Open House | October 19 & 20

.jpg)

Displaying blog entries 11-17 of 17

Can you say “reversion to the norm”?

When buying a home, taxes are one of the expenses that can make a significant difference in your monthly payment. Do you know how much you might pay for property taxes in your state or local area?

When applying for a mortgage, you’ll see one of two acronyms in your paperwork – P&I or PITI – depending on how you’re including your taxes in your mortgage payment.

P&I stands for Principal and Interest, and both are parts of your monthly mortgage payment that go toward paying off the loan you borrow. PITI stands for Principal, Interest, Taxes, and Insurance, and they’re all important factors to calculate when you want to determine exactly what the cost of your new home will be.

TaxRates.org defines property taxes as,

“A municipal tax levied by counties, cities, or special tax districts on most types of real estate - including homes, businesses, and parcels of land. The amount of property tax owed depends on the appraised fair market value of the property, as determined by the property tax assessor.”

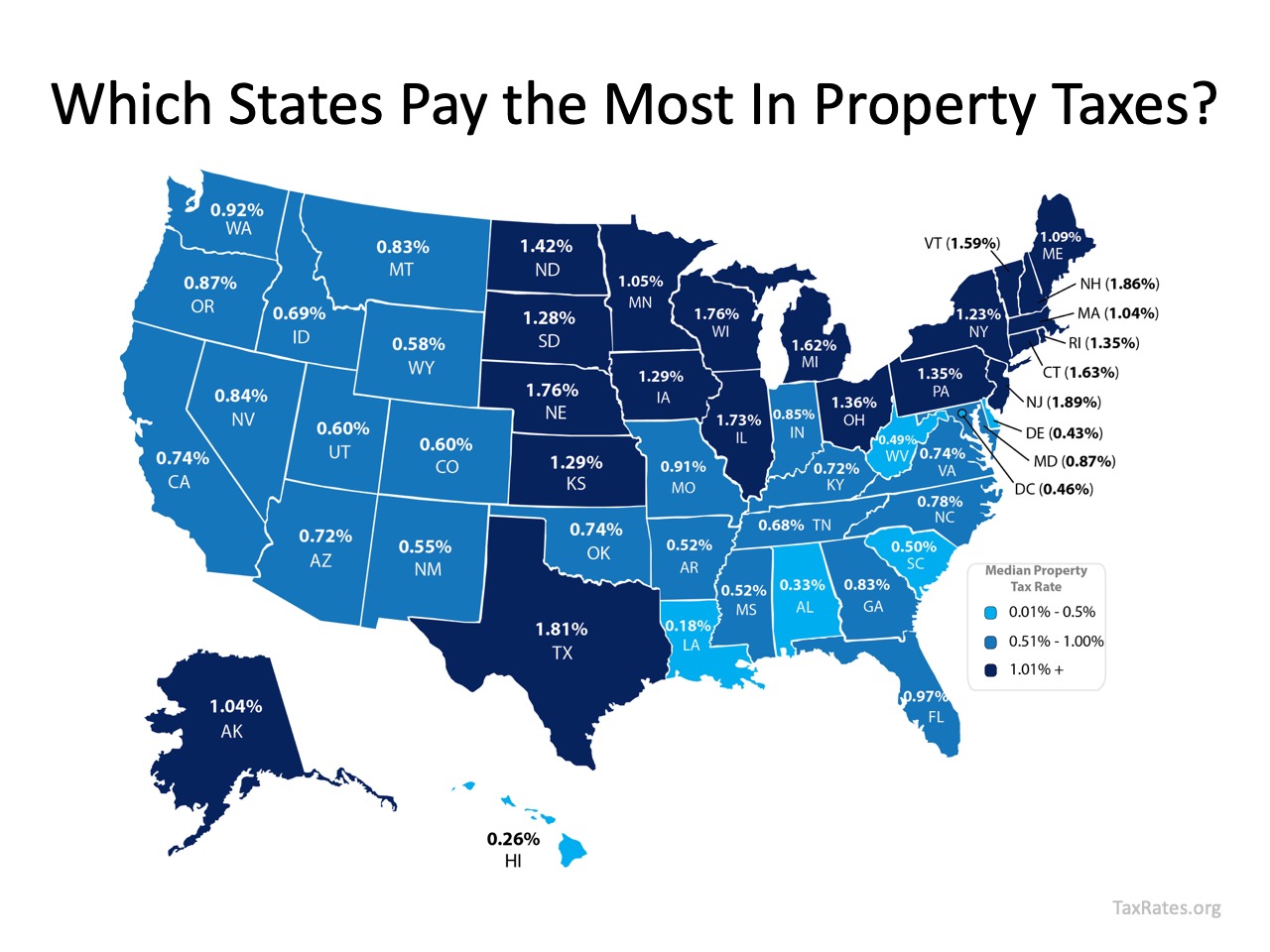

This organization also provides a map showing annual property taxes by state (including the District of Columbia), from lowest to highest, as a percentage of median home value. The top 5 states with the highest median property taxes are New Jersey, New Hampshire, Texas, Nebraska, and Wisconsin. The states with the lowest median property taxes are Louisiana, Hawaii, Alabama, and Delaware, followed by the District of Columbia.

The top 5 states with the highest median property taxes are New Jersey, New Hampshire, Texas, Nebraska, and Wisconsin. The states with the lowest median property taxes are Louisiana, Hawaii, Alabama, and Delaware, followed by the District of Columbia.

Depending on where you live, property taxes can have a big impact on your monthly payment. To make sure your estimated taxes will fall within your desired budget, let’s get together today to determine how the neighborhood or area you choose can make a difference in your overall costs when buying a home.

Below are 5 compelling reasons listing your home for sale this fall makes sense.

The latest Buyer Traffic Report from the National Association of Realtors (NAR) shows that buyer demand remains strong throughout the vast majority of the country. These buyers are ready, willing, and able to purchase…and are in the market right now. More often than not, in many areas of the country, multiple buyers are competing with each other to buy the same home.

Take advantage of the buyer activity currently in the market.

Housing inventory is still under the 6-month supply that is needed for a normal market. This means that in the majority of the country, there are not enough homes for sale to satisfy the number of buyers.

Historically, a homeowner would stay an average of six years in his or her home. Since 2011, that number has hovered between nine and ten years. There is a pent-up desire for many homeowners to move as they were unable to sell over the last few years due to a negative equity situation. As home values continue to appreciate, more and more homeowners will be given the freedom to move.

Many homeowners were reluctant to list their homes over the last couple years, for fear that they would not find a home to move to. That is all changing now as more homes come to market at the higher end. The choices buyers have will continue to increase. Don’t wait until additional inventory comes to market before you decide to sell.

Today’s competitive environment has forced buyers to do all they can to stand out from the crowd, including getting pre-approved for their mortgage financing. This makes the entire selling process much faster and simpler, as buyers know exactly what they can afford before shopping for a home. According to Ellie Mae’s latest Origination Insights Report, the time needed to close a loan is 43 days.

If your next move will be into a premium or luxury home, now is the time to move up. There is currently ample inventory for sale at higher price ranges. This means if you're planning on selling a starter or trade-up home and moving into your dream home, you’ll be able to do that in the luxury or premium market.

According to CoreLogic, prices are projected to appreciate by 5.2% over the next year. If you’re moving to a higher-priced home, it will wind up costing you more in raw dollars (both in down payment and mortgage) if you wait.

Look at the reason you decided to sell in the first place and determine whether it is worth waiting. Is money more important than being with family? Is money more important than having the freedom to go on with your life the way you think you should?

Only you know the answers to these questions. You have the power to take control of the situation by putting your home on the market. Perhaps the time has come for you and your family to move on and start living the life you desire.

That is what is truly important.

![A Recession Does Not Equal a Housing Crisis [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2019/08/29021439/20190830-MEM-1046x1308.jpg)

According to the Pew Research Center, around 37% of U.S students will be going back to school soon and the rest have already started the new academic year. With school-aged children in your home, buying or selling a house can take on a whole different approach when it comes to finding the right size, location, school district, and more.

Recently, the 2019 Moving with Kids Report from the National Association of Realtors®(NAR) studied “the different purchasing habits as well as seller preferences during the home buying and selling process.” This is what they found:

The major difference between the homebuyers who have children and those who do not is the importance of the neighborhood. In fact, 53% said the quality of the school district is an important factor when purchasing a home, and 50% select neighborhoods by the convenience to the schools.

Buyers with children also purchase larger, detached single-family homes with 4 bedrooms and 2 full bathrooms at approximately 2,110 square feet.

Furthermore, 26% noted how childcare expenses delayed the home-buying process and forced additional compromises: 31% in the size of the home, 24% in the price, and 18% in the distance from work.

Of those polled, 23% of buyers with children sold their home "very urgently," and 46% indicated "somewhat urgently, within a reasonable time frame." Selling with urgency can pressure sellers to accept offers that are not in their favor. Lawrence Yun, Chief Economist at NAR explains,

“When buying or selling a home, exercising patience is beneficial, but in some cases – such as facing an upcoming school year or the outgrowing of a home – sellers find themselves rushed and forced to accept a less than ideal offer.”

For sellers with children, 21% want a real estate professional to help them sell the home within a specific time frame, 20% at a competitive price, and 19% to market their home to potential buyers.

Buying or selling a home can be driven by different priorities when you are also raising a family. If you’re a seller with children and looking to relocate, let’s get together to navigate the process in the most reasonable time frame for you and your family.

Over the last couple of years, we’ve heard quite a bit about rising home prices. Today, expert projections still forecast continued growth, just at a slower pace. One of the often-overlooked benefits of rising home prices is the positive impact they have on home equity. Let’s break down three ways this is a win for homeowners.

With the rise in prices, homeowners naturally experience an increase in home equity. According to the Homeowner Equity Insights from CoreLogic,

“In the first quarter of 2019, the average homeowner gained approximately $6,400 in equity during the past year.”

This increase in profit means if homeowners decide to sell, they’ll be able to put their equity to work for them as they make plans to move up into their next home.

ATTOM Data Solutions recently released their Q2 2019 Home Sales Report, indicating the seller’s profit jumped at one of the fastest rates since 2015. They said:

“A look at the national numbers showed that U.S. homeowners who sold in the second quarter of 2019 realized an average home price gain since the original purchase of $67,500...the average home seller gain of $67,500 in Q2 2019 represented an average 33.9 percent return as a percentage of the original purchase price.”

Looking at the amount paid when they bought their homes, and then the amount they received after selling, we can see that some homeowners were able to walk away with a significant gain.

Negative equity occurs when there is a decline in home value, an increase in mortgage debt, or both. Many families experienced these challenges over the last decade. According to the same report from CoreLogic,

“U.S. homeowners with mortgages (roughly 63% of all properties) have seen their equity increase by a total of nearly $485.7 billion since the first quarter 2018, an increase of 5.6%, year over year.

In the first quarter of 2019, the total number of mortgaged residential properties with negative equity decreased…to 2.2 million homes, or 4.1% of all mortgaged properties.”

The good news is, many families have moved beyond a negative equity situation, and no longer owe more on their mortgage than the value of their home.

If you’re a current homeowner, you may have more equity than you realize. Your equity can open the door to future opportunities, such as moving up to your dream home. Let’s get together to discuss your options and start to put your equity to work for you.

Displaying blog entries 11-17 of 17