Getting Your House Ready To Sell? Work with an Agent for Expert Advice

In a market that’s shifting as fast as it is today, many homeowners wonder what, if anything, needs to be renovated before they sell their house. That’s where a trusted real estate professional comes in. They can help you think through today’s market conditions and how they impact what you should – and shouldn’t – do before selling your house.

Here are some considerations a professional will guide you through.

What You Need To Know About Your Local Market

Since the supply of homes for sale has increased so much this year, today’s buyers have more options than they had last year. That may mean you’re not able to ignore some of those repairs or cosmetic updates you could have skipped in previous months. As a recent article from realtor.com says:

“To stand out in the market, sellers should make their home attractive to buyers, which usually means some selective updates.”

The key word here is selective. Since it’s still a sellers’ market, focusing on a few key areas may be enough to make your house stand out from other options. And since inventory is still low overall, it’s also possible buyers may be willing to handle the renovations themselves once they move in. It all depends on buyer demand and the available inventory in your local area. For advice on what’s happening in your market and what to do to make your house show well, lean on a professional.

Not All Renovation Projects Are Equal

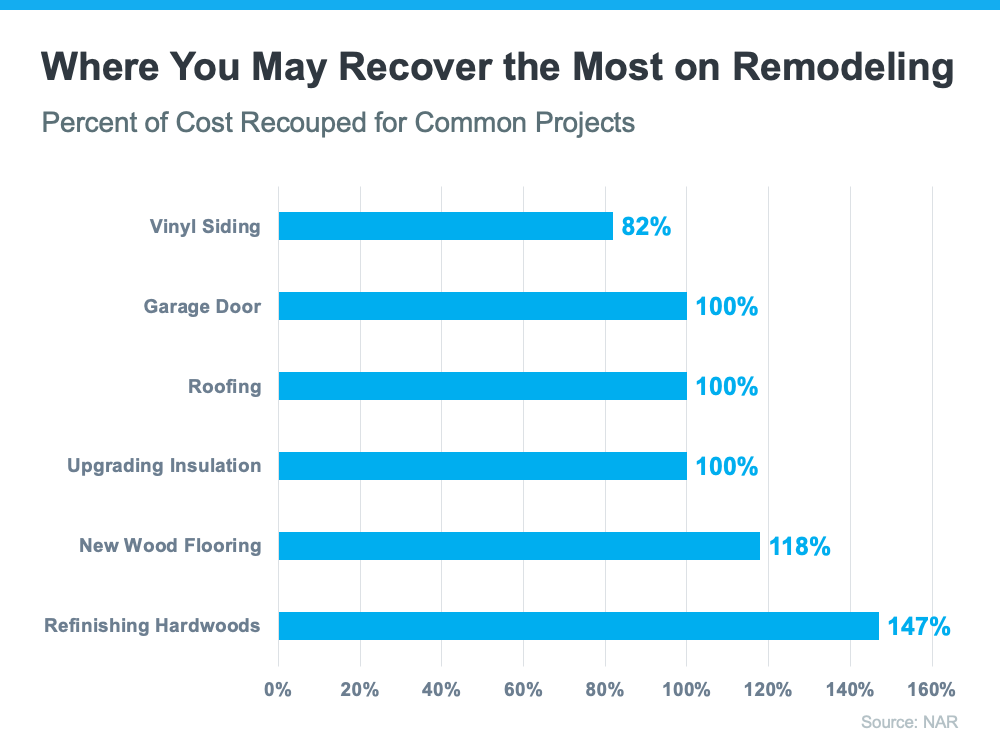

In addition to making sure your house makes a good first impression, you’ll also want to consider the return on your investment (ROI) for any renovations. According to the 2022 Remodeling Impact Report from the National Association of Realtors (NAR), here are the projects that could net you the best return when you sell your house (see visual below):

Again, your real estate advisor is your best resource. When your agent comes to your house for a walk-thru and consultation, they’ll use their expertise to offer any insight into what you may need to repair, replace, or refinish. They also know what other sellers are doing before listing their homes and how buyers are reacting to those upgrades to help steer you in the right direction. As Dr. Jessica Lautz, Vice President of Demographics and Behavioral Insights for NAR, explains:

“This year, the winner was hardwood flooring. Hardwood floor refinishing and putting in new wood flooring had the most significant value, . . .”

How To Draw Buyer Attention to the Upgrades You’ve Made

For any projects you’ve already completed or for those you plan to do before listing, make sure your real estate professional knows. They’re not just an advisor to help you decide where to focus your efforts, they’re also skilled at highlighting any upgrades in your listing. That way, potential buyers know about the features that may help sell them on the house.

No matter what, contact a local real estate professional for expert advice on what work needs to be done and how to make it as appealing as possible to future buyers. Every home is different, so a conversation with your agent is mission-critical to make sure you make the right moves when selling this season.

Bottom Line

In today’s shifting market, it’s important to spend your time and money wisely when you’re getting ready to move. Let’s connect to find out where to focus your efforts before you sell.