Buyers Taking Big Risks To Win In DFW Housing Market

NORTH TEXAS (CBSDFW.COM) – The real estate market in DFW is so competitive, some buyers are taking big risks to make sure their offer is accepted.

“Going to an open house sometimes feels like you’re pulling up to a party,” said Rachel Laviola.

She and Masud Zair have spent the last several weeks looking at available homes near their jobs in Collin County. Neither was prepared for the competition among buyers. “We didn’t expect it to be like, ‘there is one new house every day and if you don’t look at it immediately it will be gone,’” said Zair.

That was the atmosphere outside a home in Frisco recently: vehicles lined the streets while perspective buyers milled around outside, all waiting to take their tour. The home had hit the market hours earlier. Over the next two days it was shown 91 times and the sellers received 39 offers. The winning buyer offered cash with no home inspection and a lightning-fast closing.

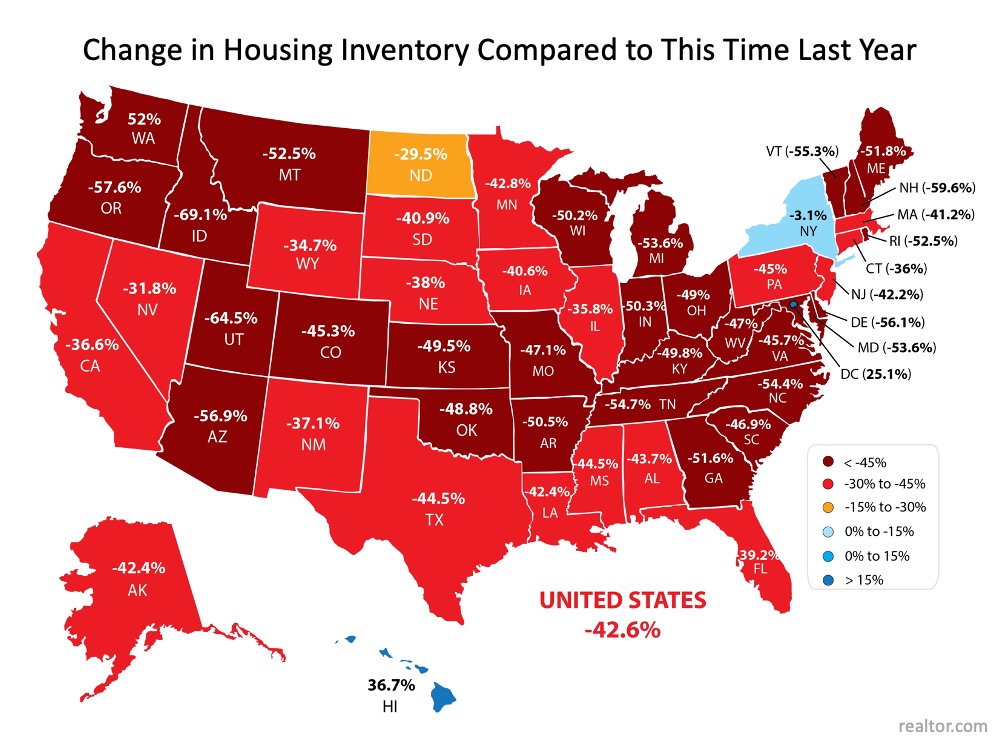

Those kind of “extras” are becoming commonplace in Collin County, where inventory is at historic lows.

“There’s just so many people trying to buy a house,” said real estate agent Katherine Meyers. “[There are] dozens and dozens of offers on pretty much every house in the area – it doesn’t matter the price range.” She says the most popular homes these days are within the Frisco ISD and Prosper ISD boundaries.

So how are buyers trying to stand out? “Free lease-backs, no home warranties, paying title feels, appraisal waivers,” said Meyers. The waivers mean if the home appraises for less than the offer, the buyer will pay the difference in cash. “It’s being used pretty much every time there are multiple offers,” said Meyers. “It almost has to be done if you want a chance at it.”

The market for new homes is just as hot. Real estate agent Marie Bailey is based in Collin County; she says builders there are selling lots faster than they can put up homes.

“Not only is the inventory going away – they are raising the prices every week,” said Bailey. “So I have clients that are on the cusp of a price range, that I say, ‘look, I can do all this research but in two days they could raise the price by $25,000.’”

Some of her clients put down money to claim a lot, even though they won’t know how much the home itself will cost until the builder is ready to start construction. “By the time they’re allowed to take a contract, the price could go up,” said Bailey. “And we don’t even know what the price could go up by.”

t’s not just North Texas. Homes across the state are selling faster, and for more money.

“It’s surprising, to be honest with you, how strong the housing market has been.” Dr. Luis Torres is a research economist for the Texas A&M Real Estate Center. He says the market broke records in 2020 not despite the pandemic, but because of it.

He says with more people working from home and not commuting, the suburbs are expanding.

Many buyers are coming from states with tighter COVID restrictions.

On top of all that, interest rates remain low.

Torres says the biggest challenge the market will face this year will be keeping up with demand. “The biggest headwind that is probably going to hold down the housing market is if we don’t get new listings, new supply,” said Dr. Torres. “That’s going to play a big role going forward.”

For buyers who want to sign on the bottom line, it leaves little choice but to go all in. “Just do it,” said Zair. “Because you really don’t have any leverage at all in this type of market.”

How hot was the 2020 housing market in your area? Search your ZIP code to see how many homes sold last year and the average price per square foot.

Article provided By Brooke Katz with CBS DFW See the entire article HERE.