Why an Economic Slowdown Will NOT Crush Real Estate this Time

Why an Economic Slowdown Will NOT Crush Real Estate this Time

Last week, the National Association for Business Economics released their February 2019 Economic Policy Survey. The survey revealed that a majority of the panel believe an economic slowdown is in the near future:

“While only 10% of panelists expect a recession in 2019, 42% say a recession will happen in 2020, and 25% expect one in 2021.”

Their findings coincide with three previous surveys calling for a slowdown sometime in the next two years:

- The Pulsenomics Survey of Market Analysts

- The Wall Street Journal Survey of Economists

- The Duke University Survey of American CFOs

That raises the question: Will the real estate market be impacted like it was during the last recession?

A recession does not equal a housing crisis. According to the dictionary definition, a recession is:

“A period of temporary economic decline during which trade and industrial activity are reduced, generally identified by a fall in GDP in two successive quarters.”

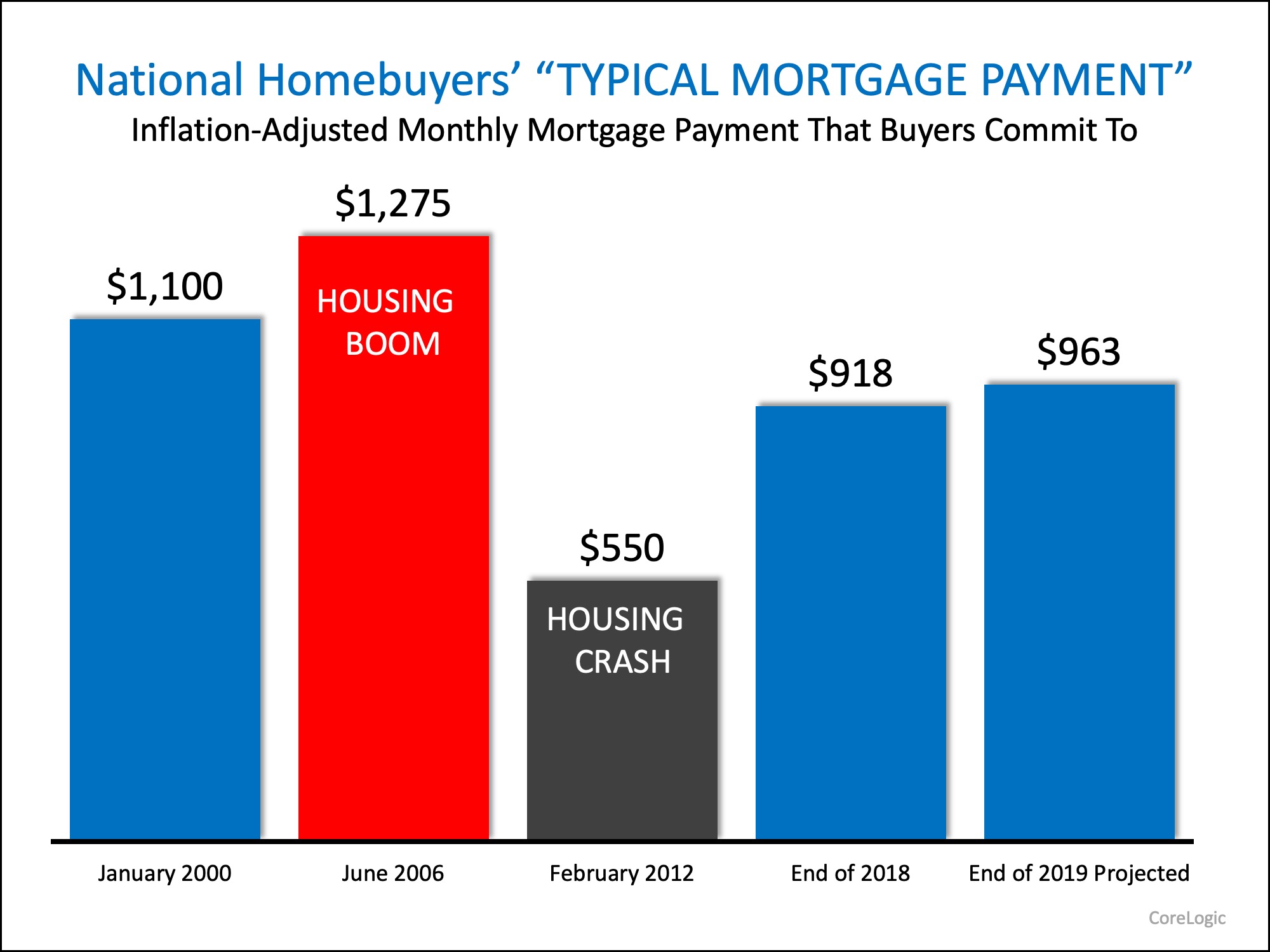

During the last recession, prices fell dramatically because the housing collapse caused the recession. However, if we look at the previous four recessions, we can see that home values weren’t negatively impacted:

- January 1980 to July 1980: Home values rose 4.5%

- July 1981 to November 1982: Home values rose 1.9%

- July 1990 to March 1991: Home values fell less than 1%

- March 2001 to November 2001: Home values rose 4.8%

Most experts agree with Ralph McLaughlin, CoreLogic’s Deputy Chief Economist, who recently explained:

“There’s no reason to panic right now, even if we may be headed for a recession. We’re seeing a cooling of the housing market, but nothing that indicates a crash.”

The housing market is just “normalizing”. Inventory is starting to increase and home prices are finally stabilizing. This is a good thing for both buyers and sellers as we move forward.

Bottom Line

If there is an economic slowdown in our near future, there is no need for fear to set in. As renowned financial analyst, Morgan Housel, recently tweeted:

“An interesting thing is the widespread assumption that the next recession will be as bad as 2008. Natural to think that way, but, statistically, highly unlikely. Could be over before you realized it began.”

Christie Cannon | REALTOR

The Christie Cannon Team

Keller Williams Realty Frisco

972-215-7747

www.ChristieCannon.com

www.CannonTeamHomes.com

![3 Tips for Making Your Dream of Buying A Home Come True [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2019/02/20084419/3-Tips-ENG-MEM-1046x1354.jpg)