Homeowner Equity Increases an Astonishing $1 Trillion

Homeowner Equity Increases an Astonishing $1 Trillion

In a year that was financially devastating for many Americans, some good news for most homeowners is the dramatic gain in home equity over the last twelve months. Last week, CoreLogic released its 2020 3rd Quarter Homeowner Equity Insights report, which reveals four major findings:

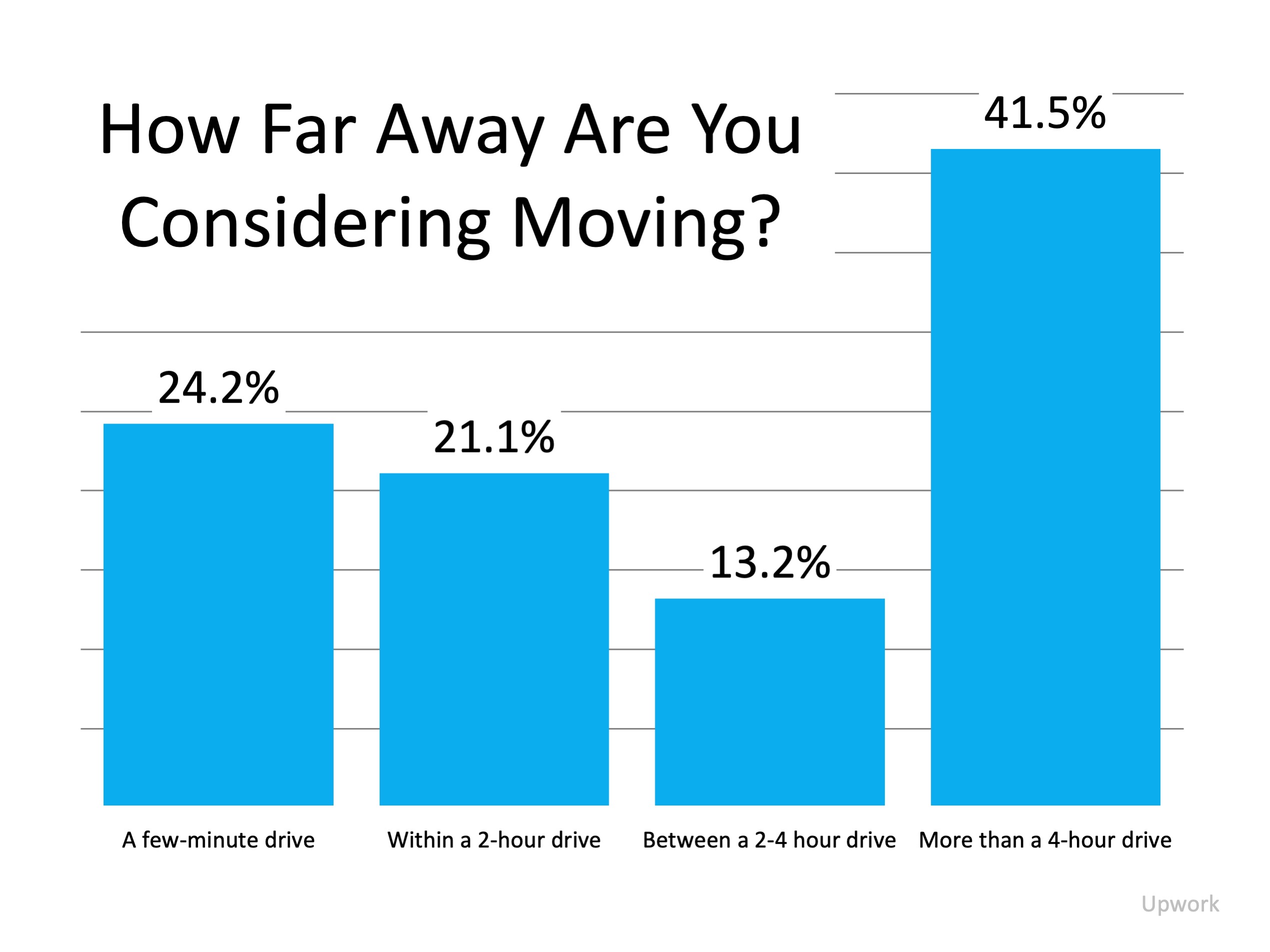

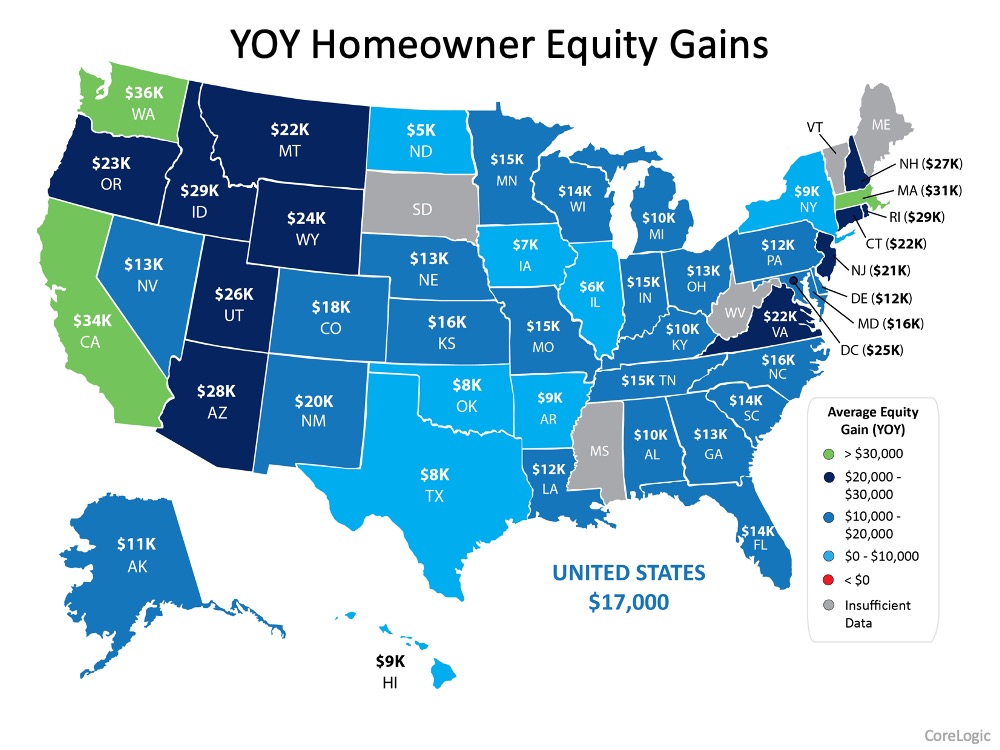

- U.S. homeowners with mortgages have seen their equity increase by a total of $1 trillion since the third quarter of 2019.

- The average homeowner gained approximately $17,000 in equity over the past year.

- This is a 10.8% increase in equity over last year.

- The average household with a mortgage now has $194,000 in home equity.

This has given many homeowners the ability to redesign their homes to meet their changing needs. Frank Martell, President and CEO of CoreLogic, explains in the report:

“The housing market has remained a strong pillar in an otherwise tumultuous economic year. A sharp rise in demand, spurred by record-low interest rates, continues to bolster homeowner equity. And with many people now spending more time than ever before at home, some homeowners have tapped into their strengthening equity to fund renovations.”

This build-up in equity also gives more options to homeowners who have been financially impacted by the pandemic. Today, homeowners with substantial equity are in a much better position to work out a deal with their lender if they cannot pay their mortgage. Alternatively, they also have the power to sell and walk away with their equity in the form of cash or as a down payment toward a more affordable house. Frank Nothaft, Chief Economist for CoreLogic, addresses the issue in the report:

"Over the past year, strong home price growth has created a record level of home equity for homeowners…This provides an important buffer to protect families if they experience financial difficulties and is one reason for the generational-low in foreclosure rates reported."

Here’s a map showing equity gains by state: This gain in home equity is a blessing for homeowners in these trying times, and it seems that the next two years will continue to reward those who own a home.

This gain in home equity is a blessing for homeowners in these trying times, and it seems that the next two years will continue to reward those who own a home.

Last week, the National Association of Realtors (NAR) held their 2020 Real Estate Forecast Summit. At the summit, they shared the results of a recent survey of 23 economic and housing market experts. The median forecast among the experts called for home values to increase further by 8% in 2021 and 5.5% in 2022.

Bottom Line

In a year that has many of us reevaluating what “home” really means, those who own their homes have been rewarded with a financial windfall that averages $17,000 individually and totals $1 trillion nationally.

![Winning as a Buyer in a Sellers’ Market [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2020/12/08151044/20201211-MEM-1046x2448.png)