Innovation Hub Called 'Silicon Valley of Golf' Ready to Tee Off in Texas

Innovation Hub Called 'Silicon Valley of Golf' Ready to Tee Off in Texas

PGA of America Focuses on Golf Innovation

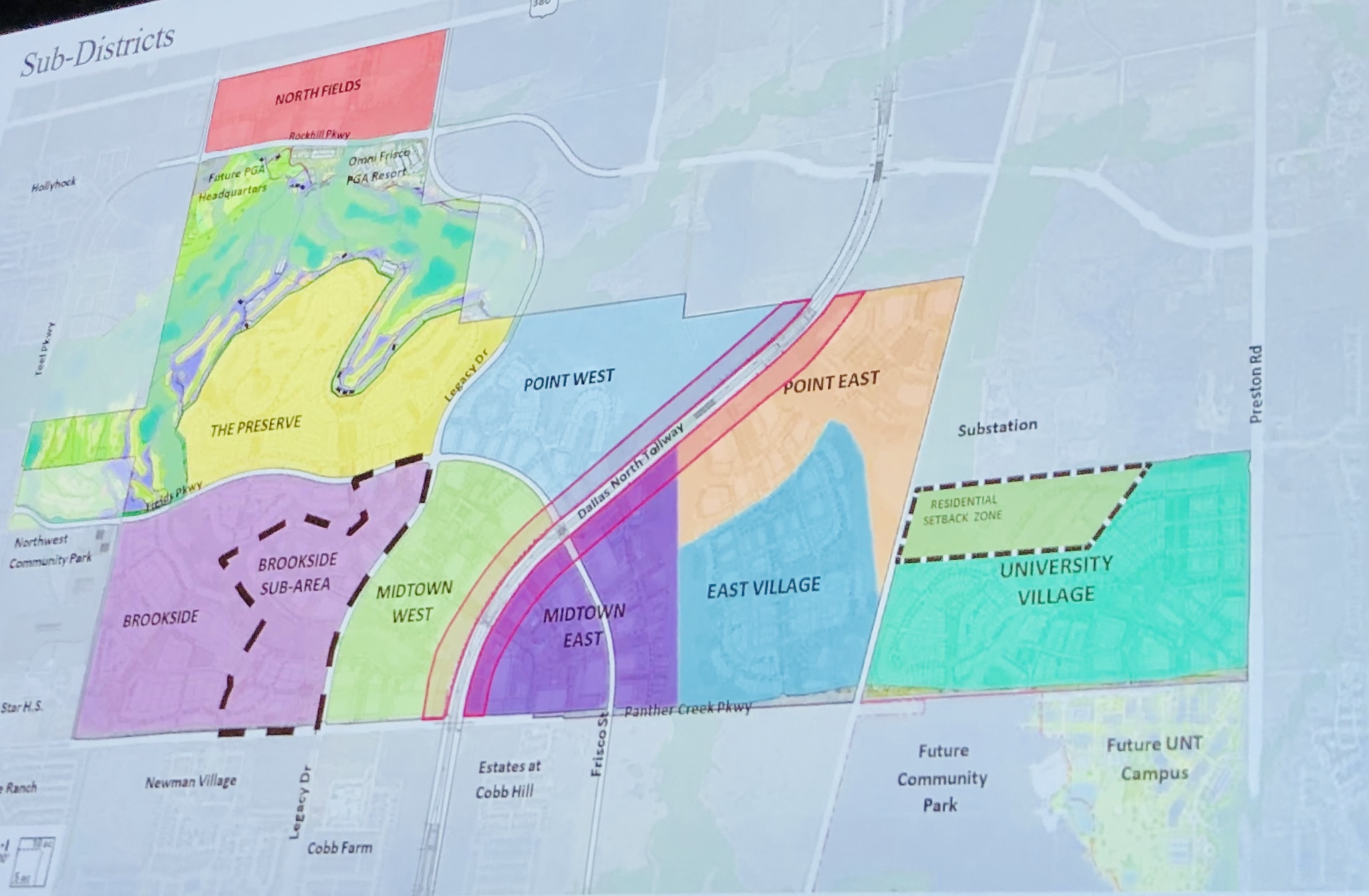

Fields is a master-planned, mixed-use development adjacent to the PGA of America proposed headquarters in Frisco, Texas. (The Karahan Cos.)

When PGA of America's Chief Operating Officer Darrell Crall and other top executives of the golf industry group began touring the country in search of fertile ground for creating innovation for the sport, they didn't expect to find it on a former cattle ranch.

But, as Crall and his team navigated the Texas Blackland Prairie ground dodging cow pies, they found a raw piece of land with enough room to build a new corporate headquarters with two championship golf courses, as well as a convention center hotel and resort. That helped them make the decision to relocate their longtime headquarters from Palm Beach Gardens, Florida, a city known for its golf courses and gated communities, for the wide, open spaces of Frisco, Texas, about 27 miles north of downtown Dallas.

PGA of America, a 104-year-old group with nearly 29,000 members, has resided in Palm Beach Gardens for 60 years. Frisco lured the headquarters from the Florida city, and beat out other cities such as Atlanta, Phoenix and Charlotte, North Carolina, by offering more than $160 million of economic incentives from various entities.

About 600 acres are being transformed into the "Silicon Valley of Golf," or a hub of innovation for the golf industry, said Seth Waugh, CEO of the PGA of America. The moniker is a tip of the golf cap to Silicon Valley in the San Francisco Bay Area, which has some of the most expensive real estate in the country and is home to tech giants such as Google, Facebook and Apple, and tech-innovation minds centered on Palo Alto's Stanford University.

The PGA of America's campus in Frisco is aimed at becoming, like Silicon Valley, a magnet for luring golf companies and services or executive golf enthusiasts wanting to be near the action. A 100,000-square-foot building for PGA of America's corporate headquarters is expected to be completed in 2022.

The two planned championship golf courses will be open to the public, the first one expected to start in 2023, and the PGA already has more than two dozen championship tournaments scheduled to be held in Frisco in the next decade.

"We want to be a hub for innovation," Crall said in an interview. "We want to build a place where ideas come to live, not to die. We are an organization rich with traditions and the only way to achieve our mission is to evolve with an entrepreneurial mindset, not just inside and under the umbrella of golf, but we want to invest in companies that have a golf app."

He declined to disclose the names of the companies the PGA of America is looking to add to its campus leader board, citing non-disclosure agreements.

With the innovation hub, the PGA of America hopes to bring more diversity to golf, a sport heavily weighted to white males, while building an affinity for the game with a younger population with the help of partnerships with Frisco Independent School District and the University of North Texas System.

More Golfers Sought

Golf participation in the United States increased incrementally in 2018 for the first time after declining year-over-year for 14 years, according to the latest golf industry report conducted by the National Golf Foundation, an advocacy group for the sport. The foundation estimated 24.2 million people played golf on a course in 2018, which increased slightly from 23.8 million people in the previous year, according to the foundation's study. Participation is well below the all-time high set in 2003 of more than 30 million golfers, but advocates say it remains relevant to millions of people.

Meanwhile, Frisco has boomed from 37,714 residents in 2010 to 155,363 residents in 2018, according to U.S. Census Bureau data. With the proposed developments in the city, including those of the PGA of America, the city doesn't show any signs of slowing.

The addition of the PGA of America and the creation of the golf innovation hub builds on the brand of the city being "Sports City U.S.A.," said Mayor Jeff Cheney, with the world headquarters and practice facility of the Dallas Cowboys; the corporate home and practice facility for the NHL team, Dallas Stars; the corporate headquarters and 20,500-seat stadium for FC Dallas, the Major League Soccer team; and the corporate headquarters and 10,316-seat ballpark for the Minor League Baseball team, Frisco RoughRiders.

"We don't just have teams and brands, but we have evolved in the business of sports by bringing startups and businesses to Frisco," Cheney said in an interview. "Like The Star in Frisco, which is home to the Dallas Cowboys, we want to create a halo effect with other brands wanting to attach their names to the Cowboys, which have led to some of the highest lease rates in all of Dallas-Fort Worth" for office space.

"With the PGA, it doesn't just play out on a national stage, but it has international recognition," he added. "Every tract of land next to the PGA is in active design and negotiations with various entities to have a direct attachment to the PGA and the golf courses. This part of Frisco is going to develop 15 years faster. It will develop seemingly overnight."

Omni Stillwater Woods, the developer of the PGA of America project, bought the 600 acres for $455 million last year from Hunt Realty Investments. The company is a joint venture led by the Omni Hotels & Resorts with Dallas-based Stillwater Capital and Dallas-based Woods Capital. Plans include a 500-room Omni resort with private villas and a 127,000-square-foot conference center.

When Chris Kleinert, CEO and president of Hunt Realty, initially saw the sprawling tract of prairie land called the Bert Fields estate, totaling more than 2,700 acres in Frisco four years ago, he and his team passed on buying the land.

The Dallas-based investment firm was primarily in the energy business and his team was selective about its real estate investments, he said. But they changed their mind when the PGA of America and the University of North Texas System began to hone in on the northern part of Frisco.

"Over the course of time, as well as talking about this with our partners, and we ended up closing on the property in August 2018," Kleinert said, adding Hunt and its development team plans to build out "a seamless campus site" to attract Fortune 100 companies and add a variety of housing from high-end homes overlooking the PGA championship golf courses to student housing on the eastern side of the master-planned development near the UNT-Frisco campus.

"There's so much potential for this site," he added. "The opportunities were too great to pass up."

Legacy West

Prior to buying the development tract, Kleinert bounced the idea off his friend Fehmi Karahan, who also happens to be the master developer behind Legacy West, a $3.2 billion mixed-use development in Plano, located just south of Frisco. Legacy West is widely considered by real estate executives as a success as an urban-suburban development and is home of Toyota's new North American campus, as well as major employment centers for JPMorgan Chase, Liberty Mutual Insurance and home to the corporate office of Boeing's new global services division.

Legacy West includes a food hall, as well as restaurants and shops typically found in urbanized cities. The result has created a new central business district in the region outside of downtown Dallas, which has been likened to Tysons Corner, Virginia, a former rural area that transformed into a central business district outside of Washington, D.C.

Karahan, who is president of the Karahan Cos., is working with Hunt Realty to build out the land in Frisco.

"The Legacy area is full without any large acreage available and I wanted to be part of a great master-planned development, which is what Fields will be," Karahan said in an interview. "Our goal is to create the master plan of the development with all the product mixes to attract great companies. This isn't just limited to the PGA-related brands, but we feel we can attract the next big relocation with an impact like Toyota and we are planning the land to accommodate it."

By the end of the month, the Fields development is set to reach a major milestone with land planning and zoning approval from city officials, which can make way for infrastructure work to begin on the raw land to help create nine distinct villages and break up the massive tract into chunks of workable real estate.

Following the addition of infrastructure and building out a roadway system, the development partnership plans to concentrate on building single-family homes overlooking the championship golf courses. But it won't be a homogeneous design.

"The blending of the residential neighborhoods is our goal," Karahan said. "We don't just want to do these gated large communities, but create an environment with all the components from a big lot with a multimillion-dollar home to a three-story townhouse with a beautiful terrace overlooking the golf course."

The development team plans to begin on the western side of the Fields master-planned development on a neighborhood known as The Preserve, followed by moving to the eastern side toward the UNT-Frisco campus. The acreage along the Dallas North Tollway, in the center of Fields, is expected to attract corporate tenants with mid- and high-rise towers.

Even though plans to add a corporate tenant could be in the years ahead, Karahan said there's the ability to add a mid- to high-rise corporate tenant, much like Liberty Mutual Insurance's campus in Plano's Legacy West, in part of Fields in the next few years. A roughly 10-acre tract along the Dallas North Tollway at the corner of Rock Hill Road could be carved out of the Fields' puzzle for the right corporate tenant, he said.

"By having more than 2,000 acres to develop, it gives us a lot of flexibility and the ability to showcase what the whole environment is going to look like," Karahan said. "This is very important to large corporations, they want to know what the neighboring environment looks like and what they can offer their employees. It helps protect their investment."

A Golf Education

The University of North Texas System has recently received approval from the Texas Higher Education Coordinating Board to begin development on its 100-acre campus at the southwest corner of Preston Road and Panther Creek Parkway in Frisco.

This October, construction is expected to begin on the initial phase of the $115 million, 130,000-square-foot education building, called Building 1, at the UNT-Frisco campus, which will sit on land donated as part of a partnership with the city of Frisco. The university system also has the ability to extend its campus on another 50 adjacent acres. At full build-out, the new UNT campus could bring up to 25,000 university students to the city.

The new building is expected to help significantly expand UNT-Frisco, which currently has an enrollment of roughly 1,500 students at Hall Park in about 36,000 square feet of leased space at 2811 Internet Blvd. in Frisco. If the university "does it right," it could have up to 25,000 students enrolled at the Frisco campus, said Wesley Randall, dean of the new Frisco campus.

"The opportunity to grow and to be focused on going back to the main campus to efficiently and agilely bring things that are of value to Frisco and to nimbly move in the ecosystem," Randall said. "We are going bring down the parts that will help enable the Frisco economic engine."

UNT's flagship campus is located in Denton, which is about 25 miles west of Frisco, and has an enrollment nearing 40,000 students. In opening a Frisco campus, Randall said the vision is to bring nanotechnology, sports innovation and other fields of study that would track well with Frisco and the PGA of America's shared vision.

The city of Frisco, development corporations, and the Frisco Independent School District contributed $35 million to helping develop the public golf facilities at the PGA of America-anchored development. The public-private partnership ensures more than 300 Frisco ISD high school golfers will have access to practice at the facility on a weekly basis.

The move echoes one seen years ago from Dallas Cowboys owner Jerry Jones' playbook when the billionaire decided to put the team's corporate headquarters and practice facility in Frisco. The venue anchors a 91-acre mixed-use development called The Star in Frisco, located along the Dallas North Tollway, a few exits from the PGA of America's soon-to-be headquarters and championship golf courses.

The Star includes The Ford Center, a 12,000-seat indoor stadium developed in a public-private partnership with the city of Frisco and Frisco ISD the Cowboys use as an indoor practice facility and allows students to play on the same field as professional players. The deal also gives the city and school district the ability to host other events, trade shows and concerts at the venue.

The allure of these partnerships being tied to the Cowboys or PGA brand, as well as the incoming students from UNT, could bring an important quality to Frisco every employer needs: A pipeline of labor.

"Corporate location decisions are driven primarily around labor," said King White, president of Dallas-based Site Selection Group. "If you are looking to staff a large operation, you want to put yourself in a strategic place to pull employees from multiple angles. The north side of Frisco is pushing out to the edges, but this move has certainly been done in the past with Silicon Valley companies in the 1980s."

Developing the urban-suburban part of the Fields puzzle will be an important piece, as well as a potential corporate magnet, in the years ahead, said White.

Meanwhile, Frisco Mayor Cheney said he expects good things to come out of this public-private partnership with the PGA of America.

"We are growing to grow the game of golf," he added. "This project is going to be a place people will want to be in even if they've never picked up a golf club. We're going to have a whole new generation of golf lovers."