house, there may not be a better time than this winter. Selling this season means you can take advantage of today’s strong sellers’ market when you make a move.

Win When You Sell

Right now, conditions are very favorable for current homeowners looking for a change. If you sell now, here’s what you can expect:

- Your House Will Stand Out – While recent data shows there are more sellers getting ready to list their homes this winter, there are still more buyers in the market than there are homes for sale. If you sell your house now before more houses are listed, it will get more attention from serious buyers who are eager to find a home.

- Your House Will Likely Get Multiple Offers – When supply is low and demand is high, buyers have to compete with each other for a limited number of homes. The latest Realtors Confidence Index from the National Association of Realtors (NAR) shows sellers are getting an average of 3.6 offers in today’s market.

- Your House Should Sell Quickly – According to the same report from NAR, homes are selling in an average of just 18 days. As a seller, that's great news for you if you’re looking for a quick process.

Win When You Move

In addition to these great perks, you’ll also win big on your next move if you sell now. CoreLogic reports homeowners gained an average of $51,500 in equity over the past year. This wealth boost is the result of buyer competition driving home prices up. You can leverage that equity to fuel a move, before mortgage rates and home prices climb higher. To get a feel for how rates are projected to rise, see the chart below. The longer you wait to make your move, the more it will cost you down the road. As mortgage rates rise, even modestly, it will impact your monthly payment when you purchase your next home. Waiting just a few months to make that change could mean a long-term financial impact.

The longer you wait to make your move, the more it will cost you down the road. As mortgage rates rise, even modestly, it will impact your monthly payment when you purchase your next home. Waiting just a few months to make that change could mean a long-term financial impact.

The good news is today’s rates are still hovering in a historically low range. According to Doug Duncan, Senior VP and Chief Economist at Fannie Mae:

“Right now, we forecast mortgage rates to average 3.3 percent in 2022, which, though slightly higher than 2020 and 2021, by historical standards remains extremely low . . .”

Selling before rates climb higher means you can make your move and lock in a low rate on the mortgage for your next home. This helps you get more home for your money and keeps your payments down too.

Bottom Line

As a homeowner, you have a great opportunity to get the best of both worlds this season. You can truly win when you sell and when you buy. If you’re thinking about making a move, let's connect so you have the information you need to get the process started.

How Sellers Win When Housing Inventory Is Low

How Sellers Win When Housing Inventory Is Low

In today’s housing market, the number of homes for sale is much lower than the strong buyer demand. As a result, homeowners ready to sell have a significant advantage. Here are three ways today’s low inventory will set you up for a win when you sell this season.

1. Higher Prices

With so many more buyers in the market than homes available for sale, homebuyers are frequently getting into bidding wars for the houses they want to purchase. According to the latest data from the National Association of Realtors (NAR), homes are receiving an average of 3.7 offers in today’s market. This buyer competition drives home prices up. As a seller, this certainly works to your advantage, potentially netting you more for your house when you close the deal.

2. Greater Return on Your Investment

Rising prices mean homes are also gaining value, which increases the equity you have in your home. In the latest Homeowner Equity Insights Report, CoreLogic explains:

“In the second quarter of 2021, the average homeowner gained approximately $51,500 in equity during the past year.”

This year-over-year growth in equity gives you the ability to sell your house and then put that money toward a down payment on your next home, or to keep it as extra savings.

3. Better Terms

In a sellers’ market like we have today, you’re in the driver’s seat if you make a move. You have the power to sell on your terms, and buyers are more likely to work with you if it means they can finally land their dream home.

So, is low housing inventory a big deal?

Yes, especially if you want to sell on your terms. Moving now while inventory is so low is key to maximizing your opportunities.

Bottom Line

If you’re interested in taking advantage of the current sellers’ market, let’s connect today to determine your best move.

Important Distinction: Homes Are Less Affordable, Not Unaffordable

Important Distinction: Homes Are Less Affordable, Not Unaffordable

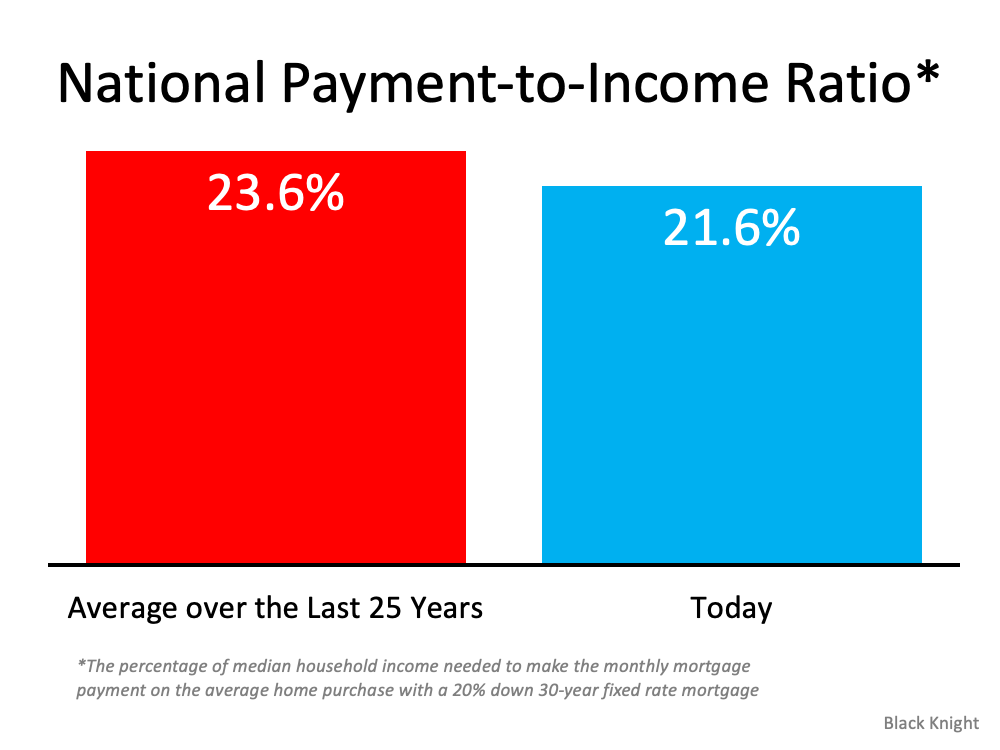

It’s impossible to research the subject of buying a home without coming across a headline declaring that the fall in home affordability is a crisis. However, when we add context to the most recent affordability statistics, we soon realize that, though homes are less affordable than they have been over the last few years, they are more affordable than they historically have been.

Black Knight, a premier provider of data and analytics for the mortgage industry, just released their latest Monthly Mortgage Monitor which includes a new analysis of the affordability situation. Here’s what the report reveals:

“The monthly payment required to purchase the average priced home with a 20% down 30-year fixed rate mortgage increased by nearly 20% (+$210) over the first nine months of 2021, . . . It now requires 21.6% of the median household income to make the monthly mortgage payment on the average home purchase, the least affordable housing has been since 30-year rates rose to nearly 5% back in late 2018.”

Basically, the report shows that homes are less affordable today than at any other time in the last three years. However, in a previous report earlier this year, Black Knight calculated that the percentage of the median household income to make the monthly mortgage payment on the average home purchase over the last 25 years was 23.6% (see graph below): Today’s payment-to-income ratio is more affordable than the average over the last 25 years. Given that context, we can see that American households still have the same ability to be homeowners as their parents did 20 years ago.

Today’s payment-to-income ratio is more affordable than the average over the last 25 years. Given that context, we can see that American households still have the same ability to be homeowners as their parents did 20 years ago.

This confirms the recent analysis of ATTOM Data resources where Todd Teta, Chief Product and Technology Officer, explains:

“The typical median-priced home around the U.S. remains affordable to workers earning an average wage, despite prices that keep going through the roof. Super-low interests and rising pay continue to be the main reasons why.”

Bottom Line

It’s true that it’s less affordable to buy a home today than it has been the last few years. However, it’s more affordable to buy today than the average over the last 25 years. In other words, homes are less affordable, but they’re not unaffordable. That’s an important distinction.

What Do Supply and Demand Tell Us About Today’s Housing Market?

What Do Supply and Demand Tell Us About Today’s Housing Market?

There’s a well-known economic theory – the law of supply and demand – that explains what’s happening with prices in the current real estate market. Put simply, when demand for an item is high, prices rise. When the supply of the item increases, prices fall. Of course, when demand is very high and supply is very low, prices can rise significantly.

Understanding the impact both supply and demand have can provide the answers to a few popular questions about today’s housing market:

- Why are prices rising?

- Where are prices headed?

- What does this mean for homebuyers?

Why Are Prices Rising?

According to the latest Home Price Insights report from CoreLogic, home prices have risen 18.1% since this time last year. But what’s driving the increase?

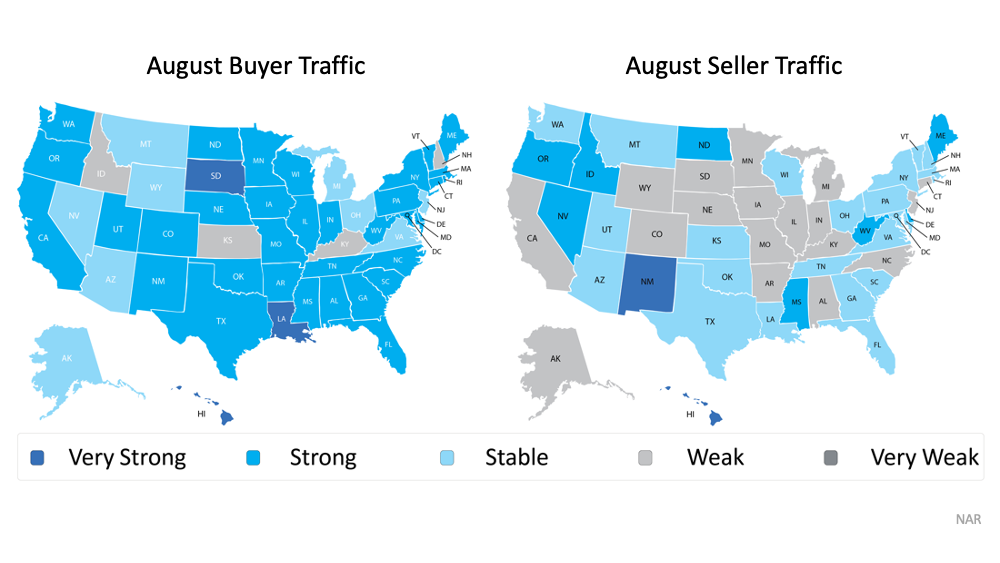

Recent buyer and seller activity data from the National Association of Realtors (NAR) helps answer that question. When we take NAR’s buyer activity data and compare it to the seller traffic during the same timeframe, we can see buyer demand continues to outpace seller activity by a wide margin. In other words, the demand for homes is significantly greater than the current supply that’s available to buy (see maps below): This combination of low supply and high demand is what’s driving home prices up. Bill McBride, author of the Calculated Risk blog, puts it best, saying:

This combination of low supply and high demand is what’s driving home prices up. Bill McBride, author of the Calculated Risk blog, puts it best, saying:

“By some measures, house prices seem high, but the recent price increases make sense from a supply and demand perspective.”

Where Are Prices Headed?

The supply of homes for sale will greatly affect where prices head over the coming months. Many experts forecast prices will continue to increase, but they’ll likely appreciate at a slower rate.

Buyers hoping to purchase the home of their dreams may see this as welcome news. In this case, perspective is important: a slight moderation of home prices does not mean prices will depreciate or fall. Price increases may occur at a slower pace, but experts still expect them to rise.

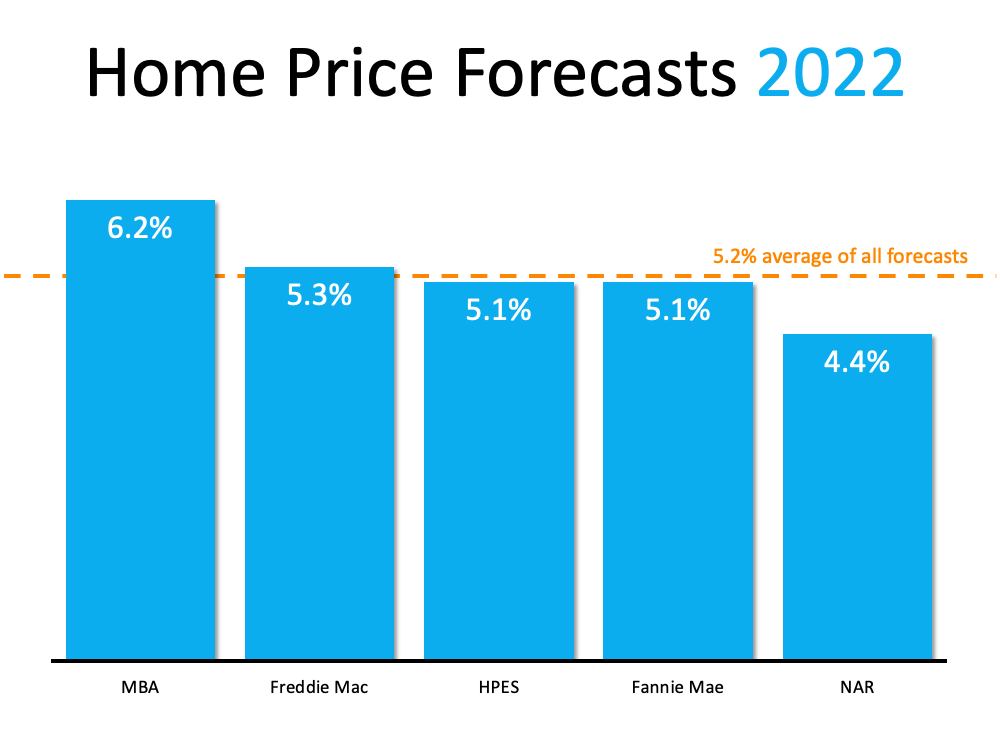

Five major entities that closely follow the real estate market forecast home prices will continue appreciating through 2022 (see graph below):

What Does This Mean for Homebuyers?

If you’re waiting to enter the market because you’re expecting prices to drop, you may end up paying more in the long run. Even if price increases occur at a slower rate next year, prices are still projected to rise. That means the home of your dreams will likely cost even more in 2022.

Bottom Line

The truth is, high demand and low supply are what’s driving up home prices in today’s housing market. And while prices may increase at a slower pace in the coming months, experts still expect them to rise. If you’re a potential homebuyer, let’s connect today to discuss what that could mean for you if you wait even longer to buy.

Two Reasons Why Waiting a Year To Buy Could Cost You

Two Reasons Why Waiting a Year To Buy Could Cost You

If you’re a renter with a desire to become a homeowner, or a homeowner who’s decided your current house no longer fits your needs, you may be hoping that waiting a year might mean better market conditions to purchase a home.

To determine if you should buy now or wait, you need to ask yourself two simple questions:

- What will home prices be like in 2022?

- Where will mortgage rates be by the end of 2022?

Let’s shed some light on the answers to both of these questions.

What will home prices be like in 2022?

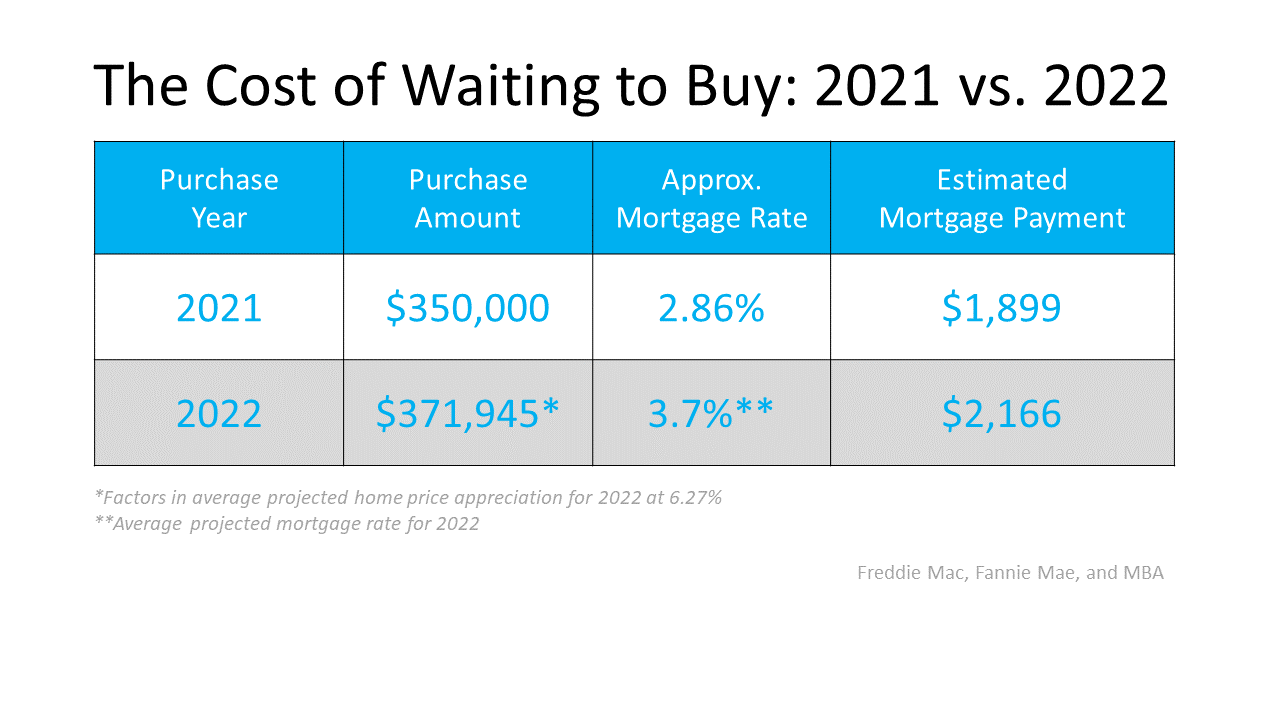

Three major housing industry entities project continued home price appreciation for 2022. Here are their forecasts:

- Freddie Mac: 5.3%

- Fannie Mae: 5.1%

- Mortgage Bankers Association: 8.4%

Using the average of the three projections (6.27%), a home that sells for $350,000 today would be valued at $371,945 by the end of next year. That means, if you delay, it could cost you more. As a prospective buyer, you could pay an additional $21,945 if you wait.

Where will mortgage rates be by the end of 2022?

Today, the 30-year fixed mortgage rate is hovering near historic lows. However, most experts believe rates will rise as the economy continues to recover. Here are the forecasts for the fourth quarter of 2022 by the three major entities mentioned above:

- Freddie Mac: 3.8%

- Fannie Mae: 3.2%

- Mortgage Bankers Association: 4.2%

That averages out to 3.7% if you include all three forecasts, and it’s nearly a full percentage point higher than today’s rates. Any increase in mortgage rates will increase your cost.

What does it mean for you if both home values and mortgage rates rise?

You’ll pay more in mortgage payments each month if both variables increase. Let’s assume you purchase a $350,000 home this year with a 30-year fixed-rate loan at 2.86% after making a 10% down payment. According to the mortgage calculator from Smart Asset, your monthly mortgage payment (including principal and interest payments, and estimated home insurance, taxes in your area, and other fees) would be approximately $1,899.

That same home could cost $371,945 by the end of 2022, and the mortgage rate could be 3.7% (based on the industry forecasts mentioned above). Your monthly mortgage payment, after putting down 10%, would increase to $2,166.

The difference in your monthly mortgage payment would be $267. That’s $3,204 more per year and $96,120 over the life of the loan.

If you consider that purchasing now will also let you take advantage of the equity you’ll build up over the next calendar year, which is approximately $22,000 for a house with a similar value, then the total net worth increase you could gain from buying this year is over $118,000.

Bottom Line

When asking if you should buy a home, you probably think of the non-financial benefits of owning a home as a driving motivator. When asking when to buy, the financial benefits make it clear that doing so now is much more advantageous than waiting until next year.

Home Price Appreciation Is Skyrocketing in 2021. What About 2022?

Home Price Appreciation Is Skyrocketing in 2021. What About 2022?

One of the major story lines over the last year is how well the residential real estate market performed. One key metric in the spotlight is home price appreciation. According to the latest indices, home prices are skyrocketing this year.

Here are the latest percentages showing the year-over-year increase in home price appreciation:

- The House Price Index (HPI) from the Federal Housing Finance Agency (FHFA): 18.8%

- The S. National Home Price Index from S&P Case-Shiller: 18.6%

- The Home Price Insights Report from CoreLogic: 18%

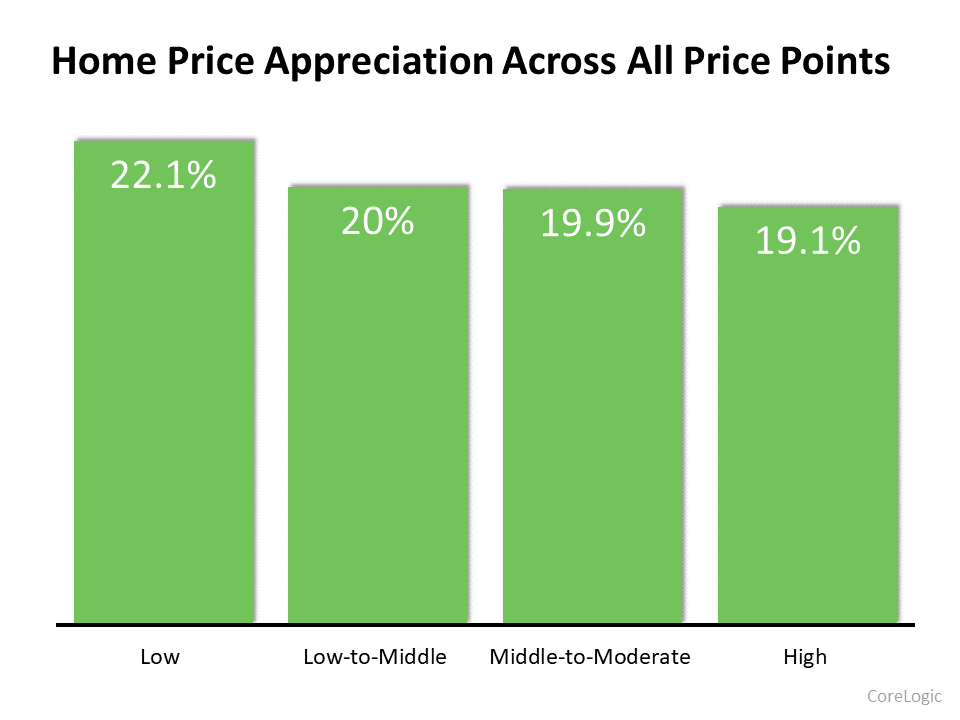

The dramatic increases are seen at every price point and in all regions of the country.

Increases Are Across Every Price Point

According to the latest Home Price Index from CoreLogic, each price range is seeing at least a 19% increase year-over-year:

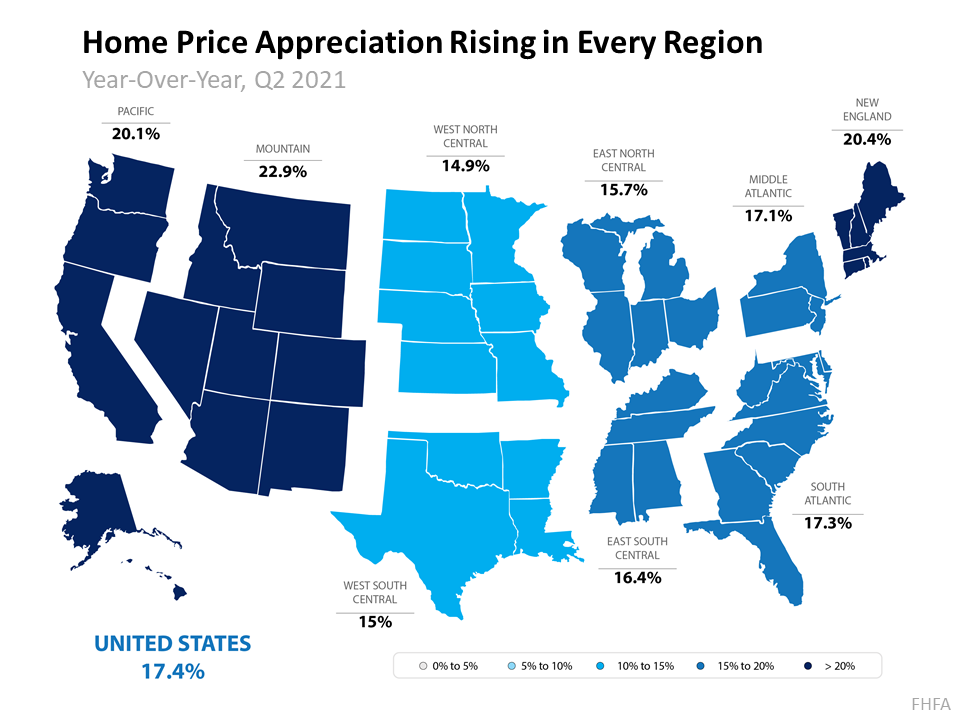

Increases Are Across Every Region in the Country

Every region in the country is experiencing at least a 14.9% increase in home price appreciation, according to the Federal Housing Finance Agency (FHFA):

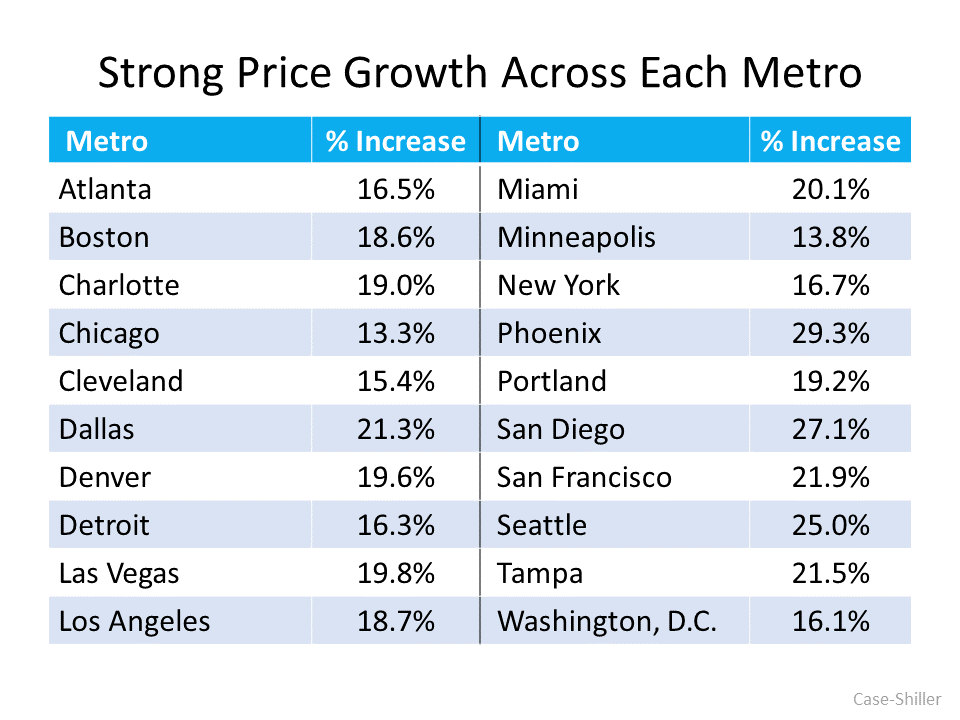

Increases Are Across Each of the Top 20 Metros in the Country

According to the U.S. National Home Price Index from S&P Case-Shiller, every major metro is seeing at least a 13.3% growth in prices (see graph below):

What About Price Appreciation in 2022?

Prices are the result of the balance between supply and demand. The demand for single-family homes has been strong over the last 18 months. The supply of houses available for sale was near historic lows. However, there’s some good news on the supply side. Realtor.com reports:

“432,000 new listings hit the national housing market in August, an increase of 18,000 over last year.”

There will, however, still be a shortage of supply compared to demand in 2022. CoreLogic reveals:

“Given the widespread demand and considering the number of standalone homes built during the past decade, the single-family market is estimated to be undersupplied by 4.35 million units by 2022.”

Yet, most forecasts call for home price appreciation to moderate in 2022. The Home Price Expectation Survey, a survey of over 100 economists, investment strategists, and housing market analysts, calls for a 5.12% appreciation level next year. Here are the 2022 home appreciation forecasts from the four other major entities:

- The National Association of Realtors (NAR): 4.4%

- The Mortgage Bankers Association (MBA): 8.4%

- Fannie Mae: 5.1%

- Freddie Mac: 5.3%

Price appreciation is expected to slow in 2022 when compared to the record highs of 2021. However, it is still expected to be greater than the annual average of 4.1% over the last 25 years.

Bottom Line

If you owned a home over the past year, you’ve seen your household wealth grow substantially, and you’ll see another nice boost in 2022. If you’re thinking of buying, consider buying now as prices are forecast to continue increasing through at least next year.

What You Can Do Right Now To Prepare for Homeownership

What You Can Do Right Now To Prepare for Homeownership

As rent prices continue to soar, many renters want to know what they can do to get ready to buy their first home. According to recent data from ApartmentList.com:

“The first half of 2021 has seen the fastest growth in rent prices since the start of our estimates in 2017. Our national rent index has increased by 11.4 percent since January . . . .”

Those rising rental costs may make it seem impossible to prepare for homeownership if you’re a renter. But the truth is, there are ways you can – and should – prepare to purchase your first home. Here’s some expert advice on what to do if you’re ready to learn more about how to escape rising rents.

Start Saving – Even Small Amounts – Now

Experts agree, setting aside what you can – even smaller amounts of money – into a dedicated savings account is a great starting point when it comes to saving for a down payment. As Cindy Zuniga-Sanchez, Founder of Zero-Based Budget Coaching LLC, says:

“I recommend saving for a home in a ‘sinking fund’ . . . . This is a savings account separate from your emergency fund that you use to save for a short or mid-term expense.”

Zuniga-Sanchez adds saving in smaller increments can help make a large goal – such as saving for a down payment –achievable:

“Breaking up your goals into smaller bite-sized pieces by saving incrementally can make a large daunting number more manageable.”

Assess Your Finances and Work on Your Credit

Another tip experts recommend: take a look at your overall finances and credit score and find ways to reduce your debt. According to the HUD, the average credit score of first-time homebuyers is 716. If you’re not sure what your credit score is, there are numerous online tools that can help you check. If your score is below that average, don’t fret. Remember that an average means there are homeowners with credit scores both above and below that threshold.

If you find out your score is below the average, there are several ways to improve your credit before you apply for a loan. HUD recommends reducing your debt as much as you can, paying your bills on time, and using your credit card responsibly.

Start the Conversation with Your Advisor Today

Finally, it’s important to talk to someone who understands the market and what it takes to become a first-time homebuyer. That’s where we come in. A trusted advisor can help you navigate your specific market and talk you through all the available options. Having the right network of real estate and lending professionals in your corner can help you plan for the homebuying process as well as determine what you can afford and how you can get pre-approved when you’re ready.

Most importantly, we can help you understand how homeownership is achievable. As Lauren Bringle, Accredited Financial Advisor with Self Financial, says:

“Don’t write home ownership off just because you have a low income . . . . With the right tools, resources and assistance, you could still achieve your dream.”

Bottom Line

If you’re planning to be a homeowner one day, the best thing you can do is start preparing now. Even if you don’t think you’ll purchase for a few years, let’s connect today to discuss the process and to set you up for success on your journey to homeownership.

Displaying blog entries 51-60 of 170