The Christie Cannon Team Brings Confidence in a Pandemic: Frisco TX's Top Real Estate Team Adapts to Virtual Market

Thursday, May 14, 2020 11:00 AM

The Christie Cannon Team is the leading Real Estate Team in North Texas and they are redefining the real estate industry by setting an example of proven systems to provide clients a top-notch service using innovative technology when buying and selling homes and are sharing their thoughts and advice in making wise decisions especially during this COVID-19 Pandemic

FRISCO, TX / ACCESSWIRE / May 14, 2020 / Adapting your career to fit the new rules created by COVID-19 is tough, especially in the world of real estate. Luckily, Christie Cannon, Frisco Texas' expert in real estate for over 20 years, has found a way to utilize technology to buy and sell homes virtually. She, and her husband Kevin, along with their entire Team have set up a process to walk their clients through every step of buying or selling a home online. Everything from house hunting, listing, touring, or signing papers can be done through a virtual portal; and Christie's team will be there to give you confidence in your search for the right home or the right buyer.

Christie's Texas based team is one of the top 25 teams with Keller Williams Realty nationwide. They have done over 455 transactions in the past 12 months, with over $150 million dollars in sales. D Magazine has awarded The Christie Cannon Team the "Top Real Estate Producers" every year for nearly a decade. This constant experience is what sets the team apart from other agents and real estate teams. For example, most real estate agents are selling 7-10 homes a year. Christie and her team manage sales each and every day. Each sale brings different experiences, people, and challenges. After working in housing development and managing the team over the course of two decades, Christie has seen it all. Her newest challenge? Adapt the home buying process to fit a digital landscape, and make people feel comfortable with it along the way.

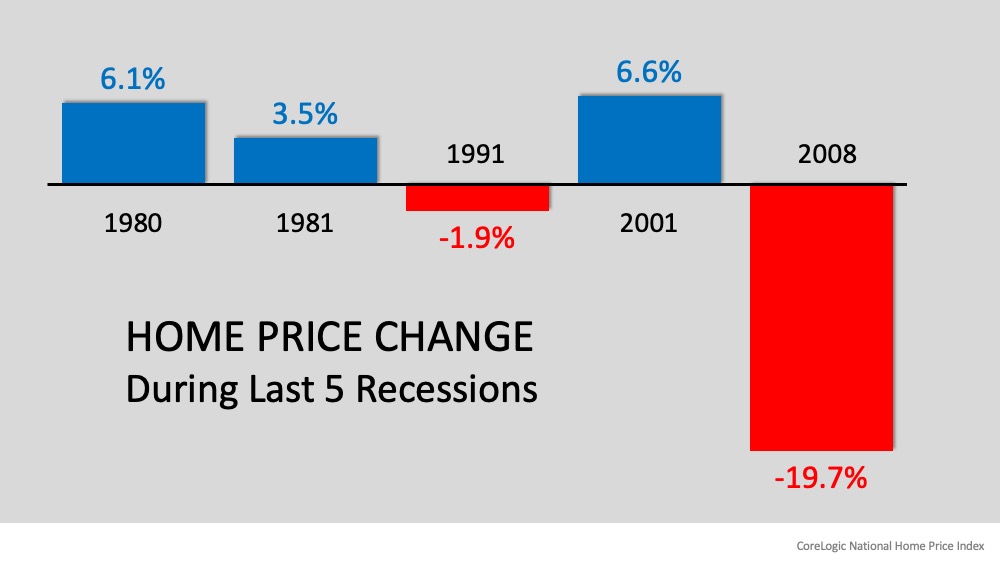

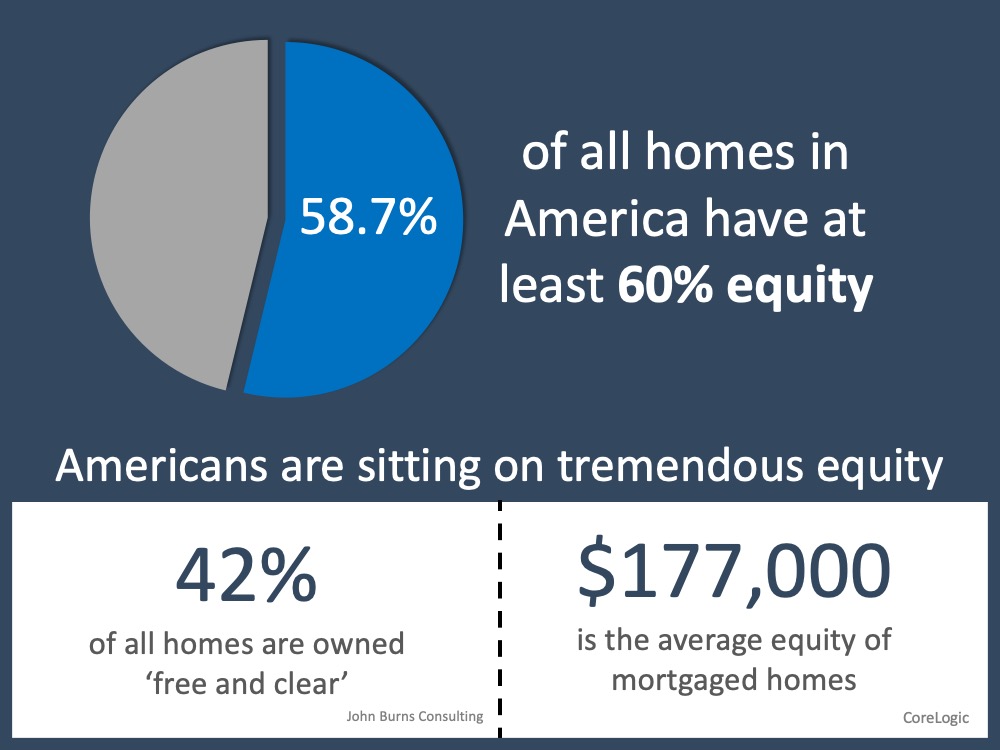

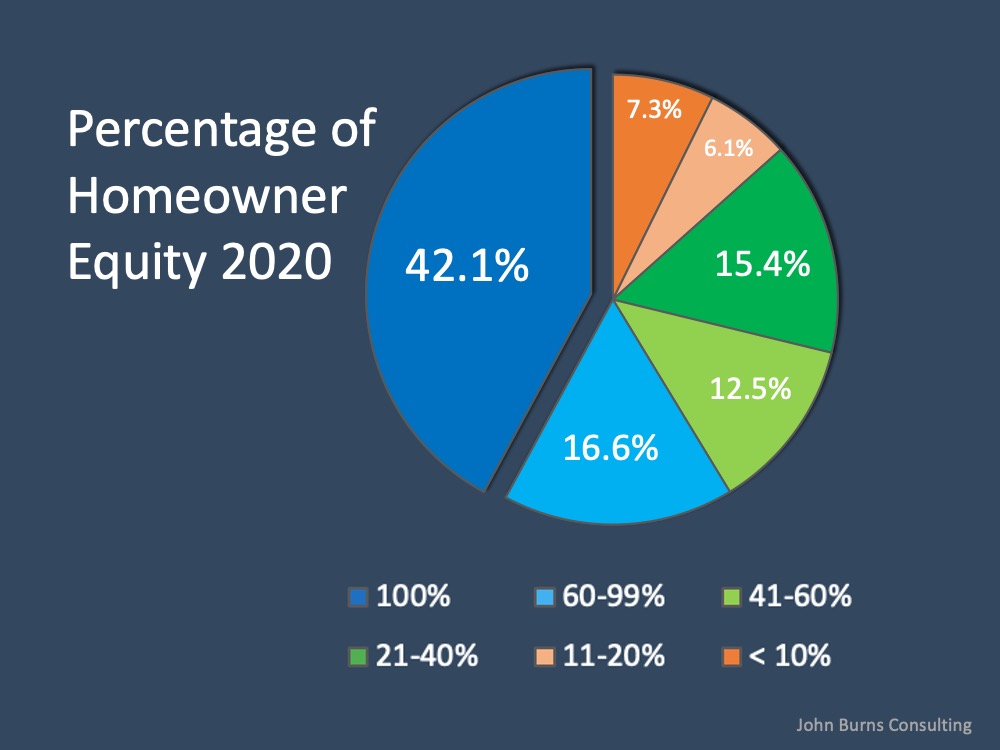

The Cannon Team has already virtually sold multiple houses completely online in the past month. Christie has found that prices have not fallen in her area, but inventory has, which is increasing demand. This means that sellers are seeing multiple offers on their home, and getting the most out of their equity. It also means that The Cannon Team's knowledge of the local market is incredibly valuable. She and her team know your area, so you don't have to and they are ready to hold your hand through finding the perfect home. Also, the level of support which they provide, paired with the quality of their service, creates an environment where clients are in constant communication and it keeps them up to date on the status of their transaction.

In a recent one-on-one interview, Christie mentioned how she and her team has been serving the market while adapting to the new rules and conditions. The level of adaptation that she has seen from people wanting to leverage technology for buying or selling their homes has been increasing day-by-day and the feedback which she has received from her clients has been very positive.

It starts with a free consultation over zoom or phone call. The Cannon Team will send you the best options for your personal situation and help pair you with a buyer or seller. Their job is not to be a salesperson, it is to educate you and take the nerves away from the whole process. "If we do our job well," Cannon said, "our clients will know and feel we have their best interest in mind, not ours."

Once they help clients find a home in their price range, one of the Team's experts can set up a virtual tour and explain every inch of the house over zoom. The client can walk through the home, ask questions, and feel confident before making an offer. When the client falls in love with a home, it's time to get the home under contract, schedule inspections and start planning your move.

On the selling side, The Cannon Team will help you check off all the boxes safely and securely. You can meet with one of the Team's experts in person at your home if you are comfortable, or over a Zoom meeting. The Team's on-staff photographer and stager can meet you at your home, or you can even elect to allow the on-staff stager to help you from afar over a Zoom meeting as you show her around your home. The only in-person meeting you will need to do is with the Team's photographer, who is dressed down in extensive PPE equipment. As a Seller, you can have control over who is entering your home and you can control the showings. The Cannon Team is encouraging "virtual" showings on all of their homes before a buyer steps foot inside to reduce unnecessary exposure. All of The Cannon Team's homes offer 3-D Virtual viewing so you can walk through an entire home without ever stepping foot inside. One of Christie's biggest focuses has been to make sure all the guidelines regarding social distancing and hygiene have been met, therefore she and her team has been working diligently with anyone who visits your property to ensure that all the government requirements and regulations are fully met and are adhered to.

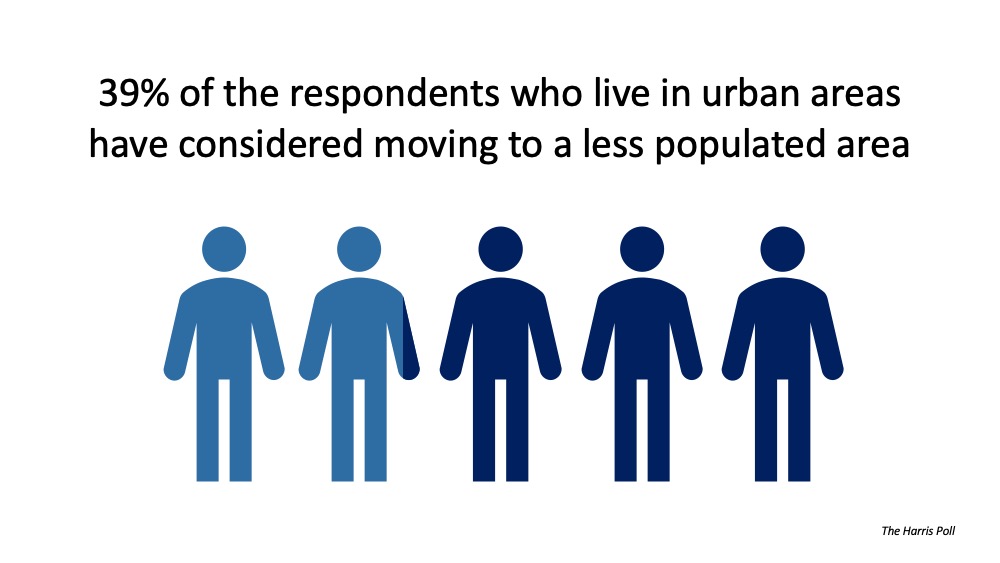

Christie and her team, with their extensive experience and knowledge of the real estate industry have seen all possible emotions which people go through while considering to buy or sell their homes using online means. However, she recommends that people should adapt to the new way of communicating and interacting as the opportunities are rising and whether you are buying or selling, there are plenty of great deals to be had during times like these.

If you are in the market to buy or sell a home, do not let the current pandmeic stop you from getting the care you need. Christie and her team have been offering free consultations to share the entire process with you and answer any of your questions to ensure that you are confident before moving ahead. She has adapted her process to hold your hand through every step, and the only thing between you and finding the home of your dreams is a computer. Christie and her husband Kevin are working everyday to help ensure their Team is servicing the needs of each and every client and home they represent.

http://christiecannon.com

http://cannonteamhomes.com

FOLLOW US ON SOCIAL MEDIA FACEBOOK AND INSTAGRAM

https://finance.yahoo.com/news/christie-cannon-team-brings-confidence-150000645.html

![How Technology is Helping Buyers Navigate the Home Search Process [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2020/04/16133213/20200417-MEM-Eng-1046x1308.png)