The Big Advantage If You Sell This Spring

The Big Advantage If You Sell This Spring

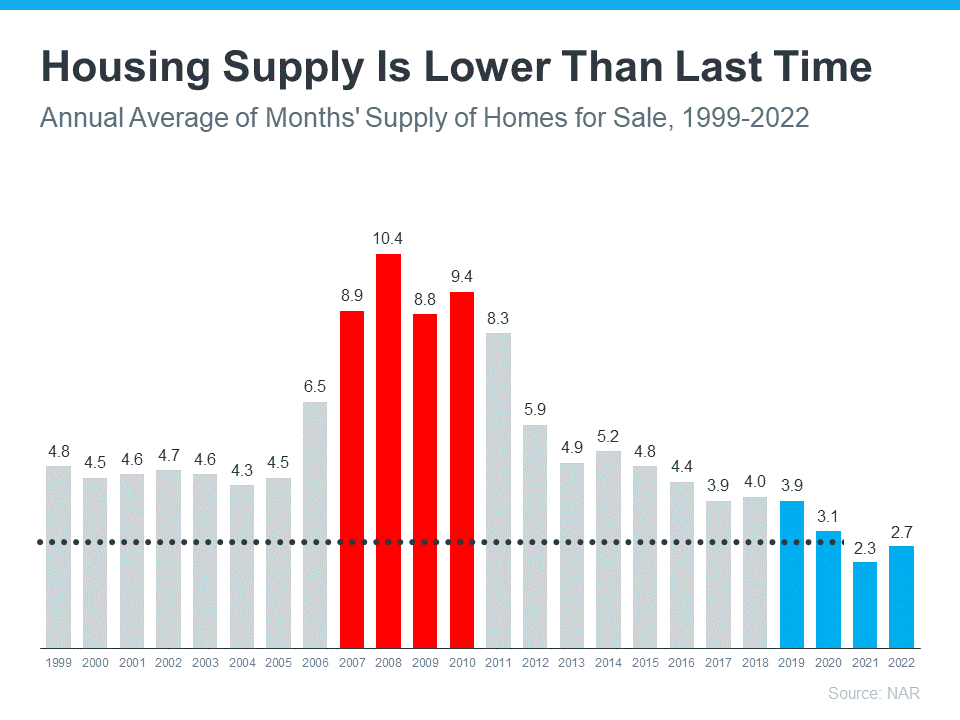

Thinking about selling your house? If you’ve been waiting for the right time, it could be now while the supply of homes for sale is so low. HousingWire shares:

“. . . the big question is whether we are finally starting to see the seasonal spring increase in inventory. The answer is no, because active listings fell to a new low last week for 2023 . . .”

The National Association of Realtors (NAR) confirms today’s housing inventory is low by looking at the months’ supply of homes on the market. In a balanced market, about a six-month supply is needed. Anything lower is a sellers’ market. And today, the number is much lower:

“Total housing inventory registered at the end of February was 980,000 units, identical to January and up 15.3% from one year ago (850,000). Unsold inventory sits at a 2.6-month supply at the current sales pace, down 10.3% from January but up from 1.7 months in February 2022.”

Why Does Low Inventory Make It a Good Time To Sell?

The less inventory there is on the market when you sell, the less competition you’re likely to face from other sellers. That means your house will get more attention from the buyers looking for a home this spring. And since there are significantly more buyers in the market than there are homes for sale, you could even receive more than one offer on your house. Multiple offers are on the rise again (see graph below):

If you get more than one offer on your house, it becomes a bidding war between buyers – and that means you have greater leverage to sell on your terms. But if you want to maximize the opportunity for a bidding war to spark, be sure to lean on your expert real estate advisor. While we’re still in a strong sellers’ market, it isn’t the frenzy we saw a couple of years ago, and today’s buyers are focused on the houses with the greatest appeal. Clare Trapasso, Executive News Editor at Realtor.com, explains:

"Well-priced, move-in ready homes with curb appeal in desirable areas are still receiving multiple offers and selling for over the asking price in many parts of the country. So, this spring, it's especially important for sellers to make their homes as attractive as possible to appeal to as many buyers as possible.”

Bottom Line

If you’ve been waiting for the right time to sell your house, low inventory this spring sets you up with a big advantage. Let’s connect today to make sure your house is ready to sell.