Why Median Home Sales Price Is Confusing Right Now

Why Median Home Sales Price Is Confusing Right Now

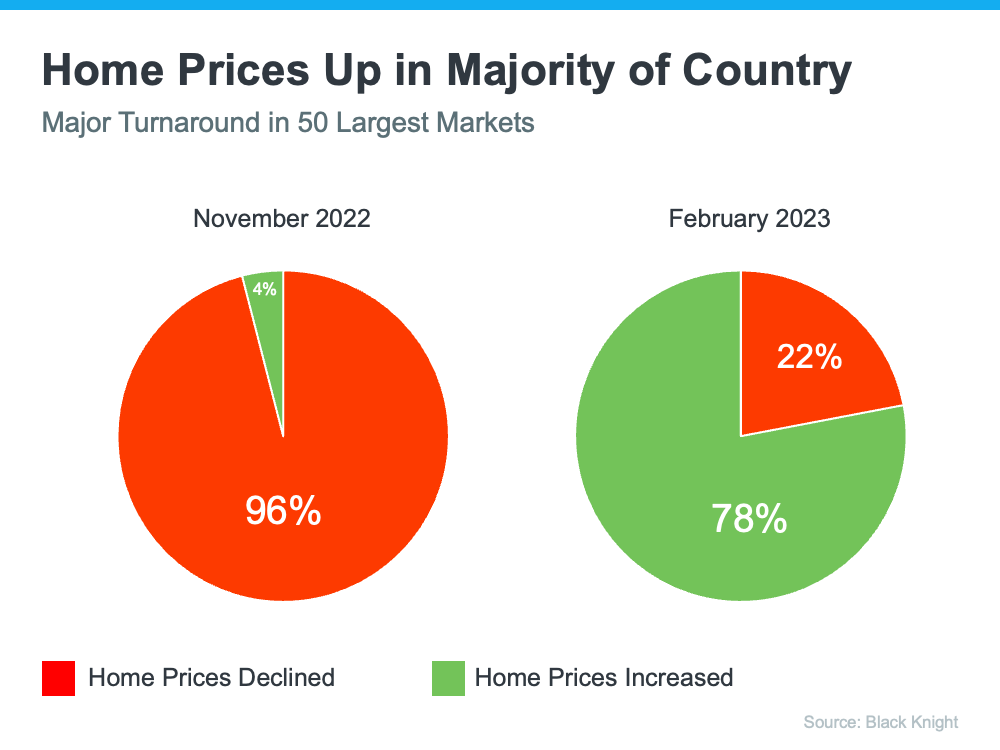

The National Association of Realtors (NAR) is set to release its most recent Existing Home Sales (EHS) report tomorrow. This monthly release provides information on the volume of sales and price trends for homes that have previously been owned. In the upcoming release, it’ll likely say home prices are down. This may seem a bit confusing, especially if you’ve been following along and reading the blogs saying home prices have hit the bottom and have since rebounded.

So, why would this say home prices are falling when so many other price reports say they’re going back up? It all depends on the methodology of each one. NAR reports on the median home sales price, while some other sources use repeat sales prices. Here’s how those approaches differ.

The Center for Real Estate Studies at Wichita State University explains median sales prices like this:

“The median sale price measures the ‘middle’ price of homes that sold, meaning that half of the homes sold for a higher price and half sold for less . . . For example, if more lower-priced homes have sold recently, the median sale price would decline (because the “middle” home is now a lower-priced home), even if the value of each individual home is rising.”

Investopedia helps define what a repeat sales approach means:

“Repeat-sales methods calculate changes in home prices based on sales of the same property, thereby avoiding the problem of trying to account for price differences in homes with varying characteristics.”

The Challenge with the Median Home Sales Price Today

As the quotes above say, the approaches can tell different stories. That’s why median home sales price data (like EHS) may say prices are down, even though the vast majority of the repeat sales reports show prices are appreciating again.

![A Crucial First Step: Mortgage Pre-Approval [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2022/09/15085222/20220916-MEM-1046x1558.png)

![Why Experts Say the Housing Market Won’t Crash [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2022/08/10115546/20220811-MEM-1046x1911.png)