Why Right Now Is a Once-in-a-Lifetime Opportunity for Sellers

Why Right Now Is a Once-in-a-Lifetime Opportunity for Sellers

If you’re thinking about selling your house in 2022, you truly have a once-in-a-lifetime opportunity at your fingertips. When selling anything, you always hope for strong demand for the item coupled with a limited supply. That maximizes your leverage when you’re negotiating the sale. Home sellers are in that exact situation right now. Here’s why.

Demand Is Very Strong

According to the latest Existing Home Sales Report from the National Association of Realtors (NAR), 6.18 million homes were sold in 2021. This was the largest number of home sales in 15 years. Lawrence Yun, Chief Economist for NAR, explains:

“Sales for the entire year finished strong, reaching the highest annual level since 2006. . . . With mortgage rates expected to rise in 2022, it's likely that a portion of December buyers were intent on avoiding the inevitable rate increases.”

Demand isn’t expected to weaken this year, either. In addition, the Mortgage Finance Forecast, published last week by the Mortgage Bankers’ Association (MBA), calls for existing-home sales to reach 6.4 million homes this year.

Supply Is Very Limited

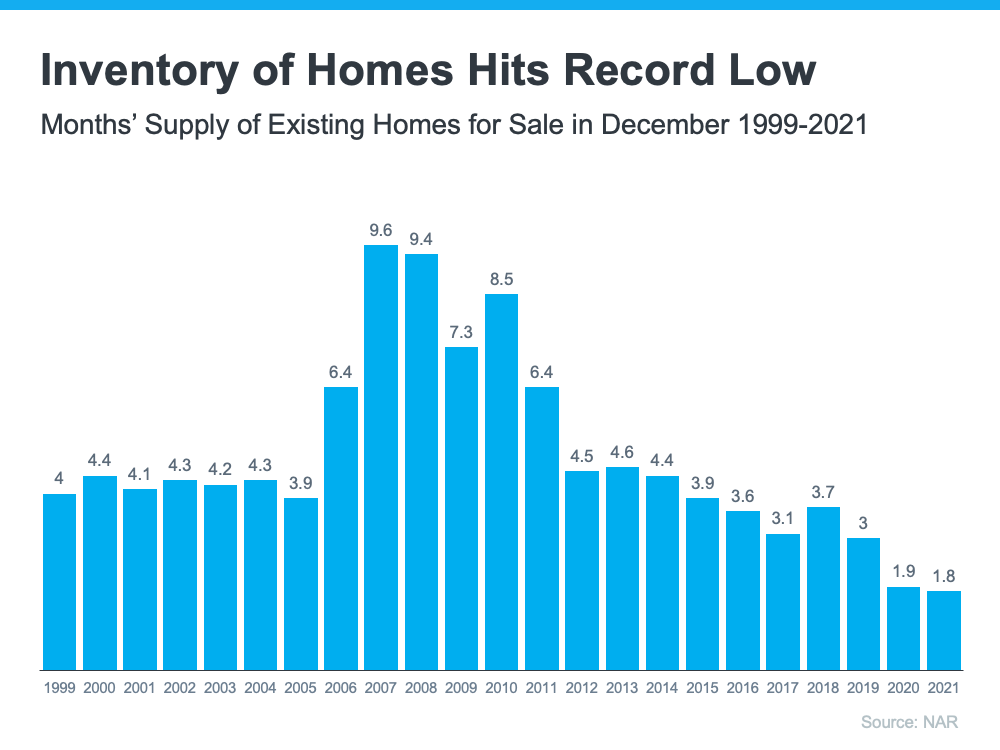

The same sales report from NAR also reveals the months’ supply of inventory just hit the lowest number of the century. It notes:

“Total housing inventory at the end of December amounted to 910,000 units, down 18% from November and down 14.2% from one year ago (1.06 million). Unsold inventory sits at a 1.8-month supply at the present sales pace, down from 2.1 months in November and from 1.9 months in December 2020.”

The reality is, inventory decreases every year in December. That’s just how the typical seasonal trend goes in real estate. However, the following graph emphasizes how this December was lower than any other December going all the way back to 1999.

Right Now, Sellers Have Maximum Leverage

As mentioned above, when there’s strong demand for an item and a limited supply of it available, the seller has maximum leverage in the negotiation. In the case of homeowners who are thinking about selling, there may never be a better time than right now. While demand is this high and inventory is this low, you’ll have leverage in all aspects of the sale of your house.

Today’s buyers know they need to be flexible negotiators that make very competitive offers, so here are a few areas that could tip in your favor when your house goes on the market:

- Competitive sales price

- Flexible closing date

- Potential for a leaseback to allow you more time to find a home

- Minimal offer contingencies

Bottom Line

If you’re thinking of selling your house this year, now is the optimal time to list it. Let’s connect to discuss how you can put your house on the market today.