Forney, Fort Worth and Frisco: Millennials are moving to DFW, report says

Article by: Brian Womack Staff Writer, Dallas Business Journal

North Texas is welcoming thousands of millennials to the area, though the Dallas may not have benefited as much recently. That's according to some new research.

Four cities in North Texas ranked among the top 20 in the nation for net migration, according to the latest analysis by SmartAsset, a financial-information provider. Texas was the clear No. 1 among the states.

Among cities, Fort Worth came in at No. 11; McKinney took No. 13; Irving was No. 18, and Frisco grabbed No. 20. The rankings, which had even stronger showings by Austin, Houston and San Antonio, were based on Census Bureau data from 2018.

Millennials are playing an increasingly important role in local economics – including Dallas-Fort Worth – as companies look for young talent in areas such as software development, cybersecurity, marketing and finance. It’s a generation that is inclined to move more – and that could be the case even more as COVID-19 shakes up people’s lives.

Still, Dallas itself did not make the top 25 list. And that came after being at the top of the rankings in the release last year.

The city had a net migration of number of negative 1,922, even with more than 12,000 moving into Dallas from another state, a spokesperson said.

Yet there have been fluctuations with the report. Dallas didn’t make the list the previous two years before grabbing the top spot, the spokesperson said. And there was some change in the approach to the data. SmartAsset looked at those between the ages of 25 and 39 to account for the generation getting older. Formerly, it was between 20 and 34.

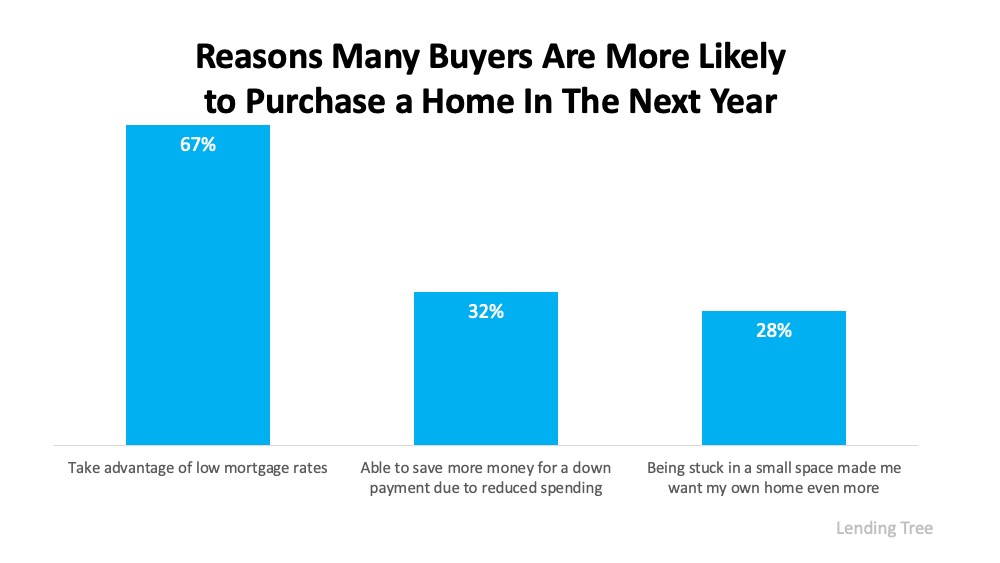

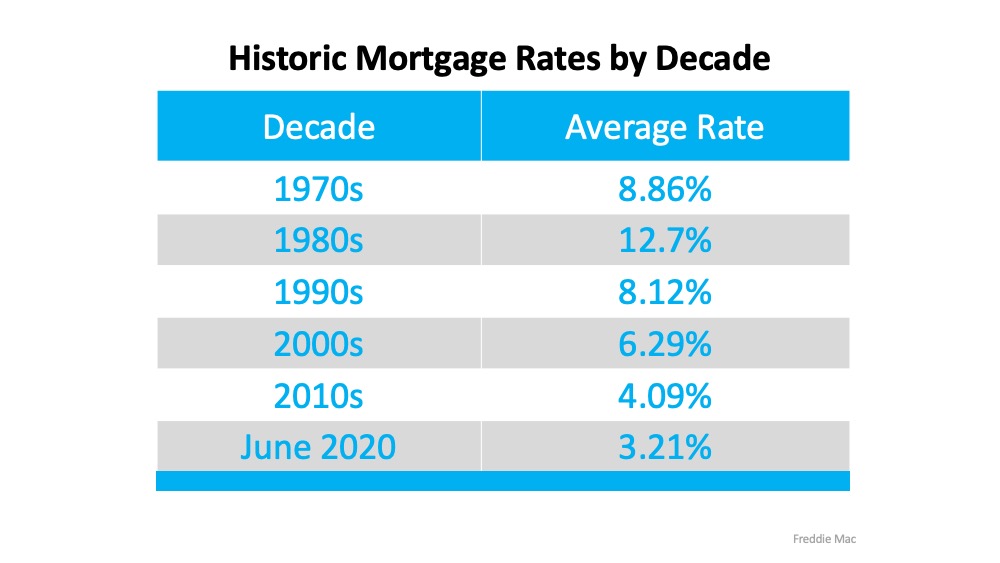

New research by the National Association of Realtors puts the Dallas area among the top ten markets for millennial homebuyers during the pandemic. Others in Texas included the Austin and Houston metros.

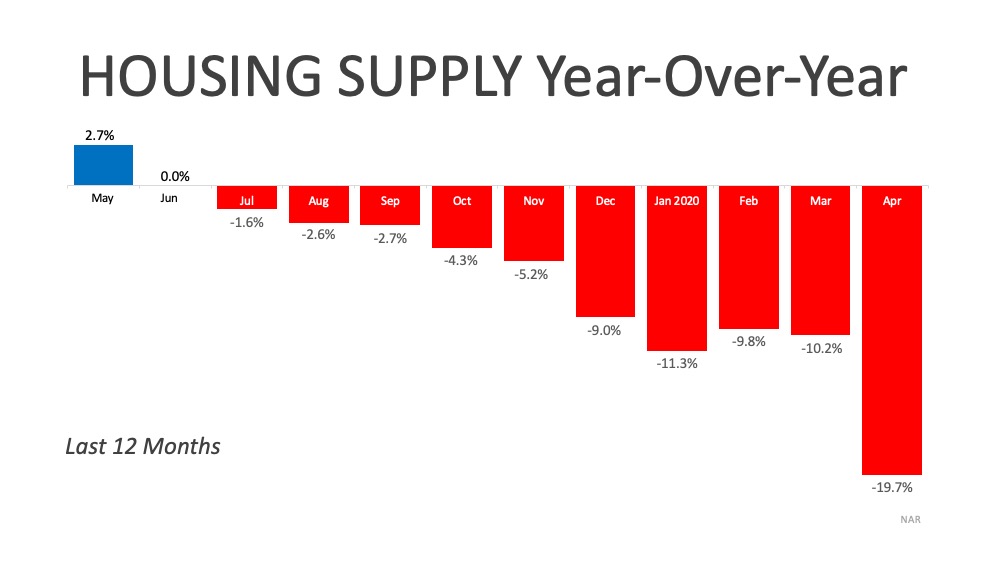

“Record-low mortgage rates have improved housing affordability, bringing more buyers into the market, and multiple offers for starter homes could become common in these metro areas,” said NAR’s Chief Economist Lawrence Yun, in the report.

Millennials make up about 30 percent of North Texas, and 44 percent of the renters in that group can afford to buy a home, the research said.

In the SmartAsset report, the winners, amid the moves, tend to be cities with no income tax – making Texas locales a stronger choice. Other states of choice include Washington, which was No. 2, along with Colorado, Georgia and Florida in the top five.

New York City fared the worst in the nation. It had a net migration losses of more than 50,000. Chicago was No. 2 while others in the top ten included Washington, D.C., San Diego, Calif., and Provo, Utah.

Earlier this year, Fred Balda, president of Dallas-based Hillwood Communities, talked up the arrival of millennials in the local region. The firm is one of North Texas’ largest developers of masterplanned residential projects.

Families aren’t making up as much of the customer base these days, Balda said.

“The millennial buyers are coming in droves now, and they’re buying off the phone, so how we market to them is a little bit different than how we’ve dealt in the past,” Balda said in an interview published in early March.

.jpg)

![Interest Rates Hover Near Historic All-Time Lows [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2020/05/21093649/20200522-MEM-1046x837.png)

/arc-anglerfish-arc2-prod-dmn.s3.amazonaws.com/public/G5AMJKVFLJB5BORUONTMA6AA64.jpg)

/arc-anglerfish-arc2-prod-dmn.s3.amazonaws.com/public/3U2OSOXNKBCVRCNMQVH7B66VCE.jpg)

.jpg)